Economic sentiment remains fairly steady

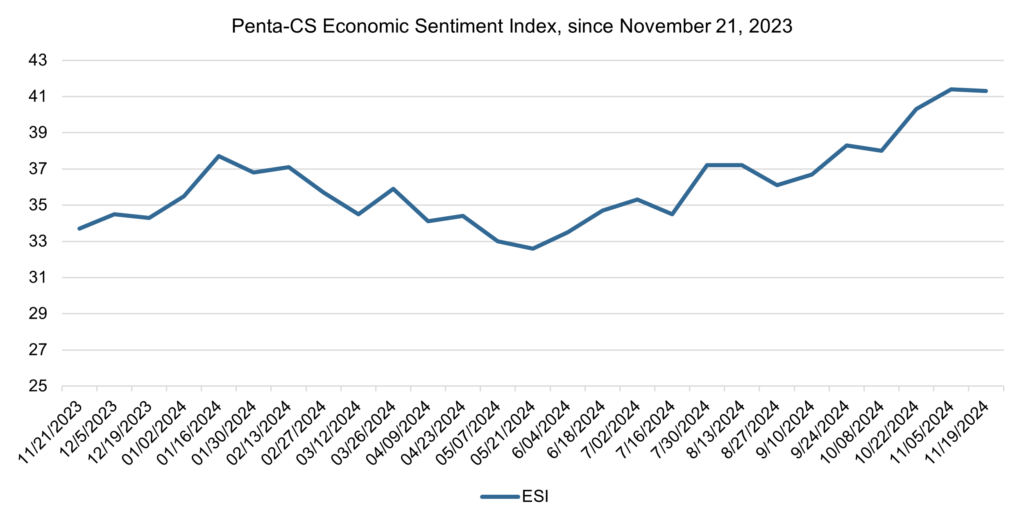

The latest biweekly reading of the Penta-CivicScience Economic Sentiment Index (ESI) decreased by 0.1 point to 41.3, marking a minor dip in overall economic confidence over the past two weeks.

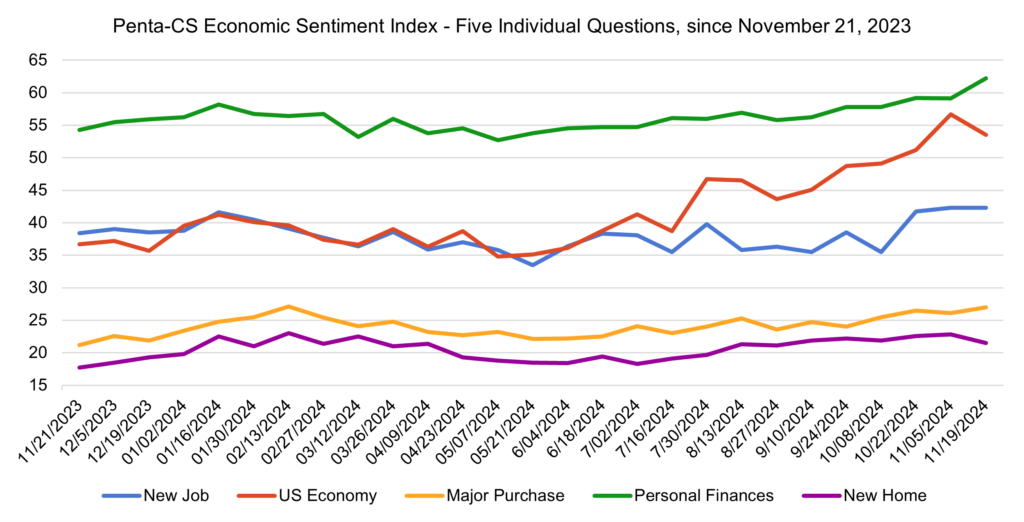

Two of the ESI’s five indicators decreased during this period. Confidence in the overall U.S. economy decreased the most, falling 3.2 points to 53.5.

—Confidence in buying a new home decreased 1.3 points to 21.5.

