Economic sentiment decreases slightly to close out 2024

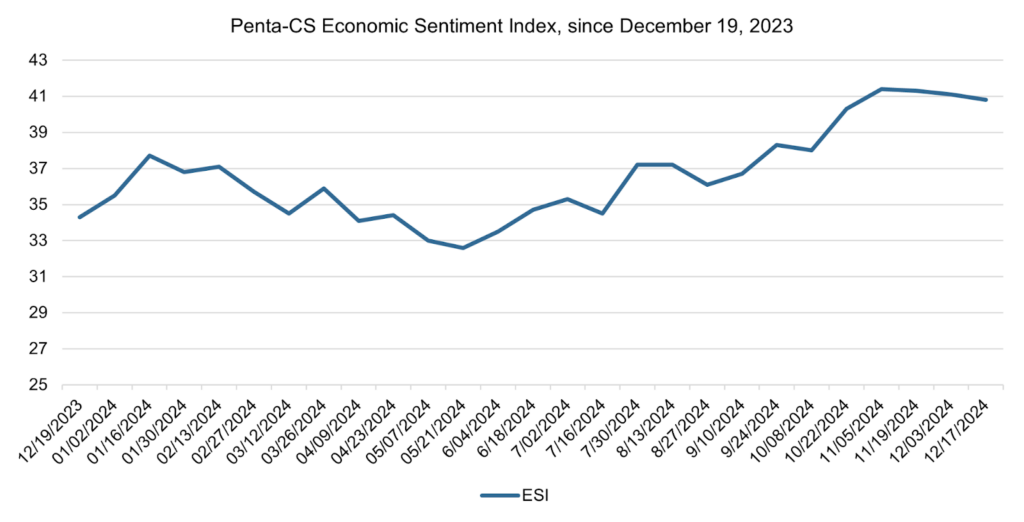

The latest biweekly reading of the Penta-CivicScience Economic Sentiment Index (ESI) decreased by 0.3 points to 40.8, marking a minor dip in overall economic confidence ahead of the new year.

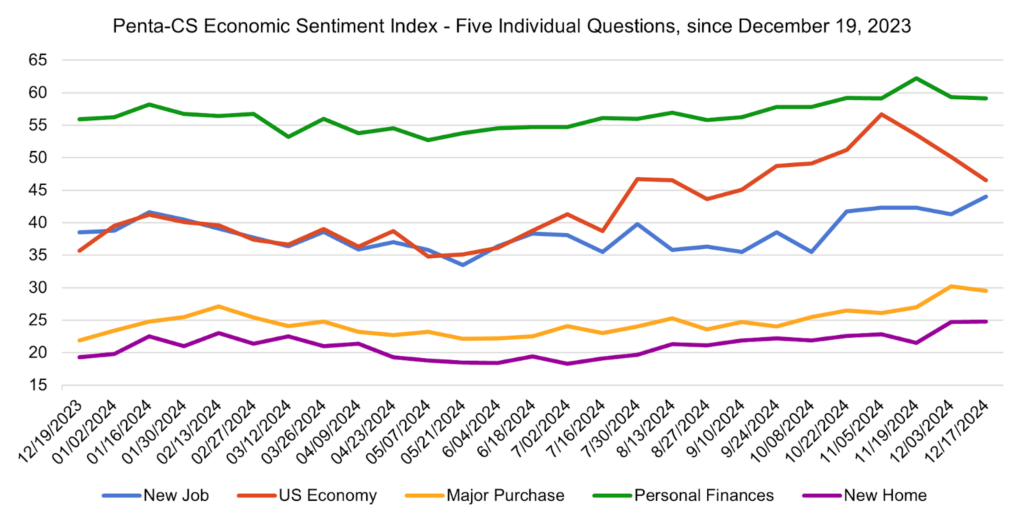

Three of the ESI’s five indicators decreased during this period. Confidence in the overall U.S. economy decreased the most, falling 3.6 points to 46.5. This marks the third period in a row this indicator has fallen by more than 3 points.

—Confidence in making a major purchase decreased 0.7 points to 29.5.

—Confidence in personal finances decreased 0.2 points to 59.1.

—Confidence in buying a new home increased 0.1 points to 24.8.

—Confidence in finding a new job increased 2.7 points to 44.0.

