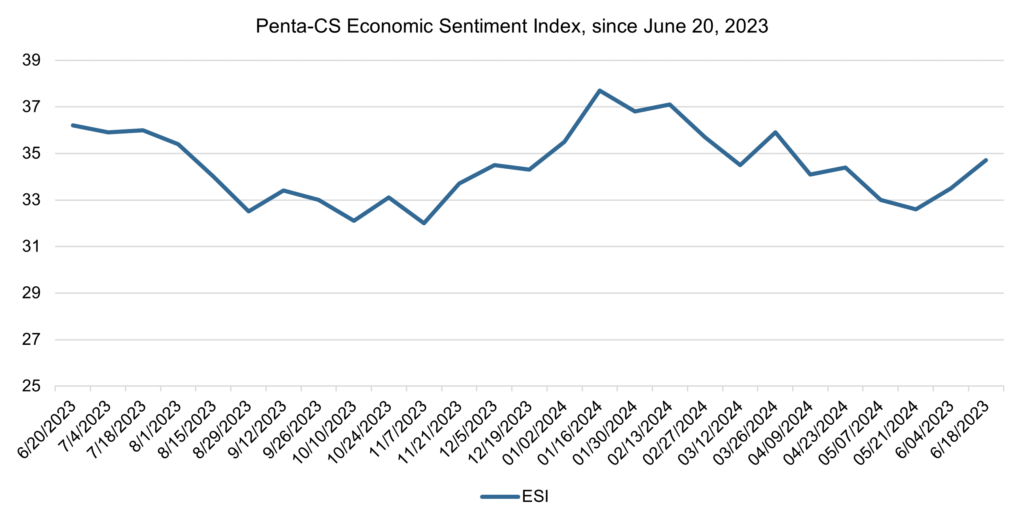

Economic sentiment continues its June rally

Economic sentiment increased again over the past two weeks, continuing its rally from the beginning of the month. The Penta-CivicScience Economic Sentiment Index (ESI) rose 1.2 points to 34.7.

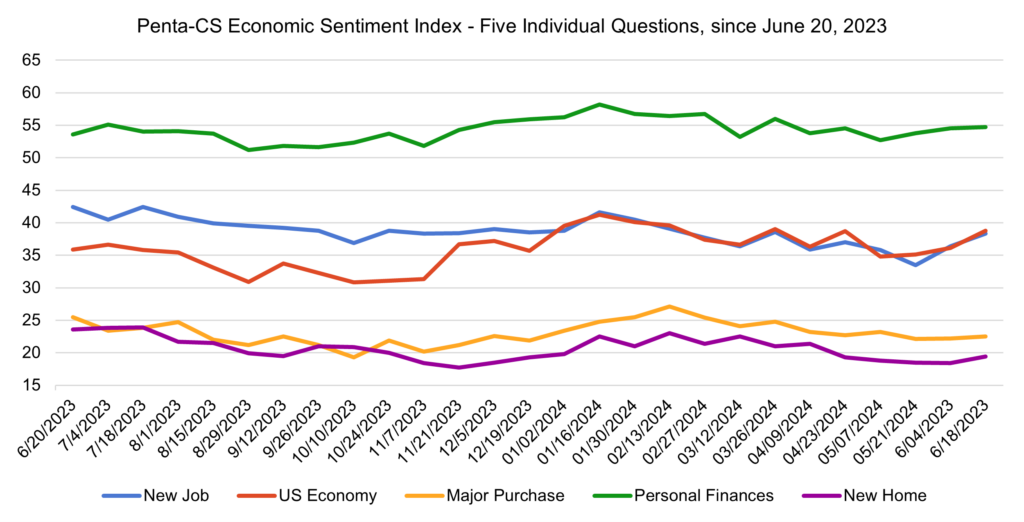

All of the ESI’s five indicators increased over the past two weeks. Confidence in the overall U.S. economy increased the most, rising 2.7 points to 38.8. This marks this indicator’s largest single-reading increase since January.

—Confidence in finding a new job increased 1.9 points to 38.3.

