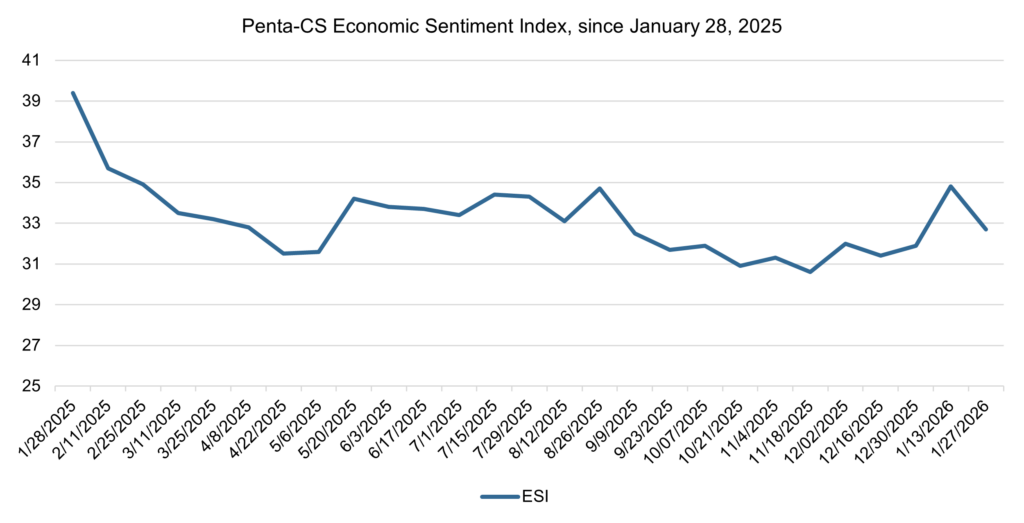

Economic sentiment falls sharply amid U.S.-Europe trade tensions

Over the past two weeks, the Penta-CivicScience Economic Sentiment Index (ESI) fell by 2.1 points to 32.7, offsetting many of the gains recorded in the prior period as all five of its indicators declined.

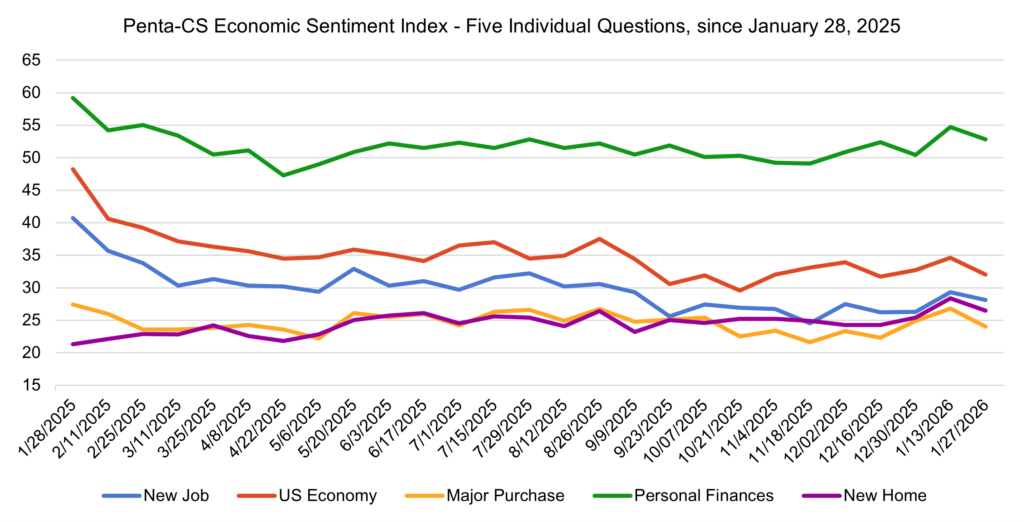

All five of the ESI’s indicators decreased during this period, reversing many of the gains from the prior period. Confidence in making a major purchase decreased the most, falling 2.8 points to 24.0.

—Confidence in the overall U.S. economy decreased 2.6 points to 32.0.

—Confidence in buying a new home decreased 1.9 points to 26.5.

—Confidence in personal finances decreased 1.9 points to 52.8.

—Confidence in finding a new job decreased 1.2 points to 28.1.

