Economic sentiment falls as confidence in finding a new job hits an all-time low

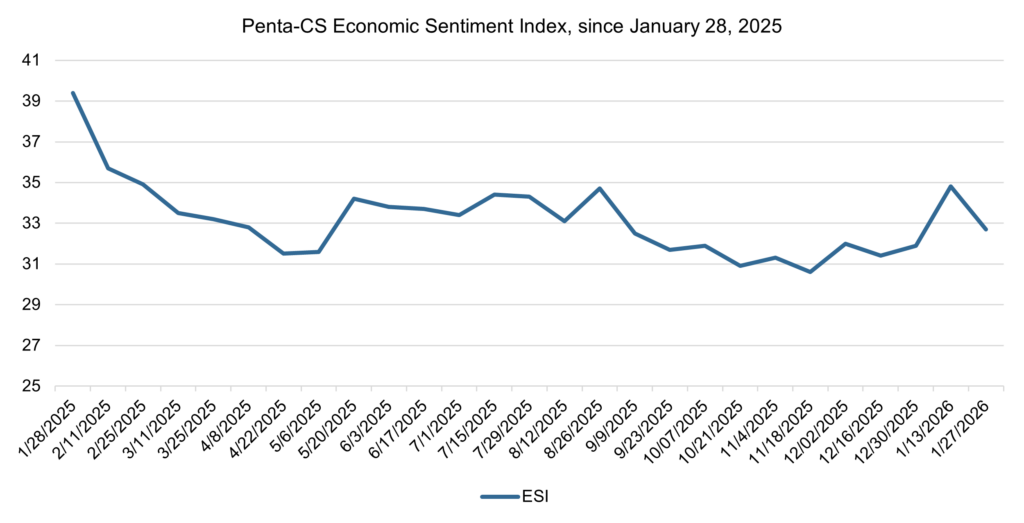

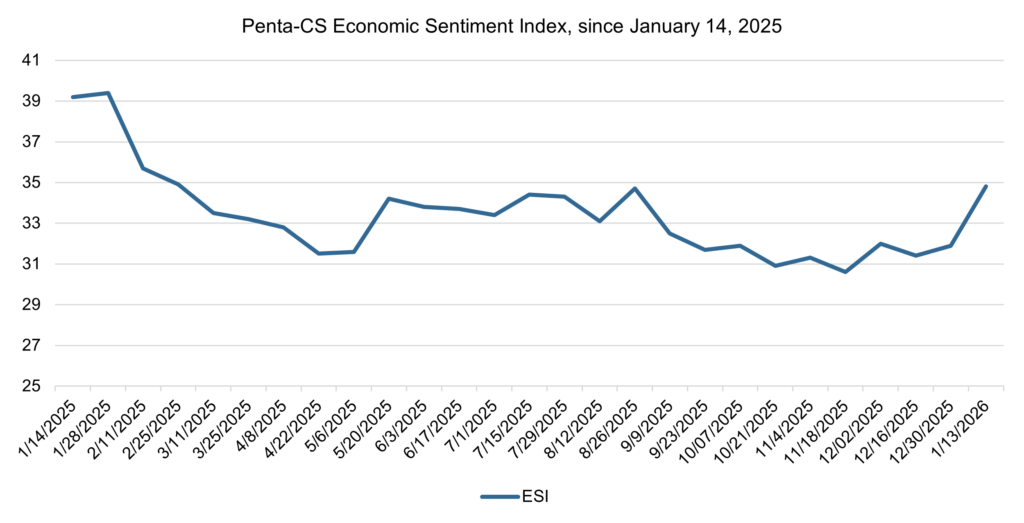

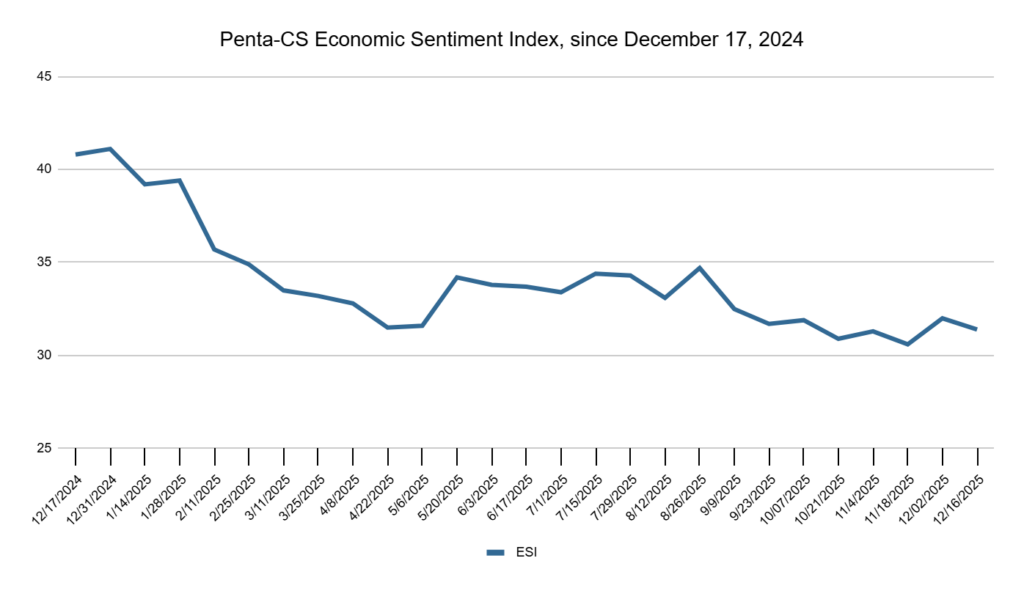

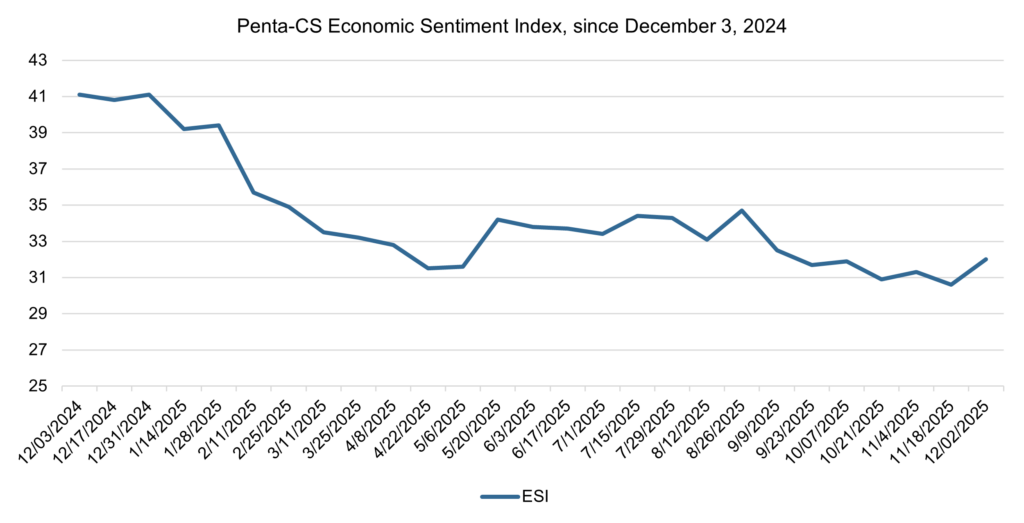

