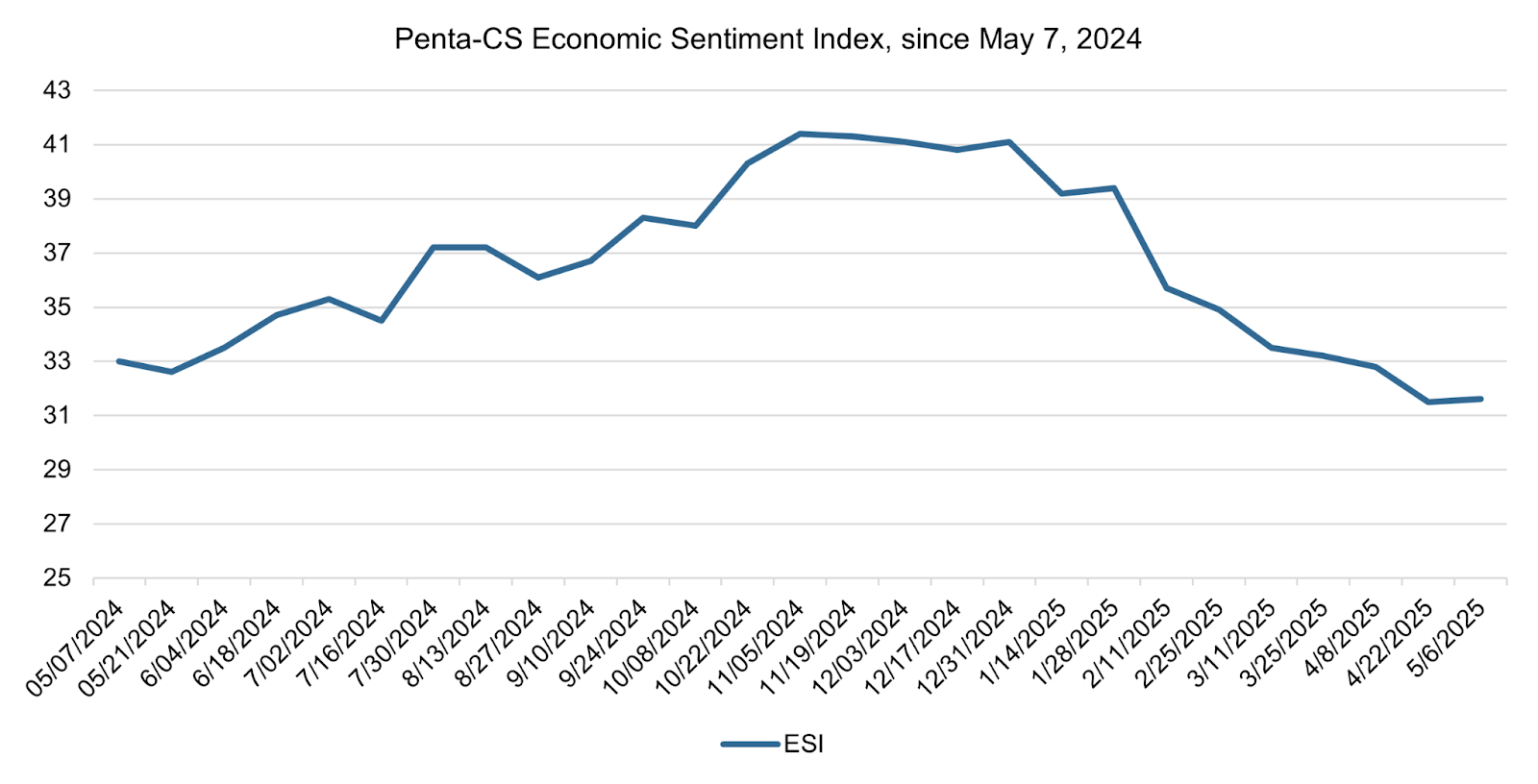

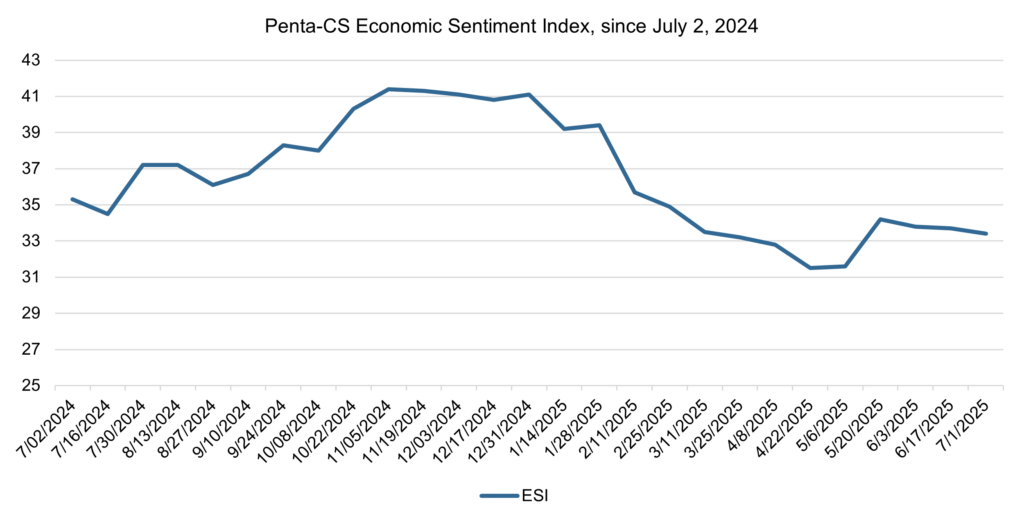

Economic sentiment slightly declined at the end of Q2

