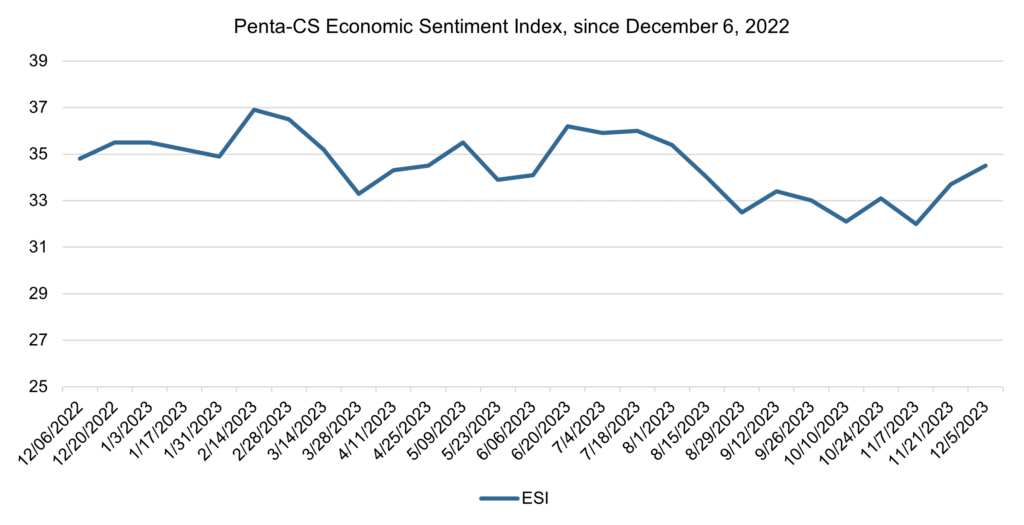

Economic sentiment increases for second reading in a row

Economic sentiment increased over the last two weeks, rising to its highest point since early August. The Penta-CivicScience Economic Sentiment Index (ESI) increased 0.8 points to 34.5.

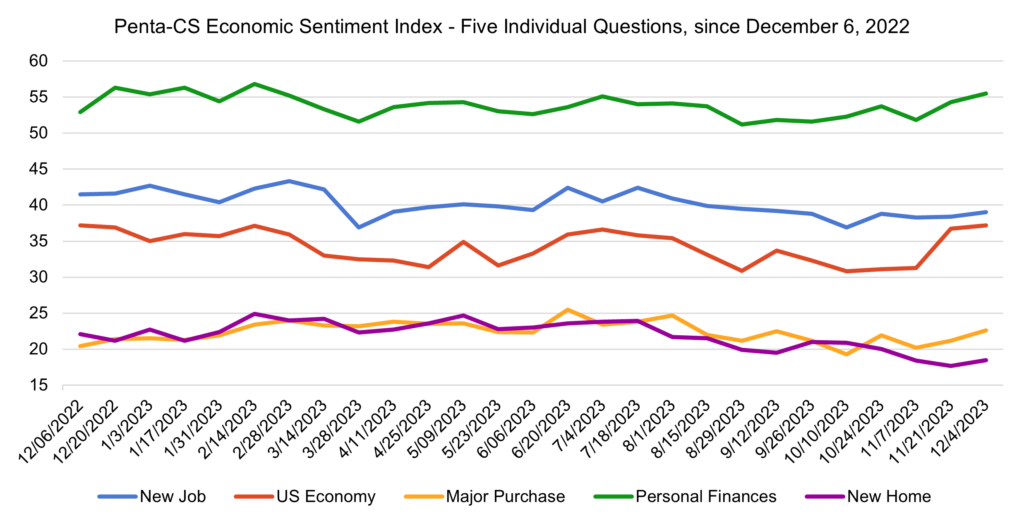

All five of the ESI indicators increased over the past two weeks—the first time since June all have increased. Confidence in making a major purchase increased the most, rising 1.4 points to 22.6.

—Confidence in personal finances rose 1.2 points to 55.5.

—Confidence in buying a new home rose 0.8 points to 18.5.

—Confidence in finding a new job rose 0.6 points to 39.0.

—Confidence in the overall U.S. economy rose 0.5 points to 37.2.

Consumers spent 81% of their monthly income in October, an increase from record lows during the pandemic but in-line with pre-pandemic spending. According to a report by WalletHub, Americans had the highest spending total for a single month since 2010 in November.

The increase in consumer spending has corresponded with a decrease in prices for durable goods on a year-over-year basis for five consecutive months, according to data from the Commerce Department. In October, durable good prices were 2.6% lower than their peak in September of 2022. This decrease has helped cool core U.S. economic inflation and consumers have become more confident in their personal finances.

The Labor Department reported that there were 8.7 million job openings in October, well below the expected 9.3 million and down significantly from 9.3 million in September. This data points to a softening of the U.S. labor market—something likely to be watched closely by the Federal Reserve as it contemplates raising interest rates. Inflation has slowed significantly since rates began to be raised, and Fed Chair Jermone Powell recently noted that the Fed would leave interest rates steady if the economy shows signs of cooling.

The Federal Housing Finance Agency (FHFA) reported that U.S. annual home prices increased on a quarterly basis 5.5% between the third quarter of 2022 and the third quarter of 2023. Additionally, home prices increased by 2.1% from the second quarter of 2023. FHFA attributes this rise in prices to the low supply of homes on the market.

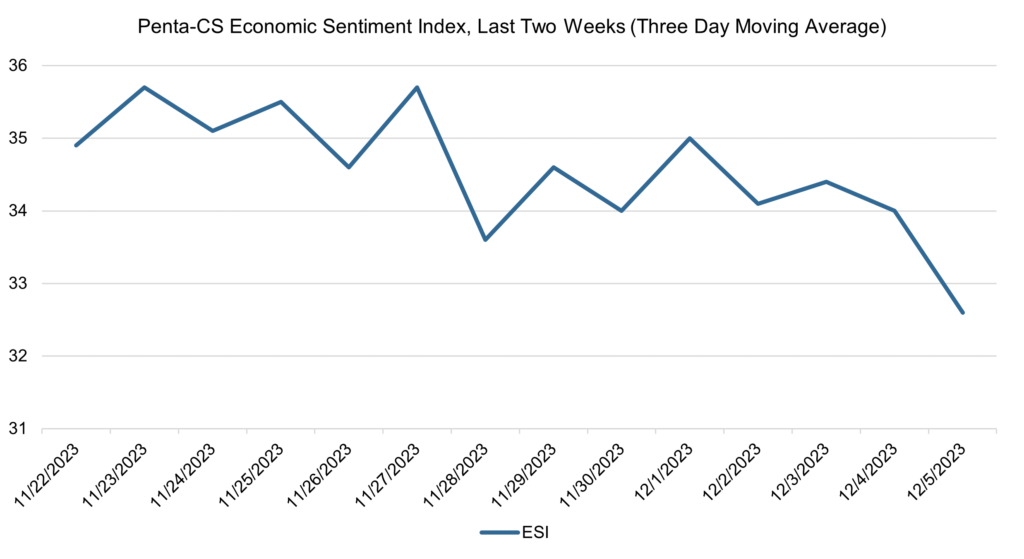

The ESI’s three-day moving average began this two-week stretch at 34.9 on November 22. It rose to a peak of 35.7 on November 23 before trending downward to 34.6 on November 26. The three-day average then rose again to a peak of 35.7, oscillated between increasing and decreasing, then reached a low of 32.6 to close out the session.

The next release of the ESI will be Wednesday, December 20, 2023.