Economic sentiment continues upswing into July 4 holiday weekend

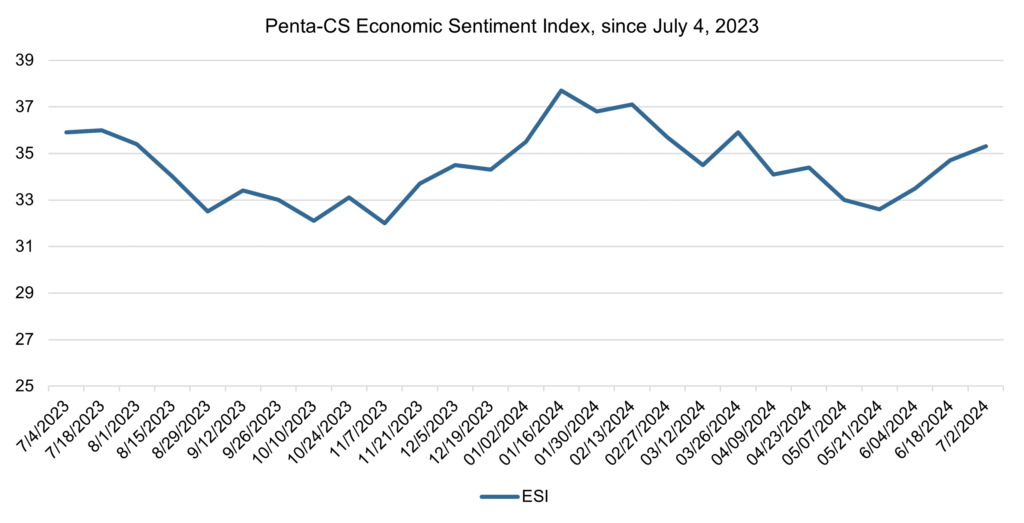

Economic sentiment increased again over the past two weeks, reaching its highest level since mid-March. The Penta-CivicScience Economic Sentiment Index (ESI) rose 0.6 points to 35.3.

Two of the ESI’s five indicators increased over the past two weeks. Confidence in the overall U.S. economy increased the most, rising 2.5 points to 41.3.

—Confidence in making a major purchase increased 1.6 points to 24.1.

—Confidence in personal finances remained unchanged at 54.7.

—Confidence in finding a new job decreased 0.2 points to 38.1.

—Confidence in buying a new home decreased 1.1 points to 18.3.

The Bureau of Labor Statistics reported on May 31 that personal consumption expenditures, excluding volatile food and energy prices, increased by seasonally adjusted 0.1% in May and are up 2.6% year-over-year. The latter reading is 0.2 percentage points lower than the year-over-year reading from April and represents the lowest reading since March 2021.

Despite this positive reading from the Fed’s preferred inflation metric, economists remain skeptical of a potential rate cut at the Fed’s next meeting on July 31 given the Fed’s continued emphasis on getting inflation down to 2%. Ryan Sweet, chief US economist at Oxford Economics, told the Financial Times that while the reading was “encouraging news” the Fed was not yet “anywhere near ready to declare victory.”

The Commerce Department revised its GDP growth estimate for the first quarter of 2024 to an annualized pace of 1.4%. This represents a slight upgrade from its previous estimate of 1.3% but still marks the GDP’s slowest quarterly growth since spring 2022 and a sharp change from the growth rate of 3.4% experienced in the last quarter of 2023.

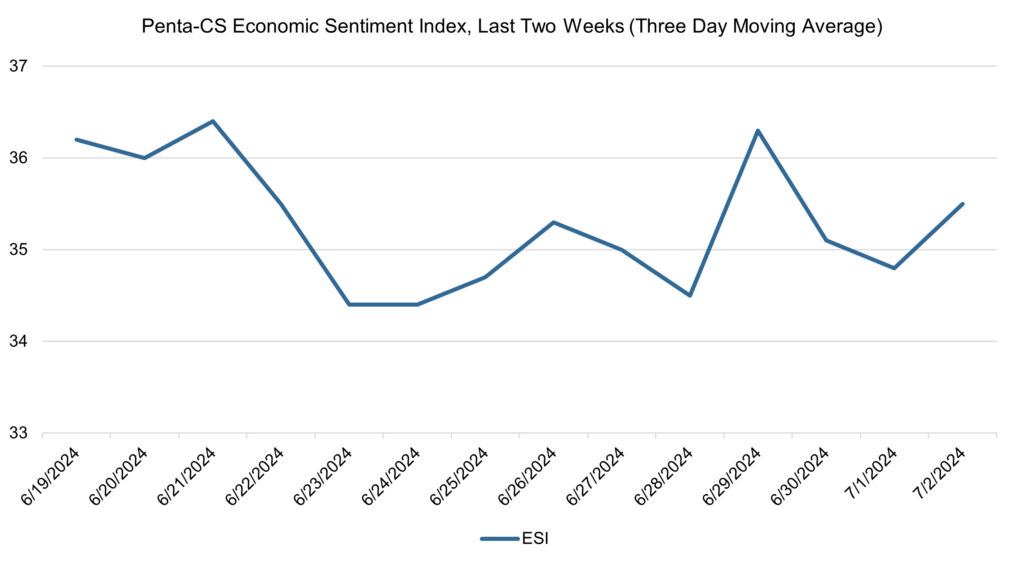

The ESI’s three-day moving average began this two-week stretch at 36.2 on June 19. It then decreased slightly before rising to a peak of 36.4 on June 21. The three-day moving average then decreased to a low of 34.4 on June 23 before rising back up to 35.3 on June 26. The average then heavily oscillated between increasing and decreasing before rising back up slightly to 35.5 on July 2 to close out the session.

The next release of the ESI will be Wednesday, July 17, 2024.