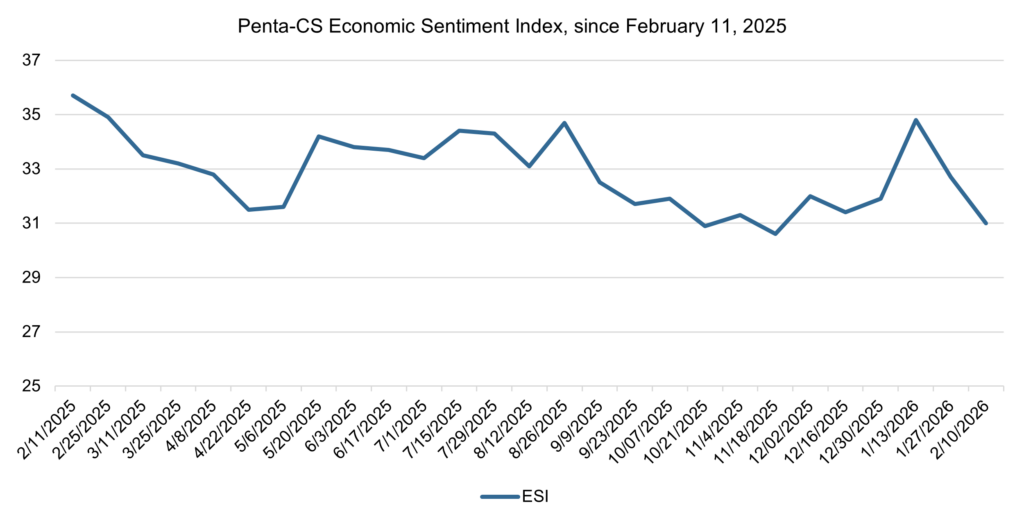

The latest biweekly reading of the Penta-CivicScience Economic Sentiment Index (ESI) fell by 1.7 points to 31.0, continuing its sharp decline and hitting its lowest level since November 2025.