The Federal Reserve reduced interest rates by 25 basis points to between 4.25 and 4.5 percent, marking the third consecutive rate cut this year. Members of the Federal Open Markets Committee had previously expected four rate cuts in 2025 but are now projecting only 50 basis points of cuts next year. Additionally, Fed officials raised their forecasts for inflation next year to 2.5 percent, up from their previous estimate of 2.1 percent, signaling that price pressures remain stubbornly elevated above the Fed’s 2 percent inflation target.

The Commerce Department reported that retail sales rose by 0.7 percent in November, up from October’s 0.5 percent increase, signaling resilient consumer spending as the holiday shopping season begins. Gains were driven largely by auto sales, which surged 2.6 percent, while online retailers saw a 1.8 percent boost. However, signs of caution emerged as sales dipped at grocery stores, restaurants, and clothing shops. The steady spending reflects an economy growing at a healthy pace despite higher interest rates, though it may prompt the Federal Reserve to slow its approach to rate cuts next year.

The U.S. Bureau of Labor Statistics released the November Consumer Price Index (CPI) report, which showed that consumer prices increased 0.3 percent in November and have risen 2.7 percent annually. This represents the CPI’s largest month-over-month increase since April 2023. The Bureau highlighted that nearly 40 percent of the increase can be attributed to rising shelter costs, which rose 0.3 percent in November. The Bureau also reported that food and energy prices increased month-over-month, rising 0.4 percent and 0.2 percent, respectively.

The November Jobs Report showed that the economy added 227,000 jobs last month, rebounding from October, where only 24,000 jobs were added after revisions. The unemployment rate ticked up to 4.2 percent from 4.1 percent last month. The Bureau reported that this represents an increase in employment across the healthcare, leisure and hospitality, government, and social assistance sectors and also noted that manufacturing jobs rebounded this month following the end of the Boeing strike.

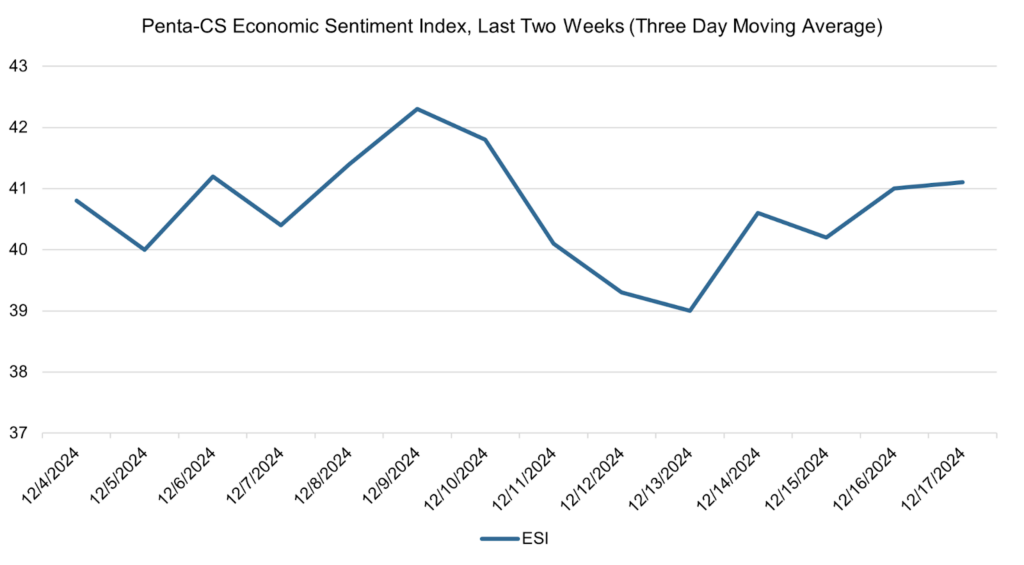

The ESI’s three-day moving average began this two-week stretch at 40.8 on December 4. It then oscillated between increasing and decreasing before rising up to a high of 42.3 on December 9. The three-day moving average then decreased, falling to a low of 39.0 on December 13, and then trended upward to 41.1 on December 17 to close out the session.

Due to the New Year’s holiday, the next release of the ESI will be on Wednesday, January 15, 2025.