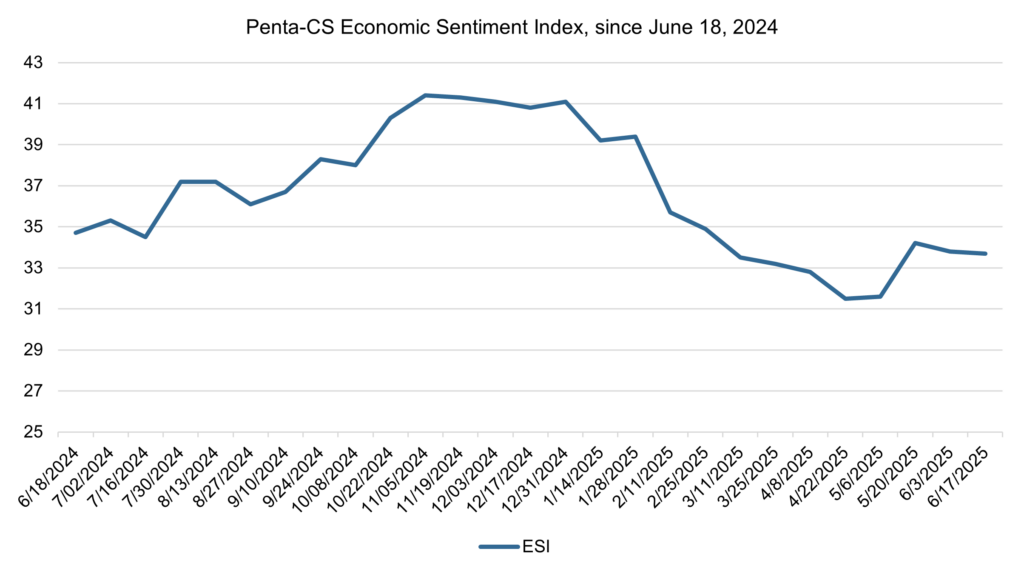

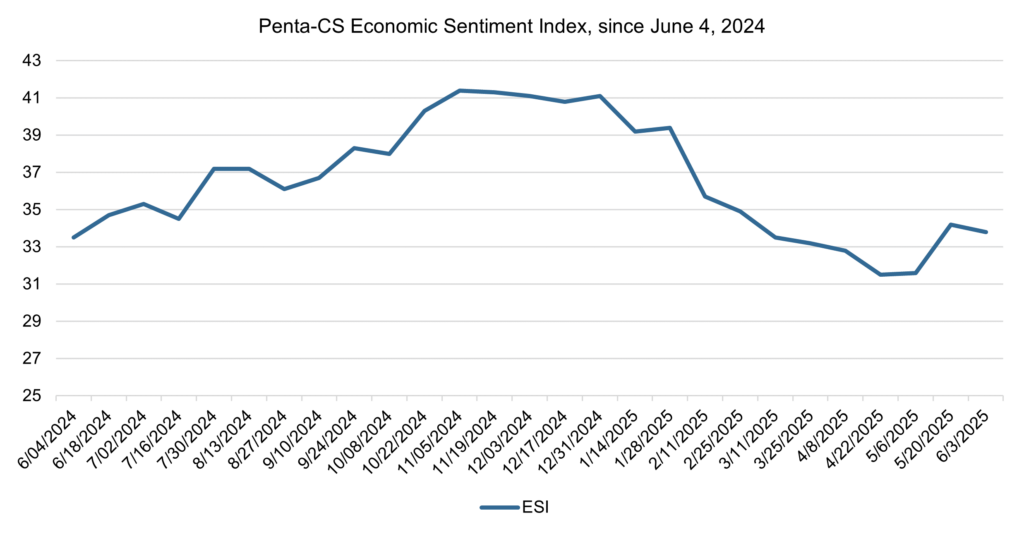

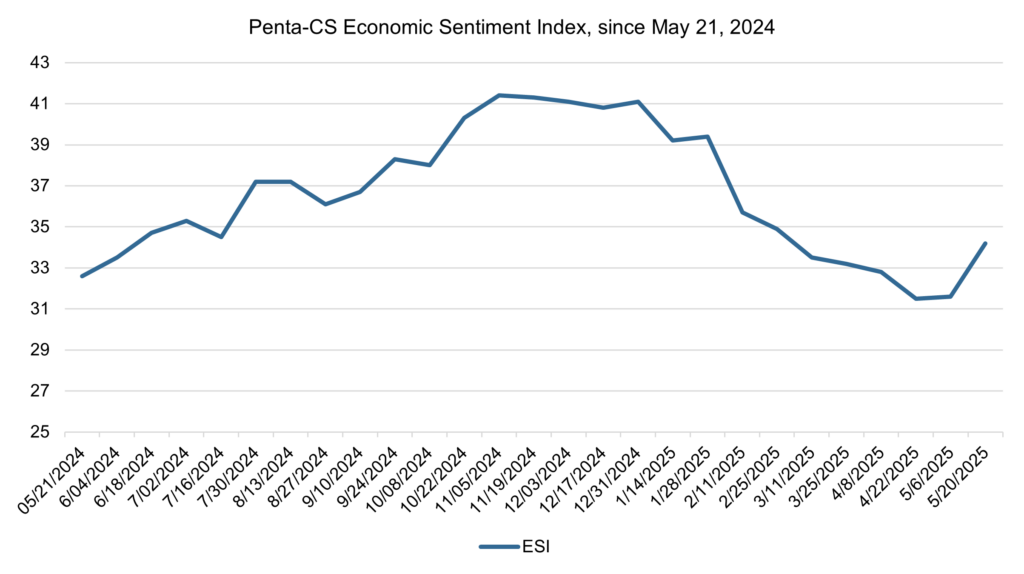

The latest biweekly reading of the Penta-CivicScience Economic Sentiment Index (ESI) declined by 0.3 points from 33.7 to 33.4, marking a small dip in overall confidence over the past two weeks.