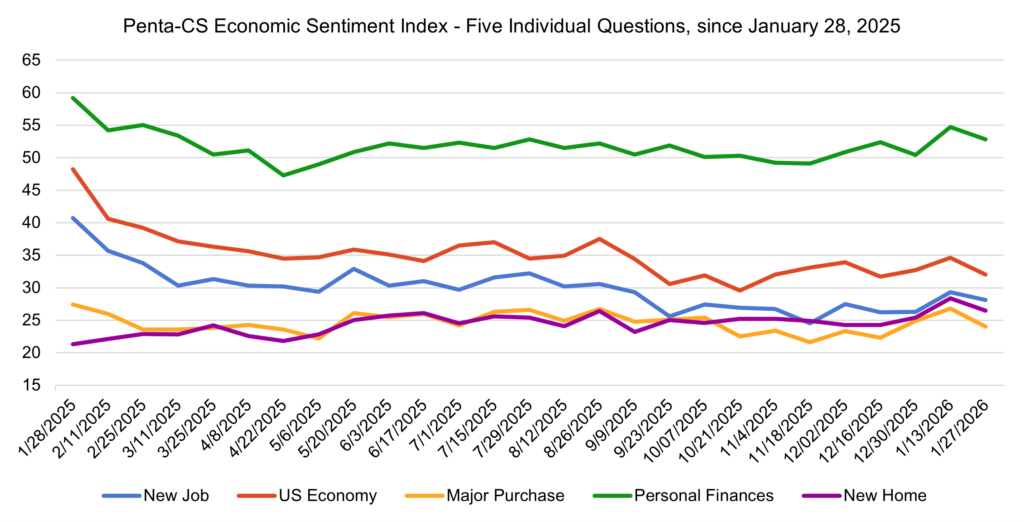

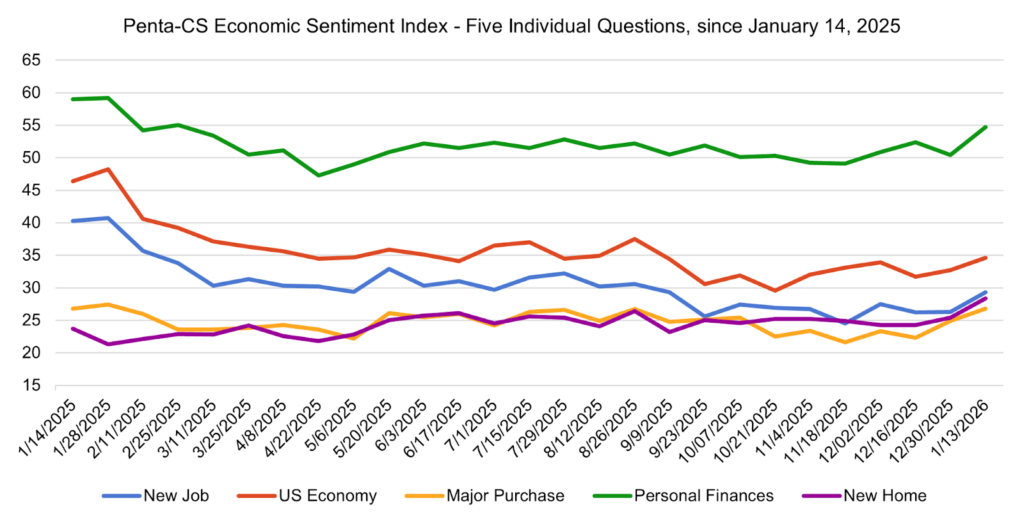

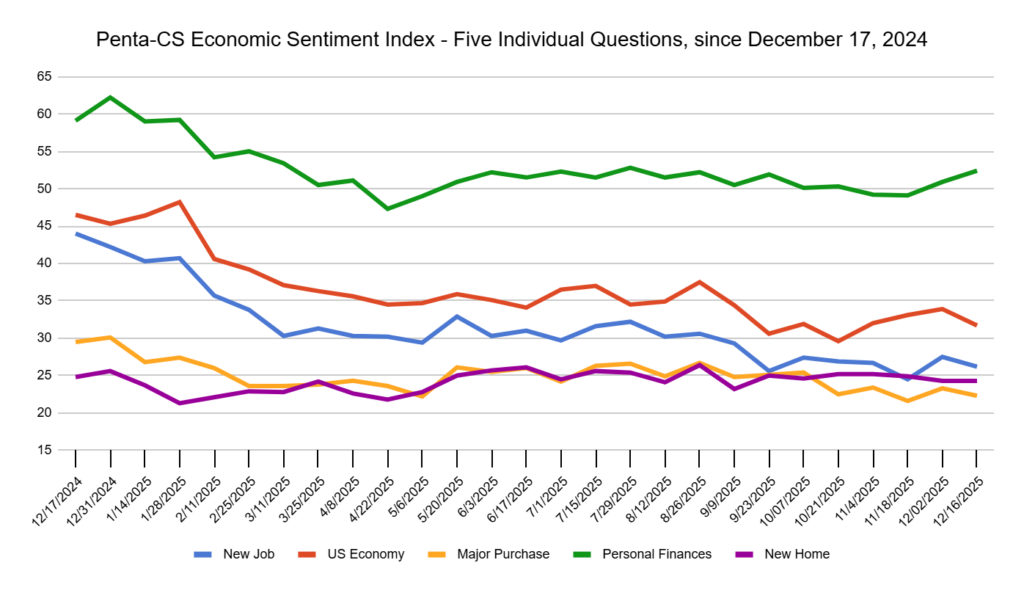

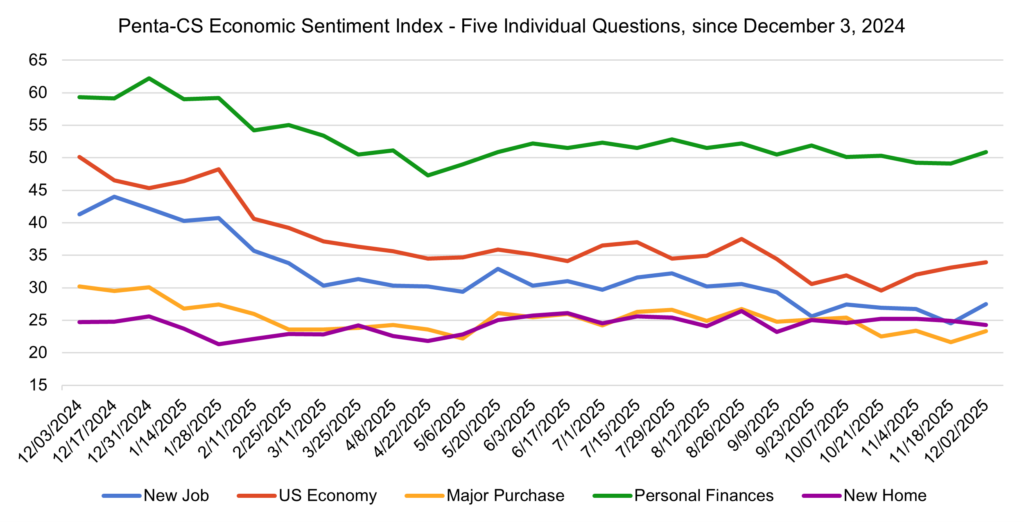

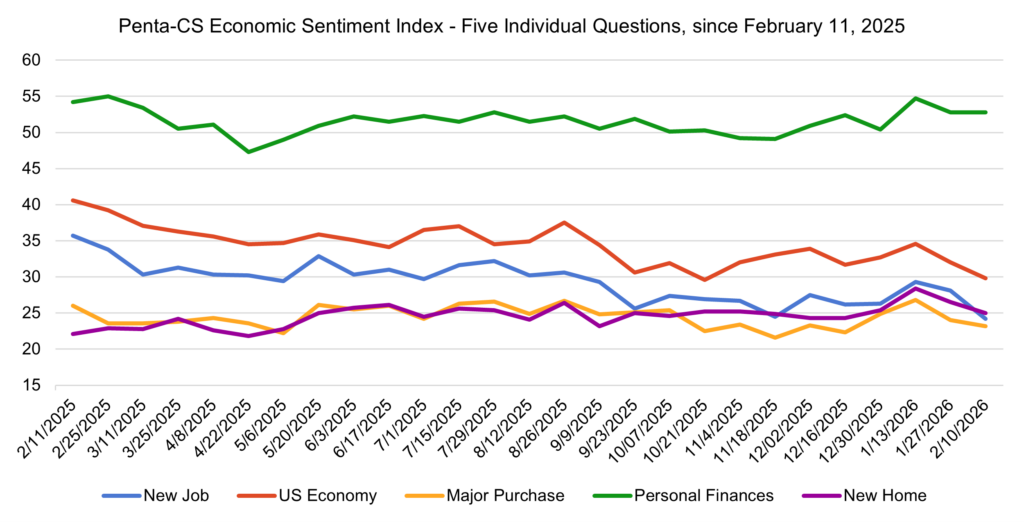

Four of the ESI’s five indicators decreased during this period. Confidence in finding a new job decreased the most, falling 3.9 points to 24.2, its lowest level in the ESI’s 12-year history.

—Confidence in the overall U.S. economy decreased 2.2 points to 29.8.

—Confidence in buying a new home decreased 1.5 points to 25.0.

—Confidence in making a major purchase decreased 0.8 points to 23.2.

—Confidence in personal finances remained flat at 52.8.

The Federal Reserve held the federal-funds rate steady at 3.5 to 3.75 percent at its January meeting, marking the first pause since July and signaling reduced urgency to continue rate cuts. The decision passed 10–2, with two FOMC participants dissenting in favor of a quarter-point cut, reflecting continued division within the FOMC around current economic conditions and the path forward for monetary policy. Fed Chair Jerome Powell pointed to stronger recent growth data and signs that the labor market has stopped deteriorating, while inflation remains above the 2 percent target but no longer worsening. Officials indicated they intend to keep rates unchanged for an extended period unless labor market conditions weaken or inflation shows clearer progress.

