Economic sentiment posts its largest single-period decrease in over a year

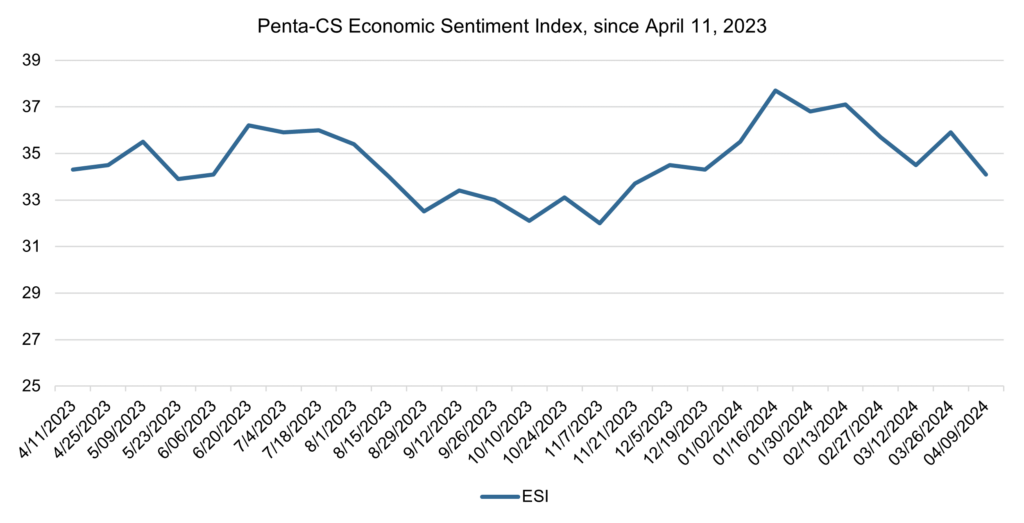

Economic sentiment decreased over the last two weeks, posting its largest single-period decrease in over a year. The Penta-CivicScience Economic Sentiment Index (ESI) dropped 1.8 points over the last two weeks to 34.1.

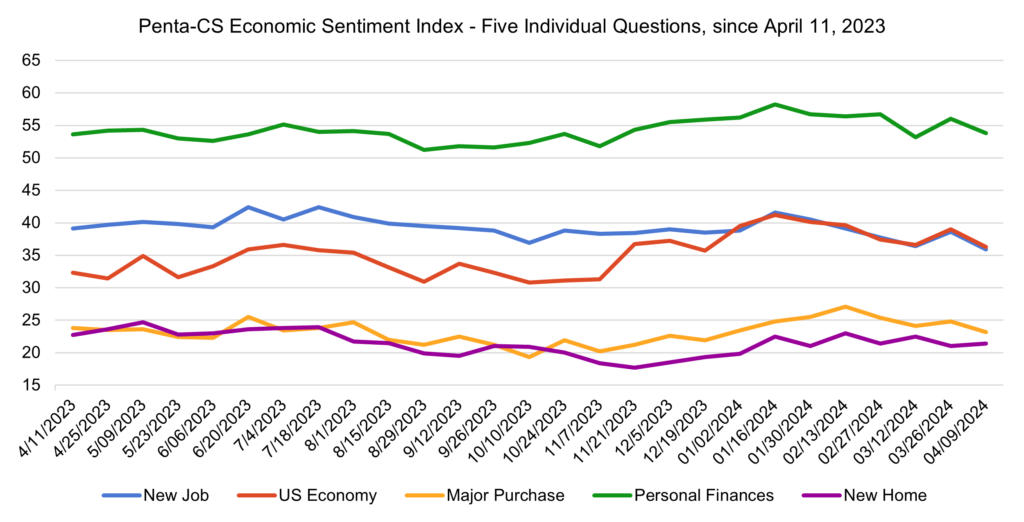

Four of the ESI’s five indicators decreased over the past two weeks. Confidence in finding a new job and confidence in the overall U.S. economy decreased the most, both falling 2.7 points to 35.9 and 36.3, respectively. This decline marked the largest single-period decrease for confidence in finding a new job in over a year, and the largest single-period decrease for confidence in the overall U.S. economy since May 2023.

—Confidence in personal finances decreased 2.2 points to 53.8.