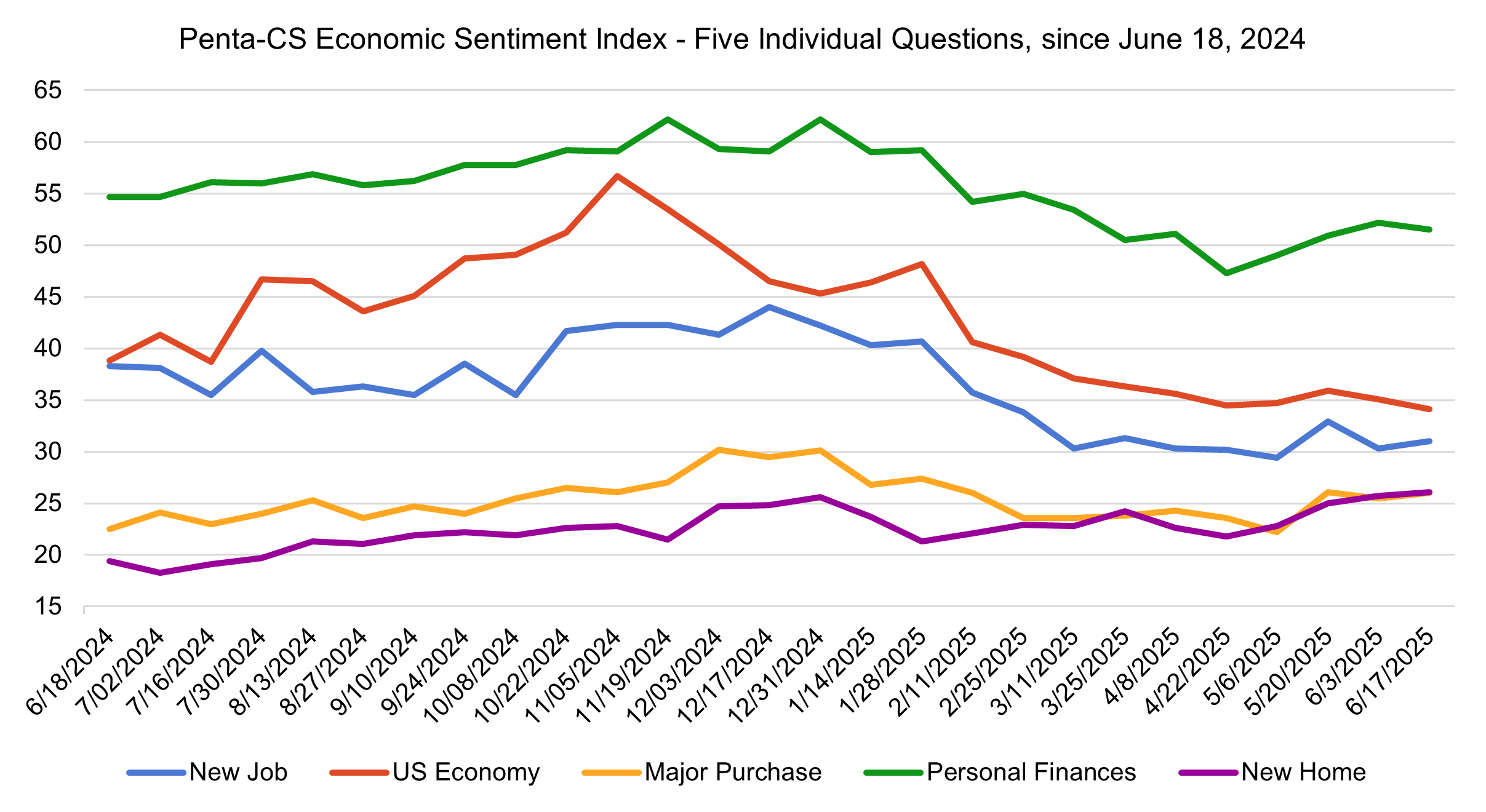

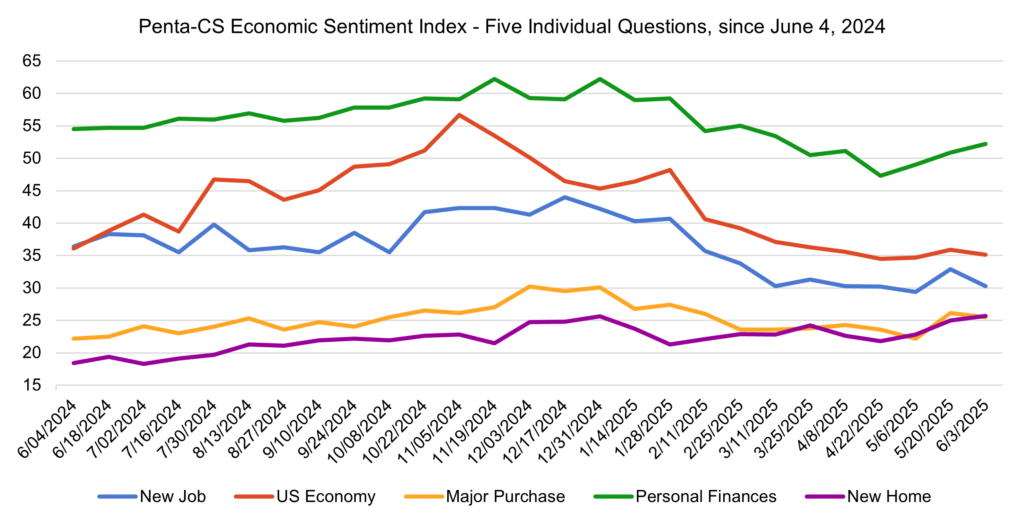

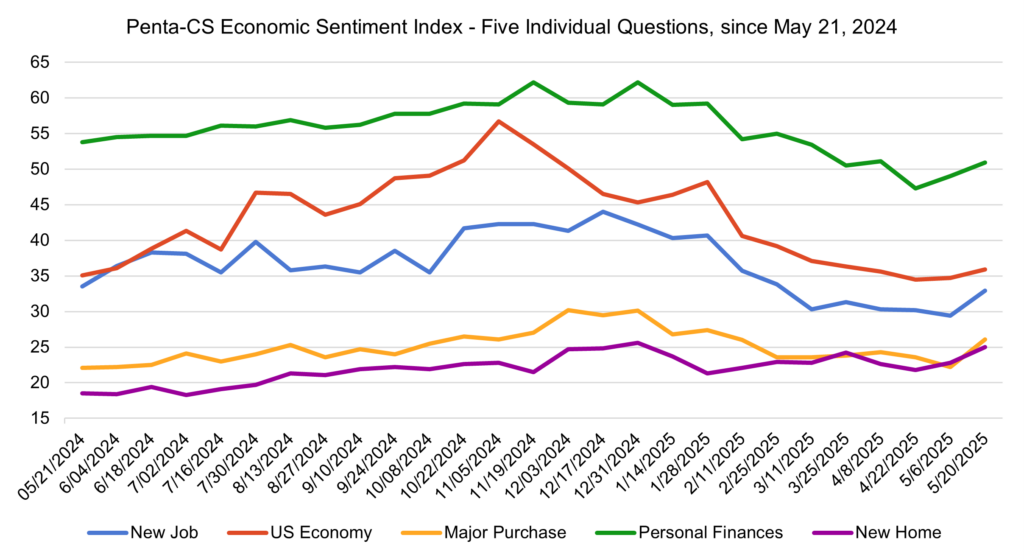

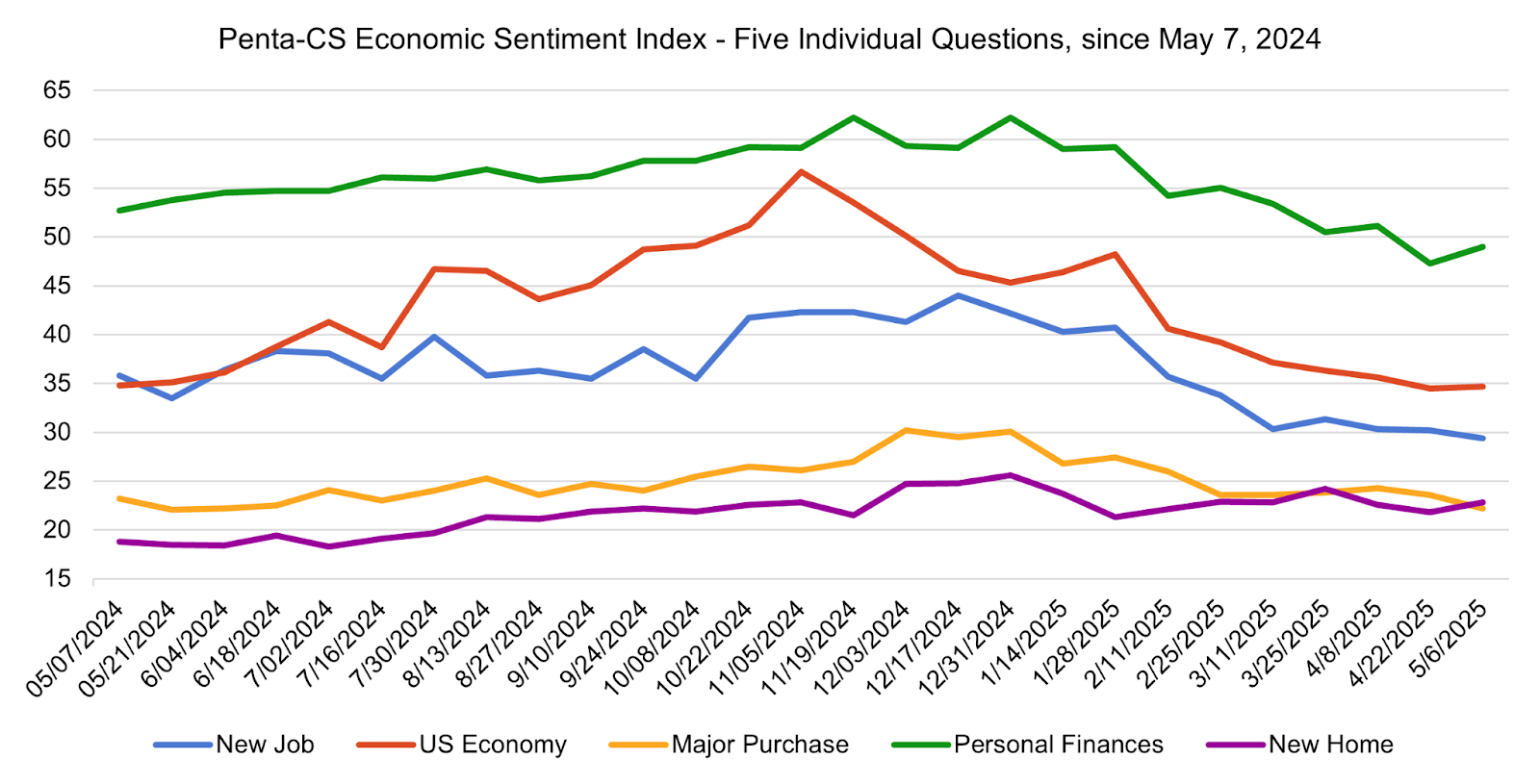

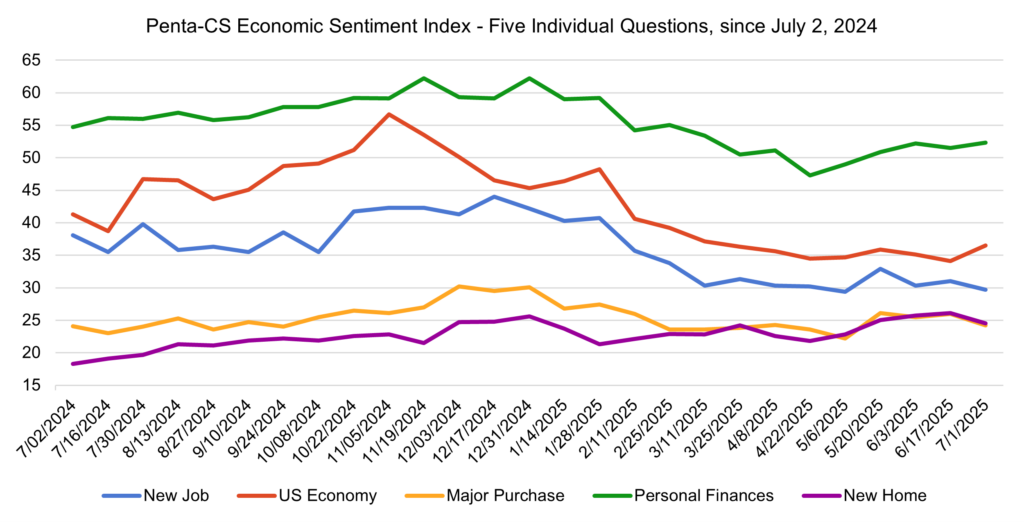

Three of the ESI’s five indicators decreased during this period. Confidence in making a major purchase decreased the most, falling 1.8 points to 24.2.

—Confidence in buying a new home decreased 1.6 points to 24.5.

—Confidence in finding a new job decreased 1.3 points to 29.7.

—Confidence in personal finances increased 0.8 points to 52.3.

—Confidence in the overall U.S. economy increased 2.4 points to 36.5.

The Federal Reserve left interest rates unchanged at between 4.25 and 4.5 percent at the June Federal Open Markets Committee (FOMC) meeting, marking the fourth meeting in a row that it held rates