Global investors sold off U.S. assets last week as escalating trade and geopolitical tensions triggered a renewed “sell America” trade. Following President Donald Trump’s threat to impose tariffs of up to 25 percent on several European countries over the U.S. bid to acquire Greenland, Treasury bond prices fell sharply and gold surged toward a record one-day gain, reflecting a broad flight to safe assets outside the U.S. American stocks also dropped more than 2 percent across major indexes, while volatility spiked to multi-month highs.

U.S. assets rebounded, however, after President Trump said the U.S. had reached a framework for a future deal on Greenland and would not proceed with tariffs scheduled to take effect on February 1. U.S. equities posted their strongest gains in months, with the S&P 500 rising more than 1 percent, as investors interpreted the announcement as a reduction in near-term trade and geopolitical risk rather than a resolution of underlying issues.

The Federal Reserve’s preferred inflation gauge, the core personal consumption expenditures (PCE) price index, showed that consumer prices continued to rise at a moderate but persistent pace in late 2025, reinforcing signs that inflation has plateaued above the Fed’s 2 percent long-run target. Prices rose 0.2 percent in both October and November, leaving inflation up 2.7 percent and 2.8 percent year-over-year, respectively. While inflation is well below post-pandemic highs, goods prices have begun to reaccelerate following the introduction of new tariffs last spring, complicating the disinflation trend.

The U.S. economy expanded at an annualized rate of 4.4 percent in the third quarter of 2025, its fastest pace in two years, according to an updated estimate from the Bureau of Economic Analysis. The acceleration—driven by strong consumer spending, rising exports, increased government outlays, and robust private investment—exceeded expectations of 3.3 percent growth.

U.S. retail sales rose 0.6 percent in November to $735.9 billion, according to the Commerce Department, marking a rebound from October’s decline and outperforming analysts’ expectations of 0.4 percent growth. This jump in consumer spending, despite mounting economic uncertainties and a more cautious labor market, underscores the resilience of personal consumption, which continues to drive over two-thirds of the economy.

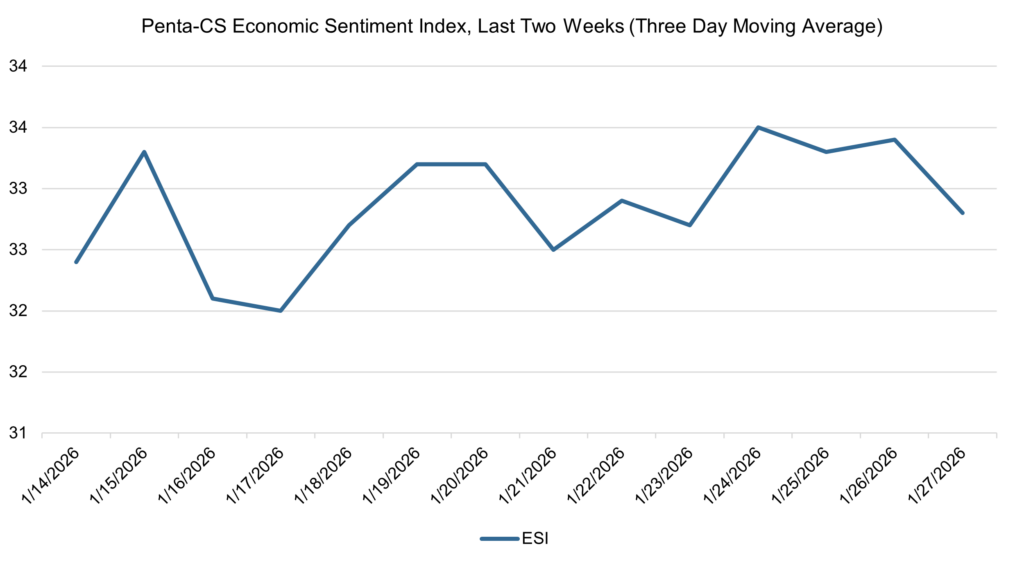

The ESI’s three-day moving average began this two-week stretch at 32.4 on January 14. It then decreased to a low of 32 on January 17 before eventually reaching a high of 33.5 on January 24, and ultimately closing out the past two weeks at 32.8 on January 27.

The next release of the ESI will be on Wednesday, February 11, 2026.