Mortgage rates held steady in early February, with Freddie Mac reporting that the 30-year fixed-rate mortgage averaged 6.1 percent as of February 5, 2026, virtually unchanged from the prior week and down from 6.89 percent a year earlier. Freddie Mac Chief Economist Sam Khater noted that, “for the last several weeks, the 30-year fixed-rate mortgage has remained at its lowest level in years,” pointing to improving affordability and rising housing availability ahead of the spring sales season. While rates remain high by historical standards, their recent stability may ease near-term financing uncertainty for buyers and sellers.

Over the last two weeks, the Commerce Department and the Labor Department have released key economic data from December 2025. Commerce Department data showed that retail sales were largely flat in December compared to November, missing expectations for the traditionally busy holiday shopping season. Meanwhile, data from the Labor Department showed that the producer-price index (PPI) increased by 0.5 percent in December, the biggest increase in five months. Taken together, the acceleration in PPI alongside flat retail sales complicates the inflation outlook, signaling upstream price pressures as demand appears to be leveling off.

The Dow Jones Industrial Average surged Friday, February 6, rising 2.47 percent and closing above 50,000 for the first time in history. This rally represented the index’s largest increase since May 2025 and was led by rebounds predominantly in the technology sector, underscoring the tension between optimism and concern around AI-driven tech growth and valuations.