steady. In its statement, the FOMC said “uncertainty about the economic outlook has diminished but remains elevated” amid persistent inflation, solid economic growth, strong labor market conditions, and a low unemployment rate. In its Summary of Economic Projections, the FOMC signaled that interest rate cuts are still on the table, with eight officials anticipating two cuts by the end of 2025. Later in June, Fed Chair Jerome Powell told the House Financial Services Committee that he expects inflation to begin rising soon due to higher tariff rates and that the Fed is going to continue monitoring tariff impacts before cutting rates again.

The Bureau of Economic Analysis revised its estimate for this year’s first quarter real GDP down even further in its third estimate, showing that the U.S. economy shrank at an annual rate of 0.5 percent, in contrast to the 2.4 percent increase in GDP during the fourth quarter of 2024. The BEA cited a decline in net exports as the primary driver in the decrease in real GDP, likely the result of higher expected tariff rates, as well as a decrease in government spending.

Separately, on June 30, the BEA found that the U.S. net international investment position for the first quarter of 2025 was -$24.61 trillion, an improvement of $1.92 trillion from -$26.54 trillion during the fourth quarter of 2024. This change was attributed to financial transactions, as well as changes in prices and exchange rates due to the appreciation of foreign currencies against the U.S. dollar. The U.S. dollar has declined in value by 10.7 percent relative to other major currencies this year, the weakest start to a year since the U.S. left the gold standard in 1973. This has occurred in part due to uncertainty over U.S. tariff policy and decreased investor confidence in the dollar as the world’s reserve currency.

The U.S. Census Bureau reported that sales of new single-family houses in May 2025 decreased 13.7 percent month-over-month, down from 722,000 in April to 623,000 in May. This data comes in below the 695,000 sales predicted by economists polled by the Wall Street Journal and reflects a year-over-year decline of 6.3 percent. Meanwhile, the National Association of Realtors (NAR) reported that U.S. existing home sales in May increased 0.8 percent from April while year-over-year sales declined 0.7 percent. NAR Chief Economist Lawrence Yun attributed the “subdued sales” to “persistently high mortgage rates.”

