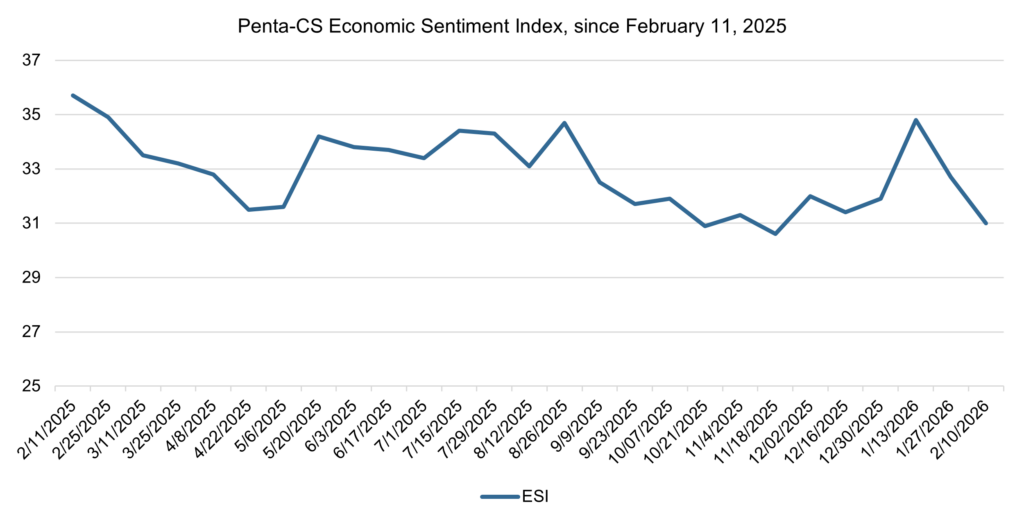

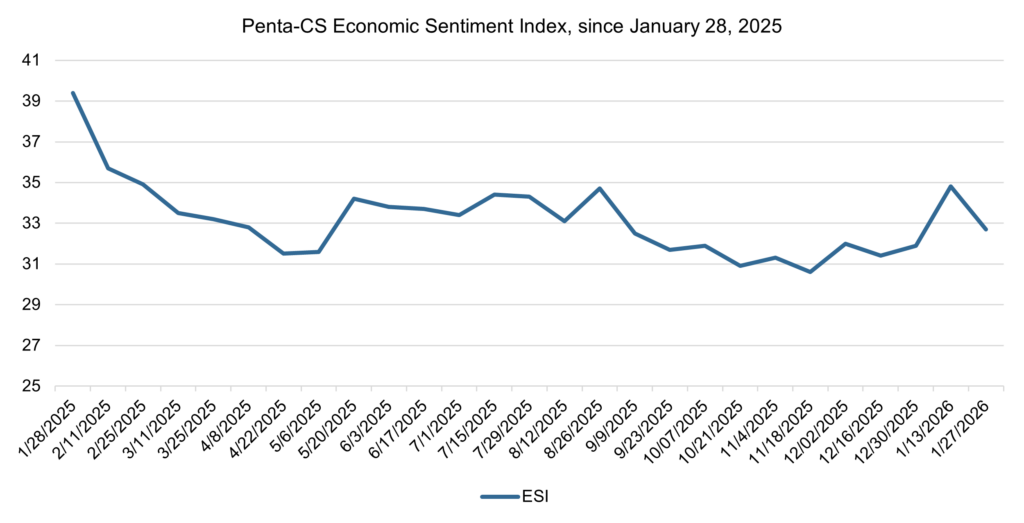

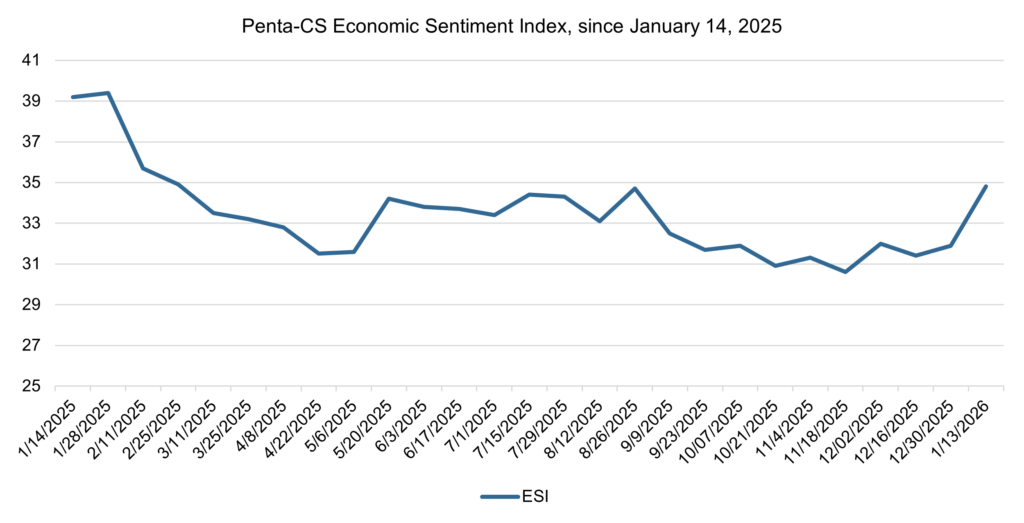

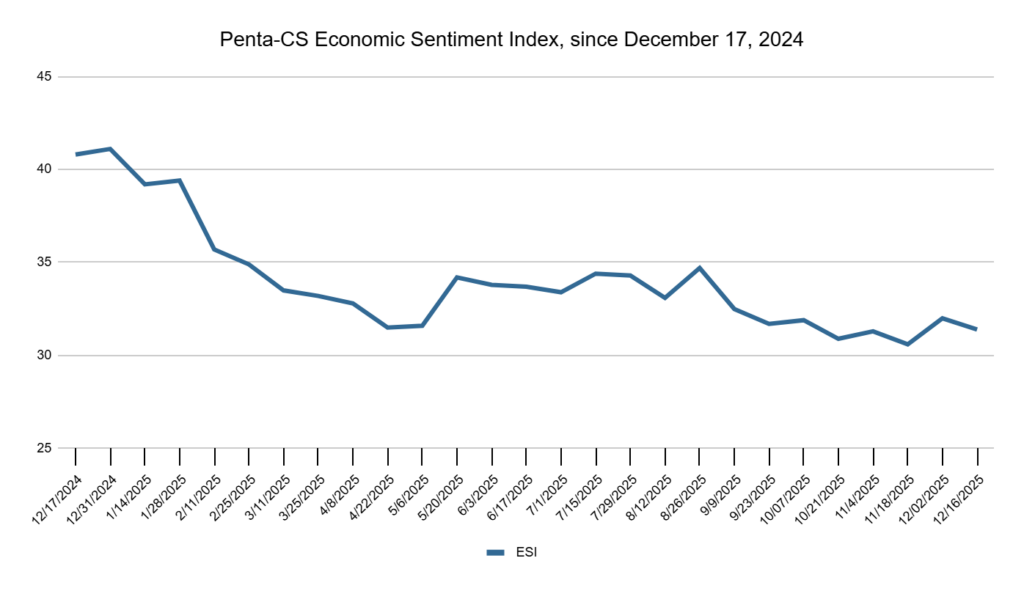

Economic sentiment picks back up after two consecutive drops

The latest biweekly reading of the Penta-CivicScience Economic Sentiment Index (ESI) rose by 0.6 points to 31.6, reversing the downward trend of the previous two periods and bolstered by a one-year high in confidence in buying a new home.