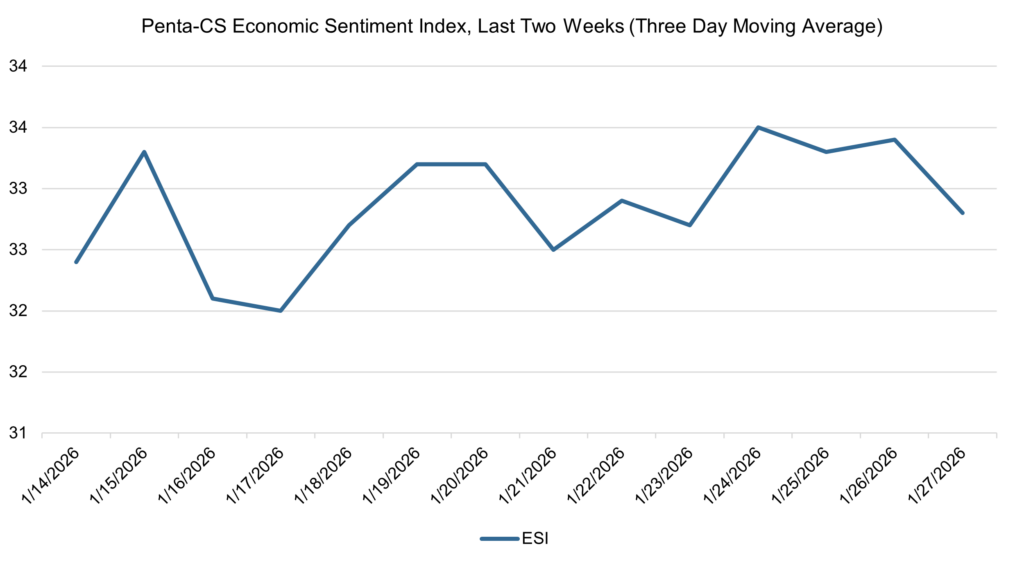

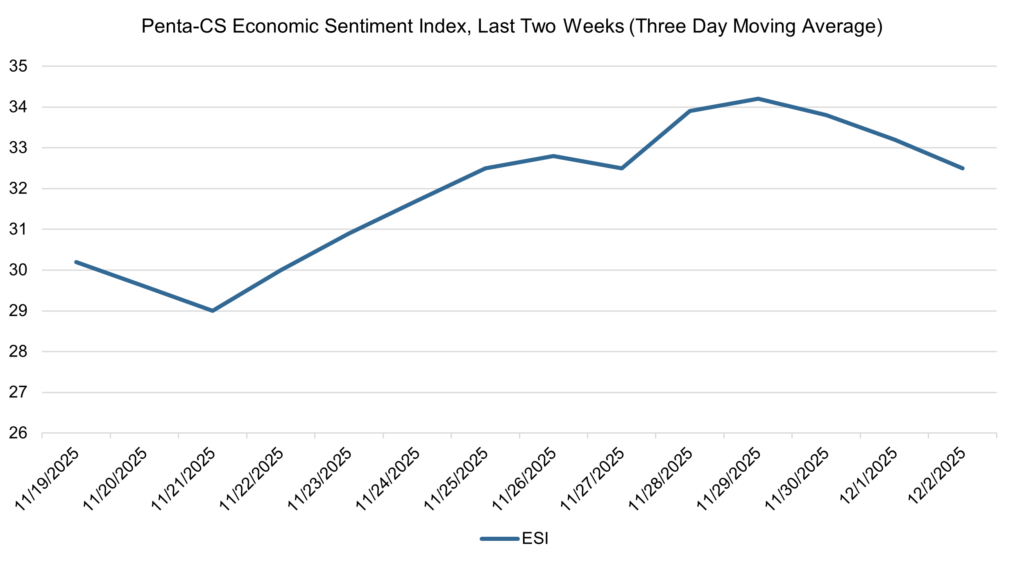

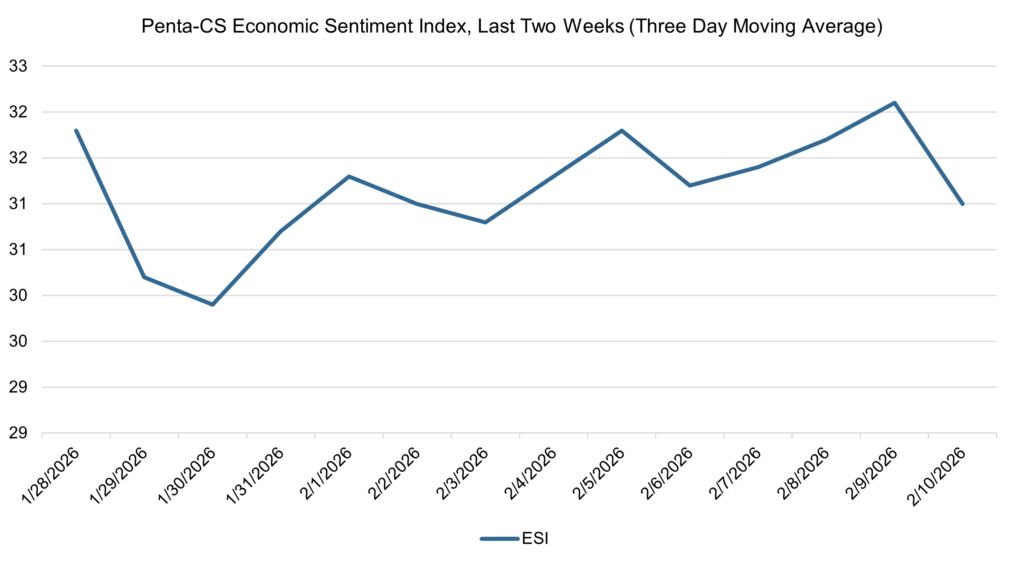

The ESI’s three-day moving average began this two-week stretch at 31.8 on January 28 before falling to a low of 29.9 on January 30. It then oscillated between rising and falling, trending upwards to a high of 32.1 on February 9. The three-day moving average then decreased, falling to 31.0 on February 10 to close out the session.

The next release of the ESI will be on Wednesday, February 25, 2026.