Economic sentiment declines alongside a decrease in overall economic confidence

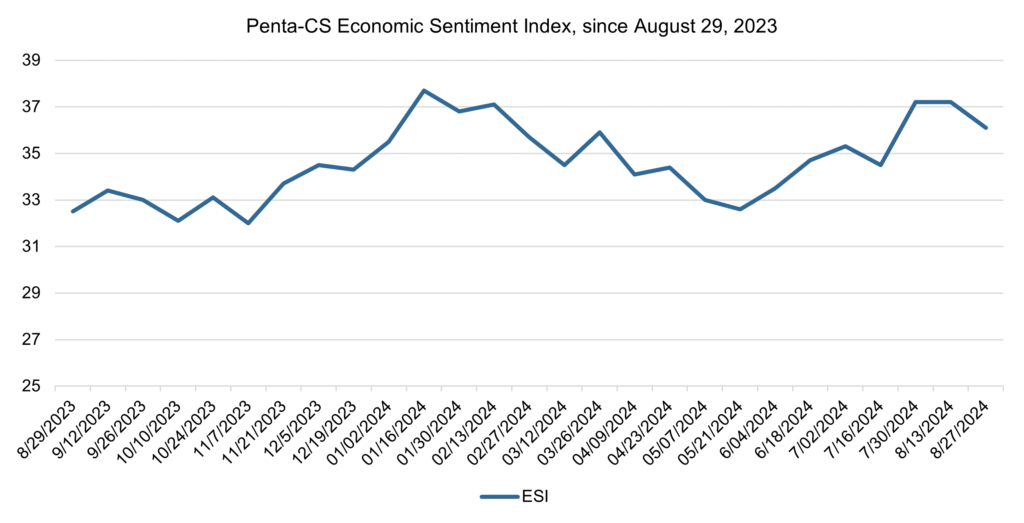

The Penta-CivicScience Economic Sentiment Index (ESI) decreased by 1.1 points to 36.1, reflecting growing concerns amid recent economic developments.

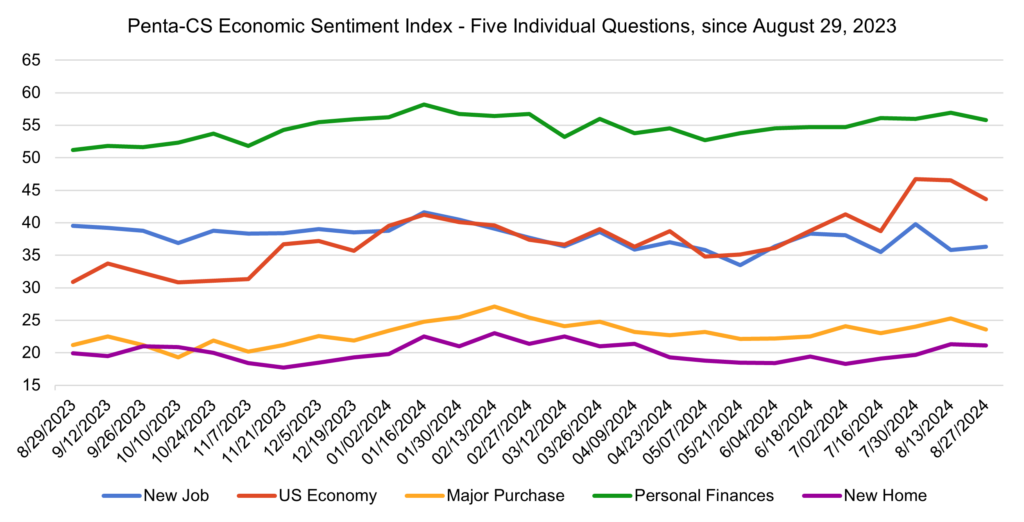

Four of the ESI’s five indicators decreased over the past two weeks. Confidence in the overall U.S. economy decreased the most, falling 2.9 points to 43.6.

—Confidence in making a major purchase decreased 1.7 points to 23.6.

—Confidence in personal finances decreased 1.1 points to 55.8.

—Confidence in buying a new home decreased 0.2 points to 21.3.

—Confidence in finding a new job increased 0.5 points to 36.3.

At the Federal Reserve’s recent Jackson Hole conference, Chair Jerome Powell signaled that the “time has come” for interest rate cuts as inflation shows signs of easing. Powell emphasized the Fed’s commitment to achieving a soft landing for the U.S. economy, balancing inflation control with maintaining a strong labor market. His comments have led to increased speculation about the Fed’s policy direction and have caused notable movements in financial markets.

The Bureau of Labor Statistics reported a significant revision to jobs data, reporting that 818,000 fewer jobs were created between March 2022 and March 2023 than initially estimated. This substantial adjustment has raised alarms about the strength of the labor market, particularly as the July Jobs Report showed only 114,000 new jobs, far below expectations. The revisions and weak job growth suggest a potentially slower economic recovery than previously anticipated.

Meanwhile, retail sales in July provided a brighter spot in the economic landscape, with a 1% increase from June and up 2.7% year-over-year. This data indicates that consumer spending remains robust. This resilience in consumer spending continues to support economic growth despite persistent headwinds such as stubborn inflation and slowing jobs growth.

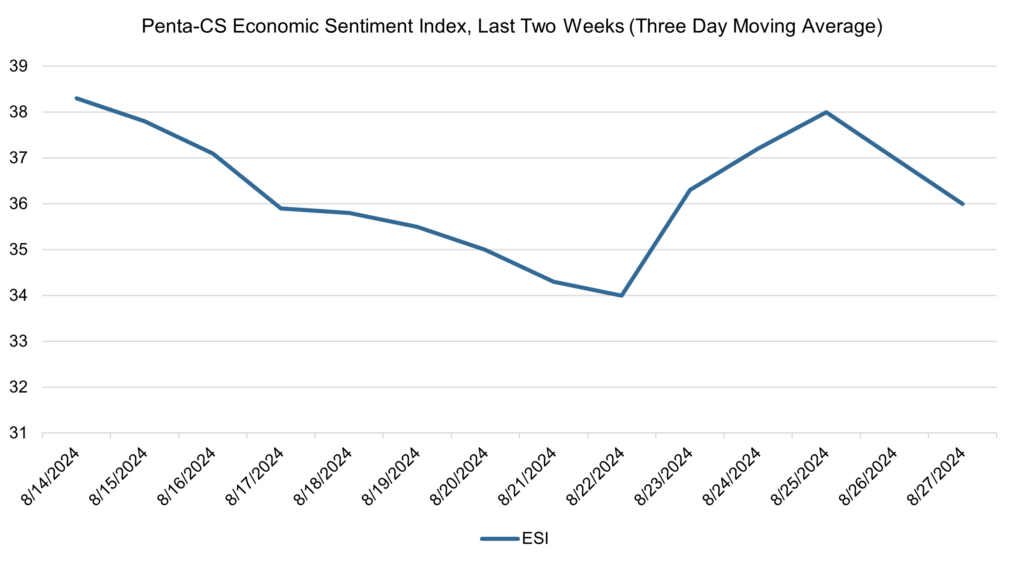

The ESI’s three-day moving average began this two-week stretch at 38.3 on August 14, then decreased steadily to 34.0 on August 22. It then rose back up to 38.0 on August 25 before decreasing to 36.0 on August 27 to close out the session.

The next release of the ESI will be on Wednesday, September 11, 2024.