—Confidence in finding a new job remained flat at 42.3.

—Confidence in making a major purchase increased 0.9 points to 27.0.

—Confidence in personal finances increased 3.1 points to 62.2.

The Federal Reserve reduced interest rates by 25 basis points on November 7, lowering the target federal funds rate to between 4.5 and 4.75 percent. This marks the second rate cut of 2024, reflecting the Federal Open Markets Committee’s belief that inflation is nearing the Fed’s 2 percent goal. In its statement, the FOMC said that “the risks to achieving its employment and inflation goals are roughly in balance.”

The Fed is also navigating uncertainty following Donald Trump’s election as president, as potential shifts in fiscal, trade, and immigration policies could influence future inflation and growth trajectories. Fed Chair Jerome Powell affirmed that immediate policy decisions would not account for speculative political changes, stating, “in the near term, the election will have no effects on our policy decisions.”

The U.S. Bureau of Labor Statistics released the October Consumer Price Index (CPI) report, showing annual inflation rising to 2.6 percent, a modest increase from September’s 2.4 percent, while the core CPI that excludes food and energy prices rose 3.3 percent over the past year. Both figures aligned with economists’ expectations and reflected mixed inflationary pressures. Shelter costs, responsible for over half of the CPI’s overall increase, rose 0.4 percent in October and 4.9 percent year-over-year, remaining a substantial inflation driver.

Retail sales rose by 0.4 percent in October, matching September’s revised gain, bringing total sales to $718.9 billion, according to the U.S. Census Bureau. Compared to October of last year, sales increased by 2.8 percent. The advance report indicates a steady consumer sector, and economists expect decent continued growth over the holiday shopping season.

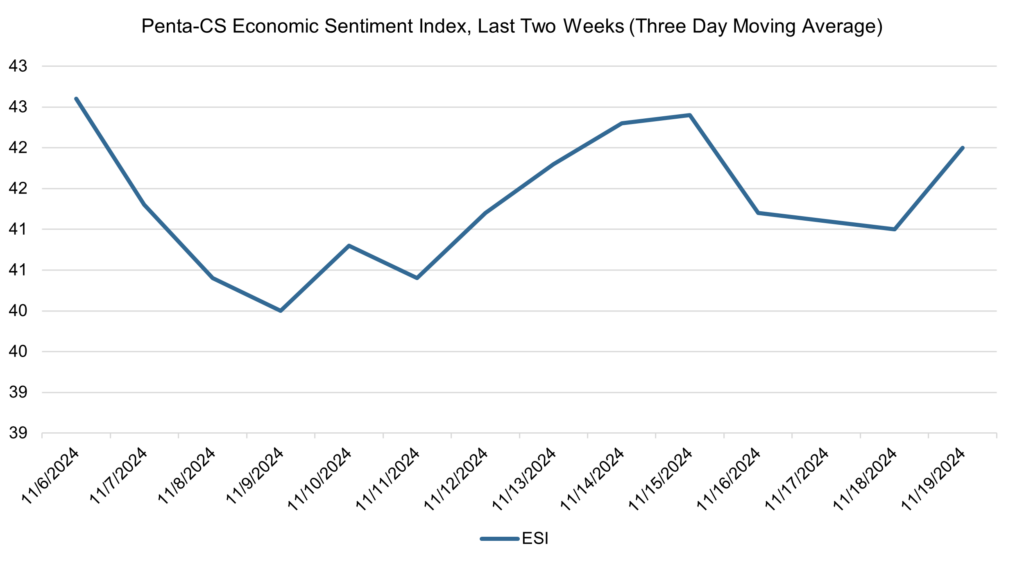

The ESI’s three-day moving average began this two-week stretch at 42.6 on November 6. It then fell to a low of 40.0 on November 9, oscillated slightly, and then rose to a high of 42.4 on November 15. The three-day moving average then decreased to 41.0 on November 18 before rising up to 42.0 on November 19 to close out the session.

The next release of the ESI will be on Wednesday, December 4, 2024.