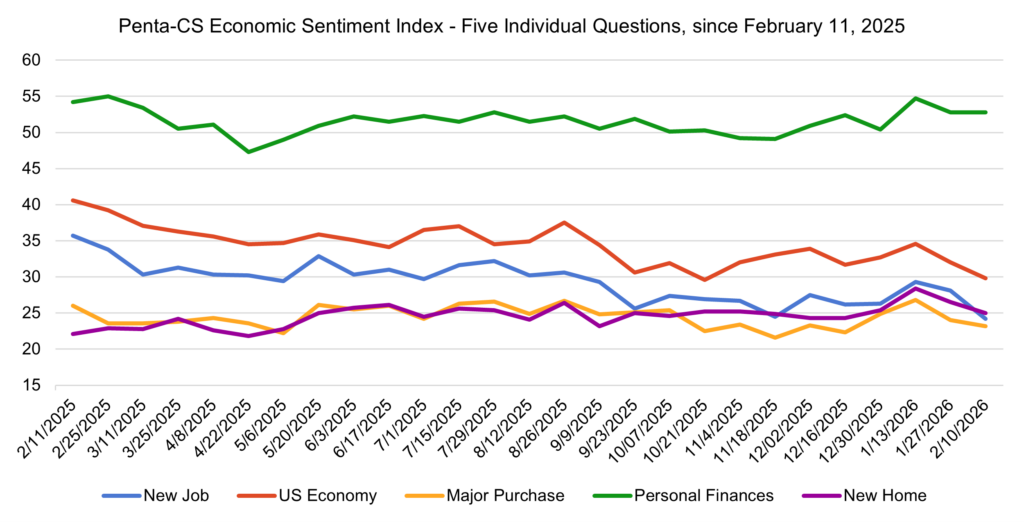

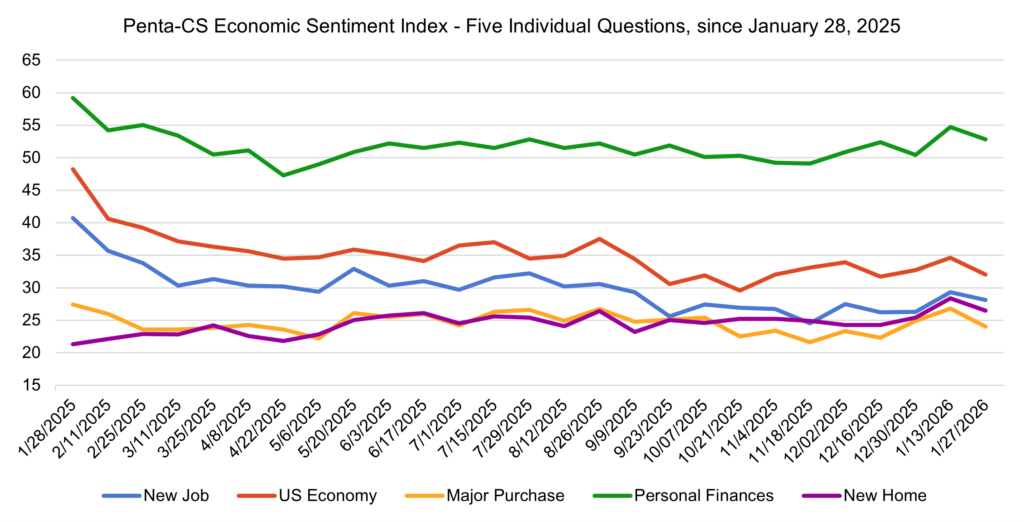

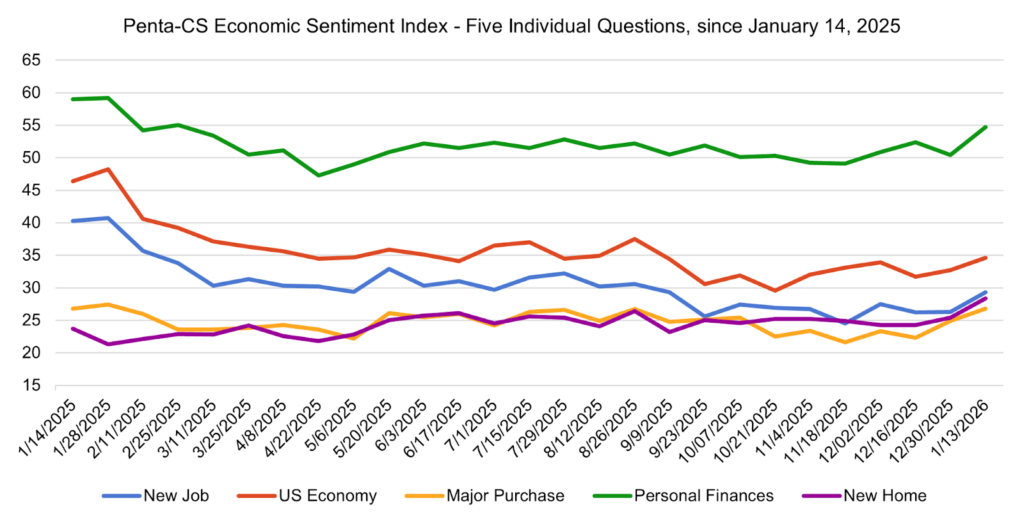

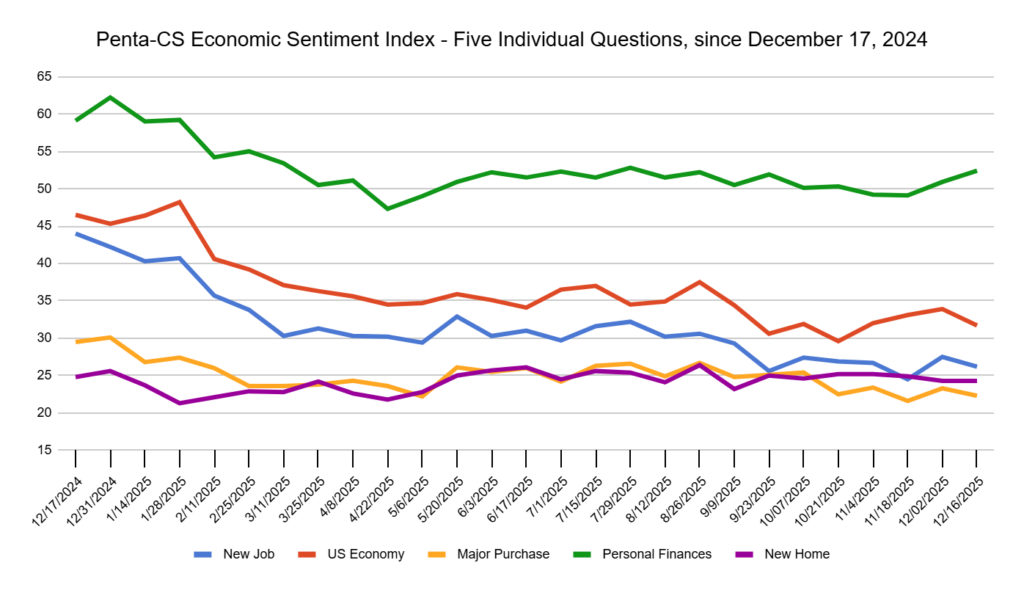

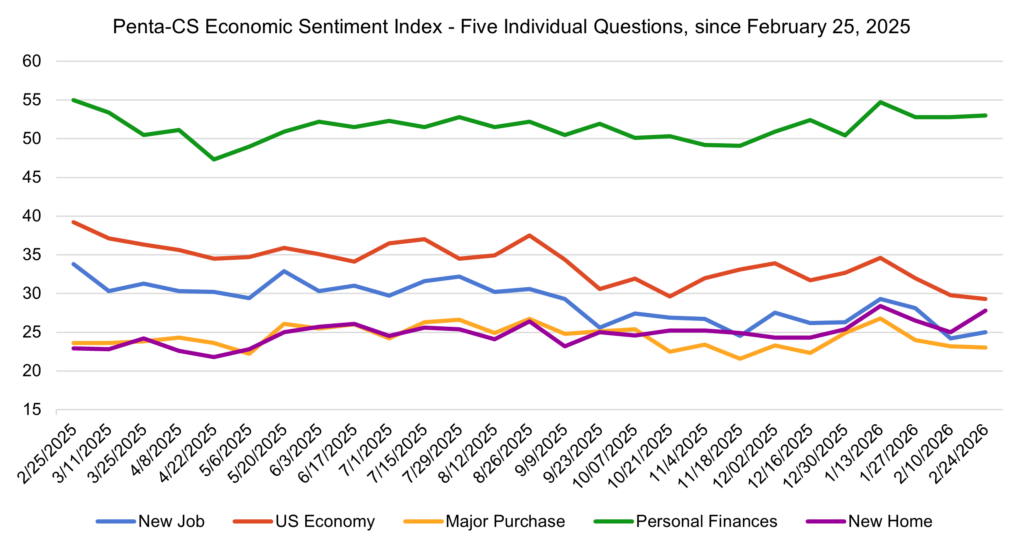

Three of the ESI’s five indicators increased during this period. Confidence in buying a new home increased the most, rising 2.8 points to 27.8.

—Confidence in finding a new job increased 0.8 points to 25.0.

—Confidence in personal finances increased 0.2 points to 53.0.

—Confidence in making a major purchase decreased 0.2 points to 23.0.

—Confidence in the overall U.S. economy decreased 0.5 points to 29.3.

Late last week, the Supreme Court ruled that President Donald Trump cannot rely on the 1977 International Emergency Economic Powers Act to impose sweeping global tariffs. Despite this, trade uncertainty remains high, as the administration has moved to impose tariffs under other legal authorities—actions that could face further legal scrutiny. Questions also remain about the status of trade agreements negotiated under the previous tariff framework and the process for refunding an estimated $133 billion in collected duties.

