Economic sentiment slightly increases following last period’s large decrease

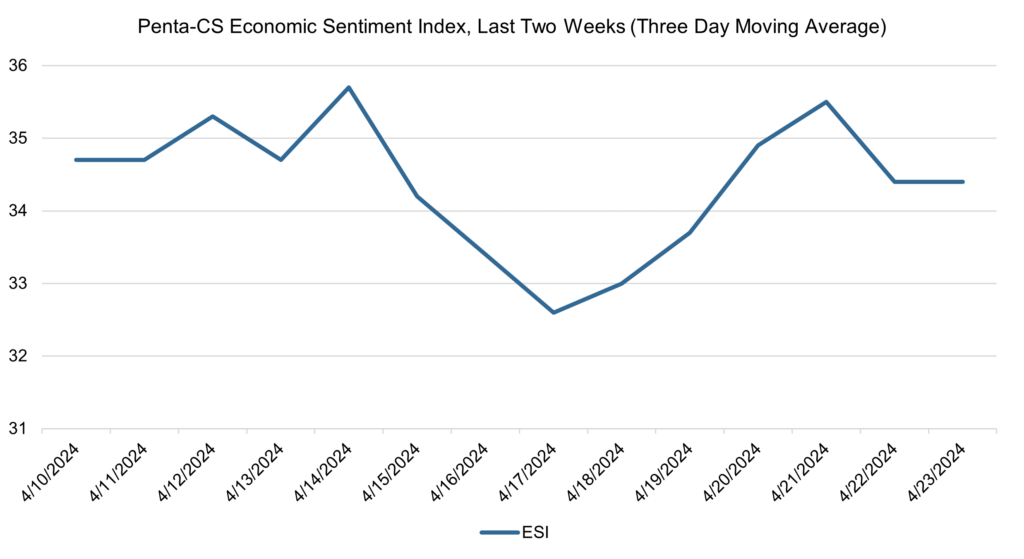

Economic sentiment slightly increased over the last two weeks following last period’s large decrease. The Penta-CivicScience Economic Sentiment Index (ESI) rose 0.3 points over the last two weeks, to 34.4.

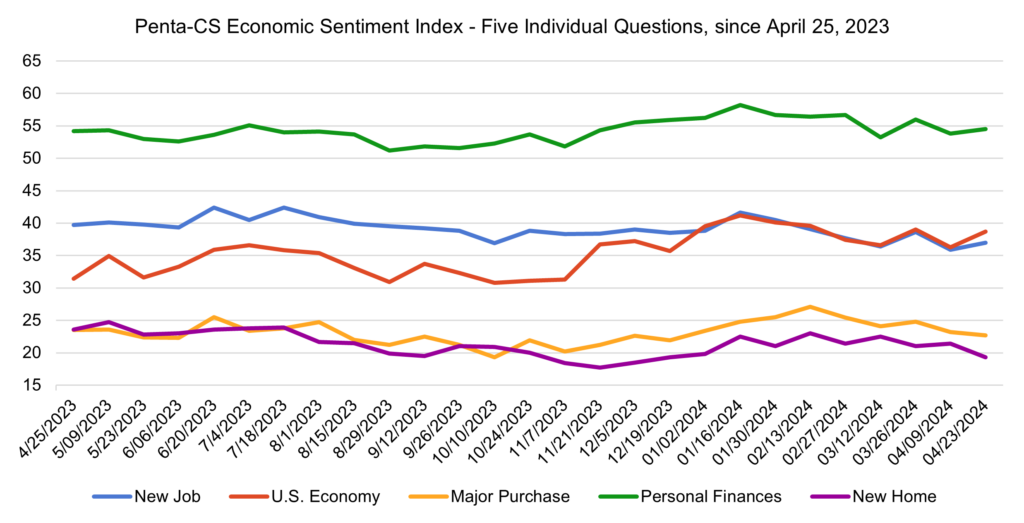

Three of the ESI’s five indicators increased over the past two weeks. Confidence in the overall U.S. economy increased the most, rising 2.4 points to 38.7.

—Confidence in finding a new job increased 1.1 points to 37.0.

—Confidence in personal finances increased 0.7 points to 54.5.

—Confidence in buying a new home decreased 2.1 points to 19.3.

—Confidence in making a major purchase decreased 0.5 points to 22.7.

The International Monetary Fund (IMF) increased its growth estimate for the U.S. economy to 2.7% in 2024, an upwards adjustment of 0.6 percentage points from the previous estimate released in January. This adjustment highlights the surprising strength of the U.S. economy. IMF chief economist Pierre-Olivier Gourinchas wrote, “The strong recent performance of the United States reflects robust productivity and employment growth, but also strong demand in an economy that remains overheated. This calls for a cautious and gradual approach to (monetary) easing by the Federal Reserve.”

In a question-and-answer session on April 16, Fed Chair Jerome Powell continued to discuss the possibility of rate cuts amid persistent inflation. Powell stated, “The recent data have clearly not given us greater confidence and instead indicate that it is likely to take longer than expected to achieve that confidence.” This statement followed the release of March’s consumer price index, which showed that inflation accelerated faster than economists had previously predicted.

The Federal Reserve’s “Beige Book” survey, which polled business across the Fed’s 12 districts over the six weeks prior to April 8, found that economic activity “expanded slightly,” with ten of the Federal Reserve’s 12 districts having “experienced either slight or modest economic growth—up from eight in the previous report, while the other two reported no changes in activity.” Additionally, the survey found that increases in prices were “modest, on average, running at about the same pace as in the last report” and that employment increased at “a slight pace overall.”

The ESI’s three-day moving average began this two-week stretch at 34.7 on April 10. It then oscillated slightly before rising to a peak of 35.7 on April 14. The three-day moving average then fell to a low of 32.6 before increasing back up to 35.5 on April 21. It fell to 34.4 on April 23 to close out the session.

The next release of the ESI will be Wednesday, May 8, 2024.