—Confidence in buying a new home increased 1.0 points to 19.4.

—Confidence in making a major purchase increased 0.3 points to 22.5.

—Confidence in personal finances increased 0.2 points to 54.7.

The May jobs report showed the economy added 272,000 jobs in the month, blowing past economists’ predictions of 190,000. Meanwhile, the U.S. Department of Labor Statistics reported that the unemployment rate increased by 0.1 percentage points to 4 percent. This is the first time that this metric has breached the 4 percent threshold since January 2022.

Meanwhile, the U.S. Department of Labor Statistics released the May Consumer Price Index (CPI) data, showing that the Index remained unchanged in May and rose 3.3 percent on an annual basis. Meanwhile, Core CPI inflation increased slightly, rising 0.2 percent in May.

On the heels of the CPI data, the Federal Reserve announced it again decided to leave interest rates unchanged at between 5.25 percent and 5.5 percent. This represents the 11th consecutive month the Fed has left the rates unchanged. In its Federal Open Markets Committee statement, the Fed stated that “Recent indicators suggest that economic activity has continued to expand at a solid pace” and “Inflation has eased over the past year but remains elevated.” The Fed again reiterated its goal of reducing inflation to 2 percent.

The World Bank upgraded its prediction for global economic growth in 2024, forecasting that it will expand 2.6 percent this year. This represents an increase of 0.2 percentage points from its prediction in January of this year. The World Bank’s Chief Economist, Indermit Gill, credited part of this revision to the U.S. economy, stating, “Globally, overall things are better today than they were just four or five months ago. A big part of this has to do with the resilience of the U.S. economy.”

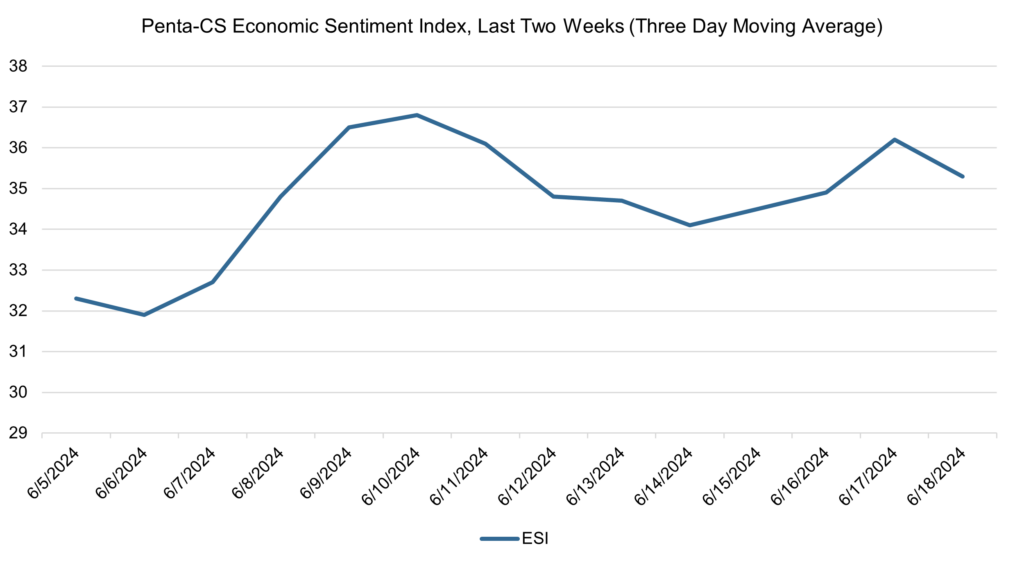

The ESI’s three-day moving average began this two-week stretch at 32.3 on June 5. It then decreased to a low of 31.9 on June 6 before rising to a peak of 36.8 on June 10. The three-day moving average then decreased to 34.1 on June 14 before rising back up to 36.2 on June 17. Finally, the moving average closed out the session by falling to 35.3 on June 18.

The next release of the ESI will be Wednesday, July 3, 2024.