Mortgage rates continued to decline in February, with Freddie Mac reporting that the average 30-year fixed mortgage rate fell below 6 percent to approximately 5.99 percent, its lowest level since 2022. The decline has reduced borrowing costs for prospective homebuyers and contributed to a surge in refinancing activity. Data from the Mortgage Bankers Association’s survey for the week ending February 13 revealed that home loan refinancing applications are up over 130 percent higher from one year ago, even as pending home sales remained subdued.

The Bureau of Economic Analysis released its initial estimate for gross domestic product (GDP) for the fourth quarter of 2025 which indicated slowing U.S. economic growth in the final months of last year, with GDP increasing at an annual rate of 1.4 percent. This came in well-below economists’ predictions of a 2.5 percent gain. The slower pace of growth reflected a pullback in federal spending during the 2025 government shutdown and slower overall economic momentum relative to earlier quarters, even as personal consumption and business investment continued to contribute positively to growth.

The U.S. economy added 130,000 jobs in January and the unemployment rate edged down to 4.3 percent, according to the Labor Department, marking a rebound after several weak months. However, annual revisions showed that the U.S. had nearly no job growth in 2025, with total gains for the year reduced to 181,000 and average monthly growth revised down to 15,000. January’s hiring was concentrated in health care, social assistance, and construction, while federal and financial sector employment declined.

The Labor Department also reported that inflation eased in January, with the Consumer Price Index (CPI) rising 2.4 percent year-over-year, down from 2.7 percent in December, while core inflation edged down to 2.5 percent. Monthly price growth was softer than expected at 0.2 percent, as falling energy costs and moderating housing prices offset gains in some services. The combination of stabilizing employment and softer inflation provides near-term relief for the Federal Reserve, though tariff uncertainty and lingering core price pressures are likely to keep policymakers cautious about resuming rate cuts.

