Economic sentiment continues its downward trend to start May

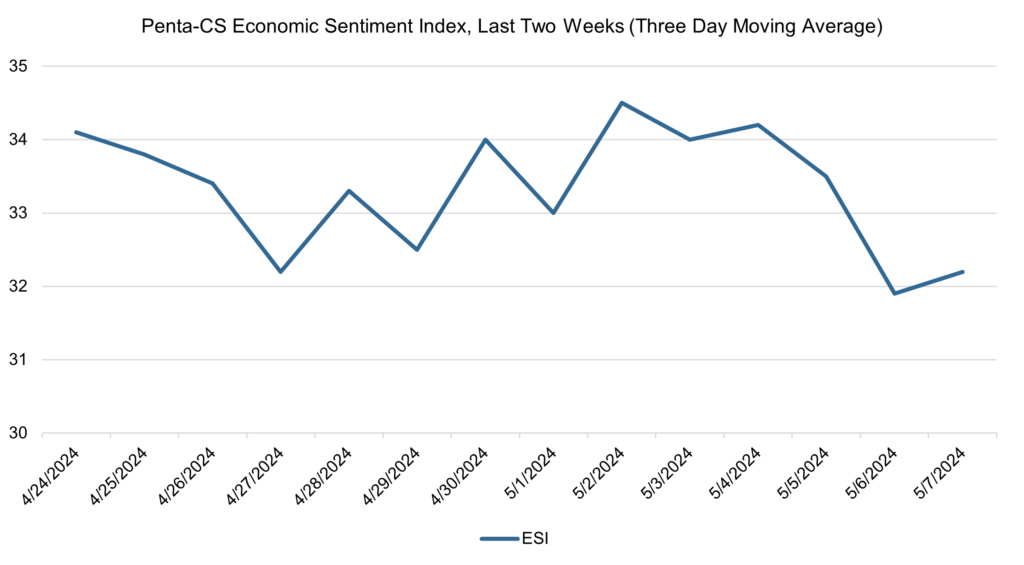

Economic sentiment decreased over the last two weeks, continuing the ongoing downward trend observed since the start of the year. The Penta-CivicScience Economic Sentiment Index (ESI) decreased 1.4 points over the last two weeks, to 33.0.

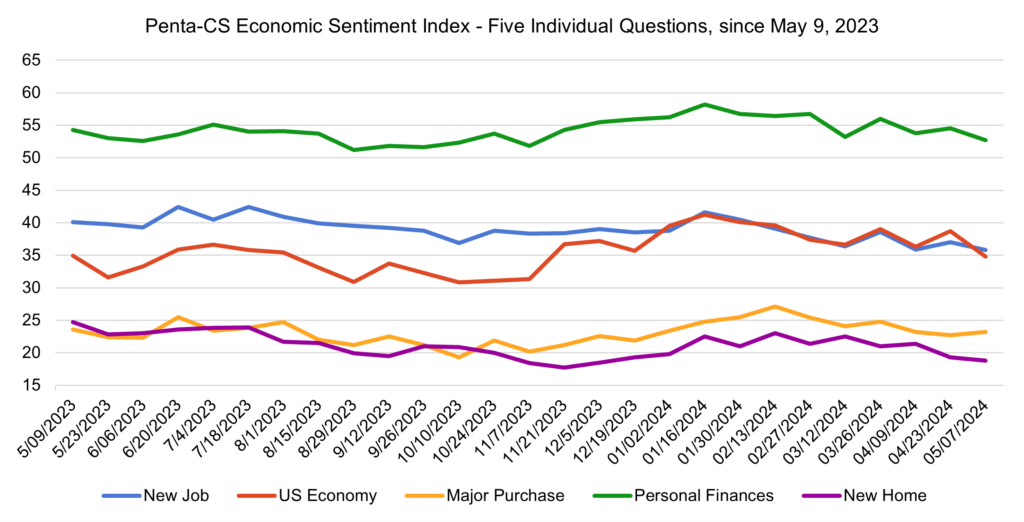

Four of the ESI’s five indicators decreased over the past two weeks. Confidence in the overall U.S. economy decreased the most, falling 3.9 points to 34.8. This marks this indicator’s largest single-period decrease in over a year.

—Confidence in personal finances decreased 1.8 points to 52.7.

—Confidence in finding a new job decreased 1.2 points to 35.8.

—Confidence in buying a new home decreased 0.5 points to 18.8.

—Confidence in making a major purchase increased 0.5 points to 23.2.

The Commerce Department reported that the U.S. economy grew by an annualized rate of 1.6 percent in the first quarter of 2024. This represents a sharp slowdown in growth compared to the fourth quarter of 2023, where the economy grew by an annualized rate of 3.4 percent. Additionally, this report was much lower than the growth rate of 2.4 percent that economists were predicting. The Bureau of Economic Analysis stated that the “deceleration in real GDP in the first quarter primarily reflected decelerations in consumer spending, exports, and state and local government spending and a downturn in federal government spending.”

Despite this bleak report, U.S. Treasury Secretary Janet Yellen continued to reaffirm the U.S.’s economic outlook. In an interview with Reuters Next, Yellen stated, “The U.S. economy continues to perform very, very well.” Yellen also implied that the data may be revised upwards when more data becomes available.

The U.S. Bureau of Labor Statistics reported that total non-farm payrolls increased by 175,000 in April while the unemployment rate increased 0.1 percentage points to 3.9 percent. This was well below the predictions of economists’ who had forecasted an increase of 240,000 jobs.

On May 1, the Federal Reserve issued its Federal Open Market Committee statement where it decided to leave interest rates unchanged at between 5.25 percent and 5.5 percent. The Fed’s statement read, “recent indicators suggest that economic activity has continued to expand at a solid pace” but that “there has been a lack of further progress toward the Committee’s 2 percent inflation objective.”

Media attention has begun to report on the possibility of the U.S. entering a stagflationary period. Fed Chair Jerome Powell last week stated that he doesn’t “really understand where talk of a stagflation scenario is coming from.” However, JPMorgan Chase CEO Jamie Dimon was recently a little less optimistic, stating, “You should be worried about (the possibility of stagflation).”

The ESI’s three-day moving average began this two-week stretch at 34.1 on April 24. It decreased to 32.2 on April 27, then oscillated between increasing and decreasing until it reached a peak of 34.5 on May 2. The three-day moving average then decreased to a low of 31.9 on May 6 before slightly rising to 32.2 on May 7 to close out the session.

The next release of the ESI will be Wednesday, May 22, 2024.