—Confidence in making a major purchase decreased 1.6 points to 23.2.

—Confidence in buying a new home increased 0.4 points to 21.4.

The U.S. Bureau of Labor Statistics released its March consumer price index (CPI) on April 10. The Bureau reported that the index rose 0.4 percent in March month-over-month and rose 3.8 percent on an annual basis. The March index accelerated at a faster rate than economists were predicting, highlighting the continued stickiness of inflation.

Amid rising inflation, conversation over the past two weeks has continued to speculate if and when the Federal Reserve will cut rates. In a conference at Stanford University, Fed Chair Jerome Powell, reiterated the need to continue watching inflation in order “to let the incoming data guide our decisions on policy.” Minneapolis Federal Reserve President Neel Kashkari even raised the prospect of no rate cuts in 2024 when he stated, “if we continue to see inflation moving sideways, then that would make me question whether we need to do those rate cuts at all.”

The Wall Street Journal reported that, in contrast to the three quarter-point cuts signaled by the Fed in March, traders are now anticipating one or two, or possibly even zero, rate cuts for 2024.

The U.S. Bureau of Labor Statistics reported that the U.S. economy added 303,000 jobs in the month of March, blowing past economists’ predictions of 200,000 new jobs. Meanwhile, the unemployment rate decreased slightly from February, down 0.1 percentage point from 3.9 percent to 3.8 percent. The growth in jobs was strong across the economy due to gains in many industries including increases of 72,000 jobs in healthcare, 71,000 jobs in government, and 39,000 jobs in construction.

The Commerce Department revised its measure of fourth quarter 2023 gross domestic product (GDP), stating that the economy grew at an annualized pace of 3.4 percent. This measure was revised slightly upwards from the Commerce Departments’ first and second estimates of 3.3 and 3.2 percent, respectively. Despite this upward revision, GDP growth from 2023 stayed at 2.5 percent.

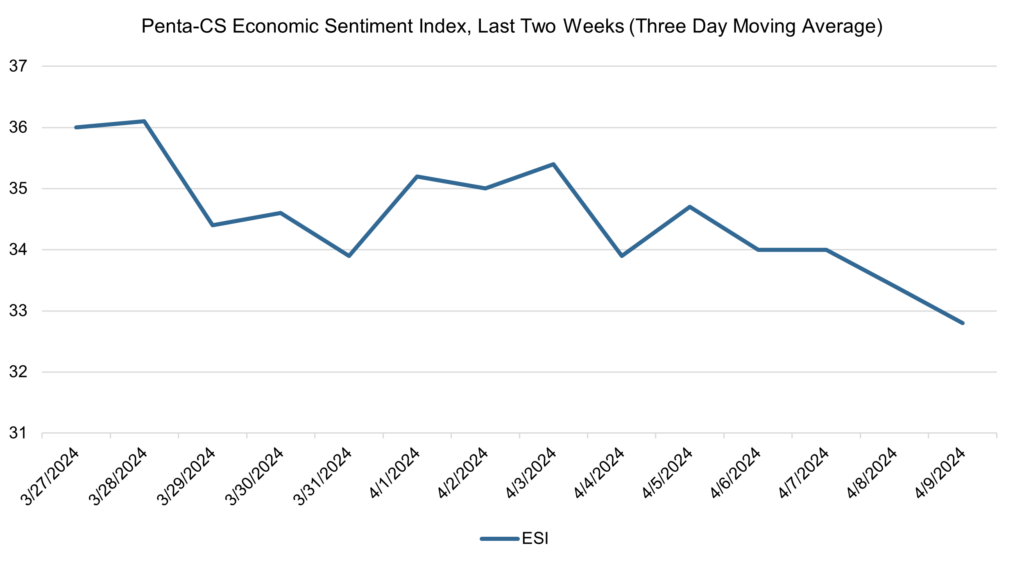

The ESI’s three-day moving average began this two-week stretch at 36.0 on March 27. It then decreased to 33.9 on March 31. The three-day moving average then oscillated between increasing and decreasing, rising to 35.4 on April 3, before continuing to oscillate and eventually fall to 32.8 on April 9 to close out the session.

The next release of the ESI will be Wednesday, April 24, 2024.