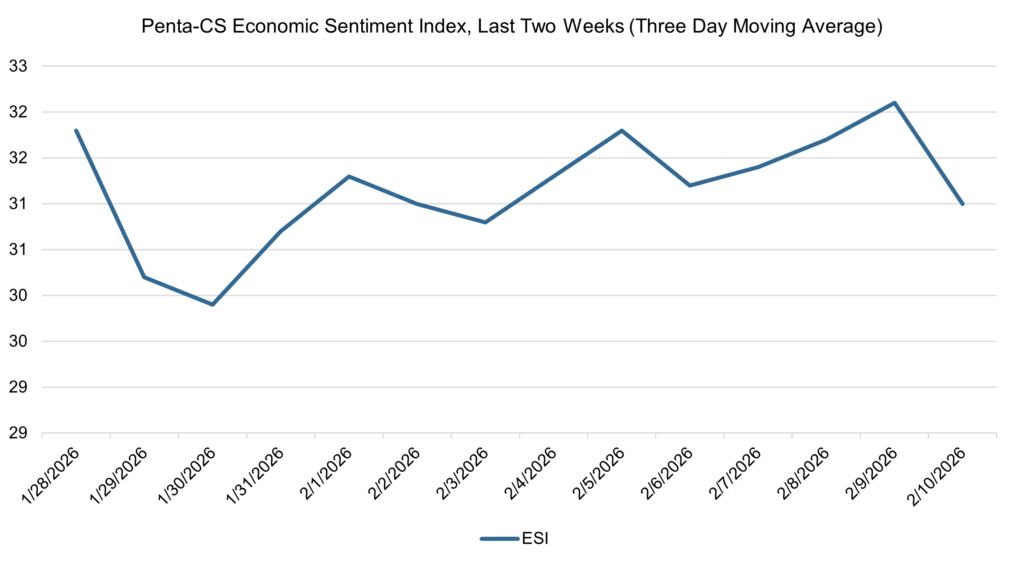

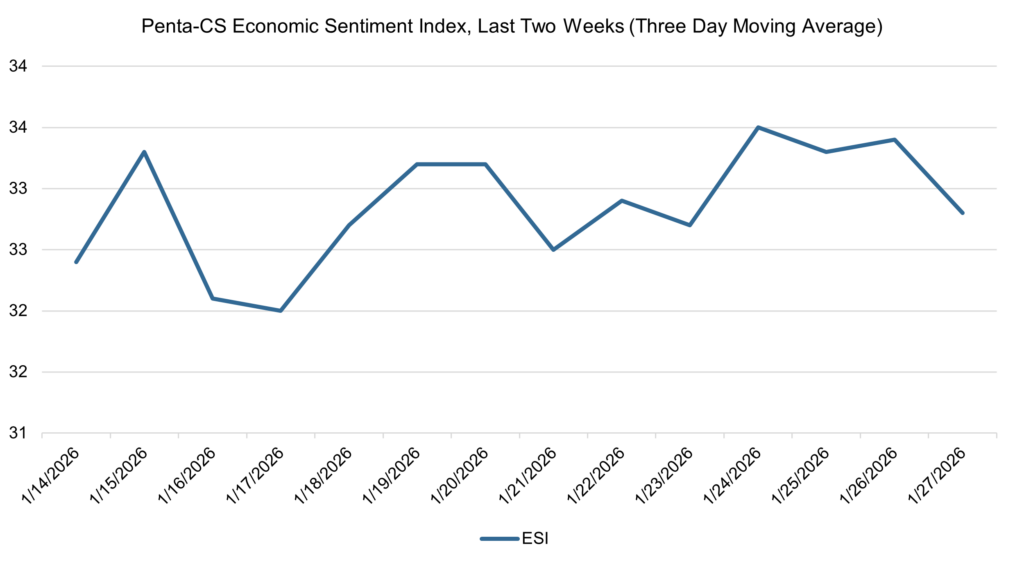

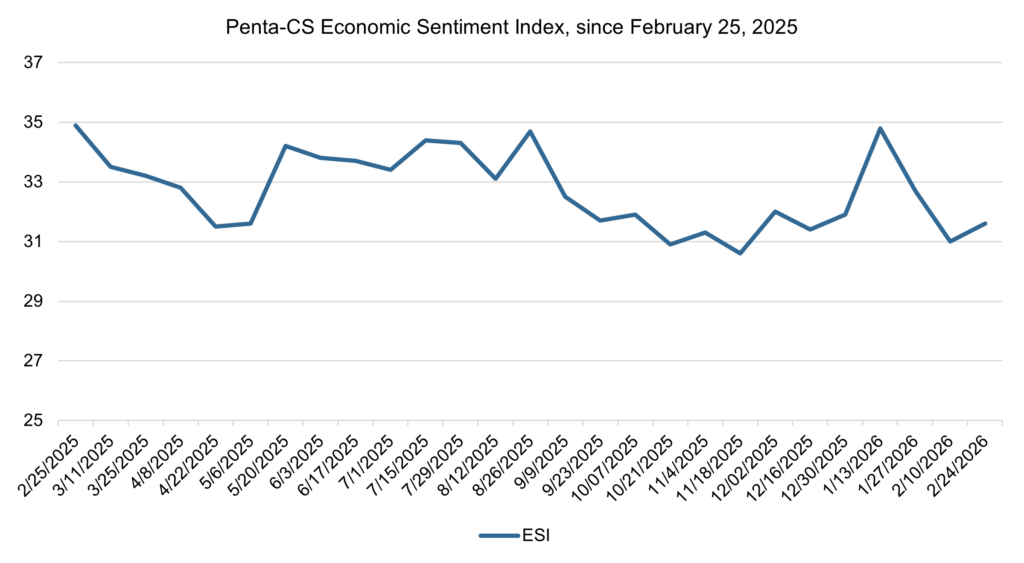

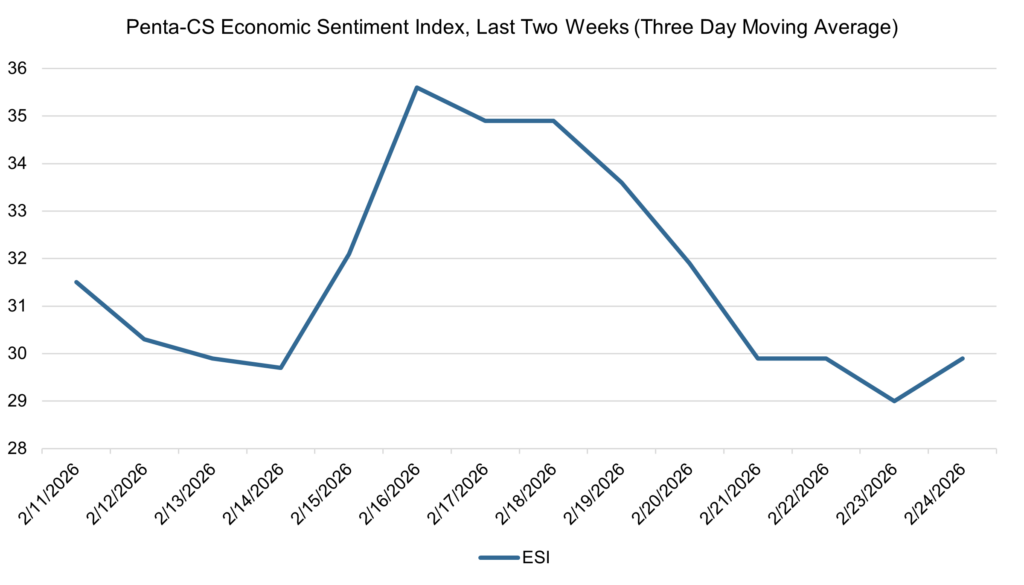

The ESI’s three-day moving average began this two-week stretch at 31.5 on February 11. It decreased slightly to 29.7 on February 14 before rapidly climbing to a high of 35.6 on February 16. Following a period of steady decline, the three-day moving average dropped to a session low of 29.0 on February 23 before closing out the past two weeks at 29.9 on February 24.

The next release of the ESI will be on Wednesday, March 11, 2026.