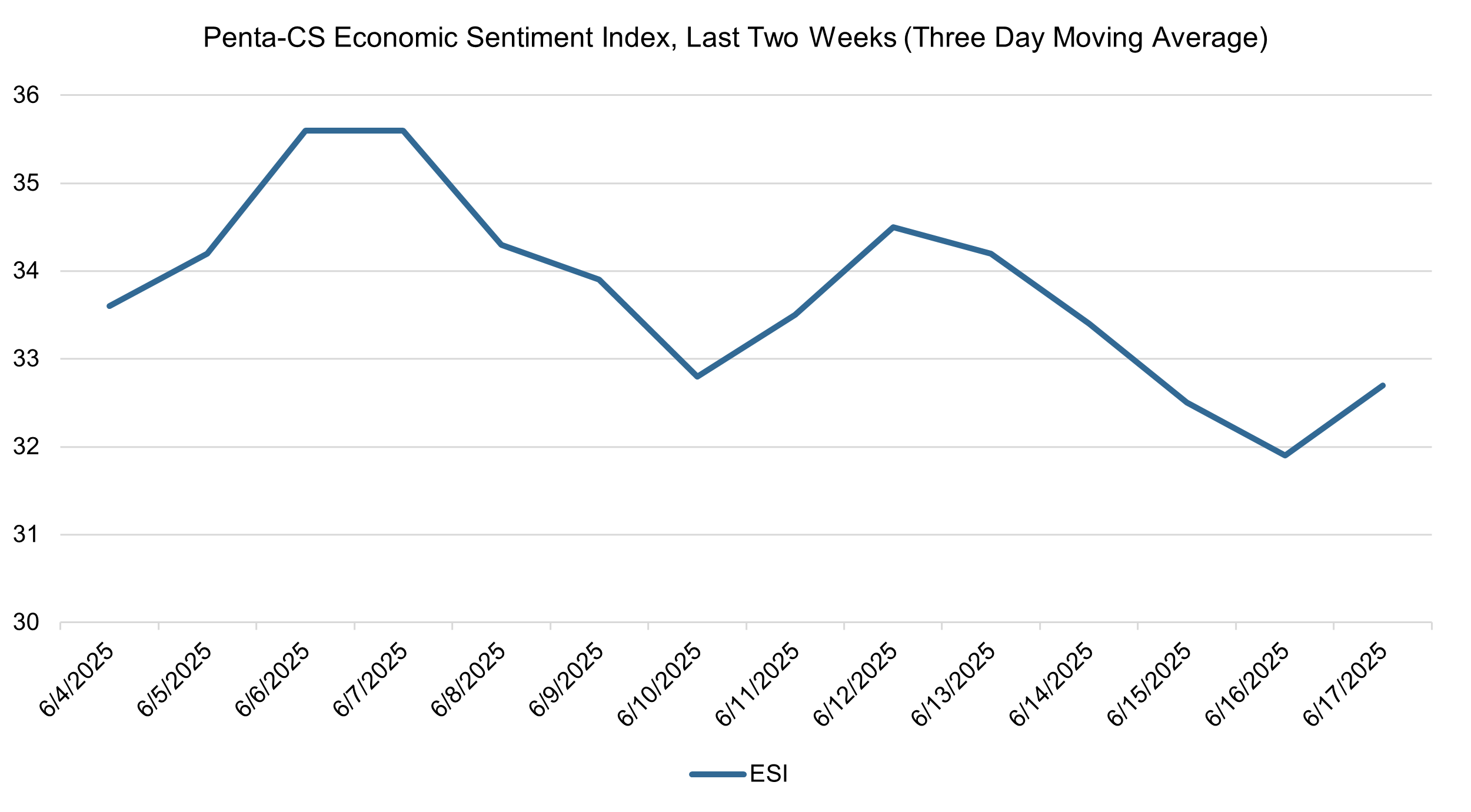

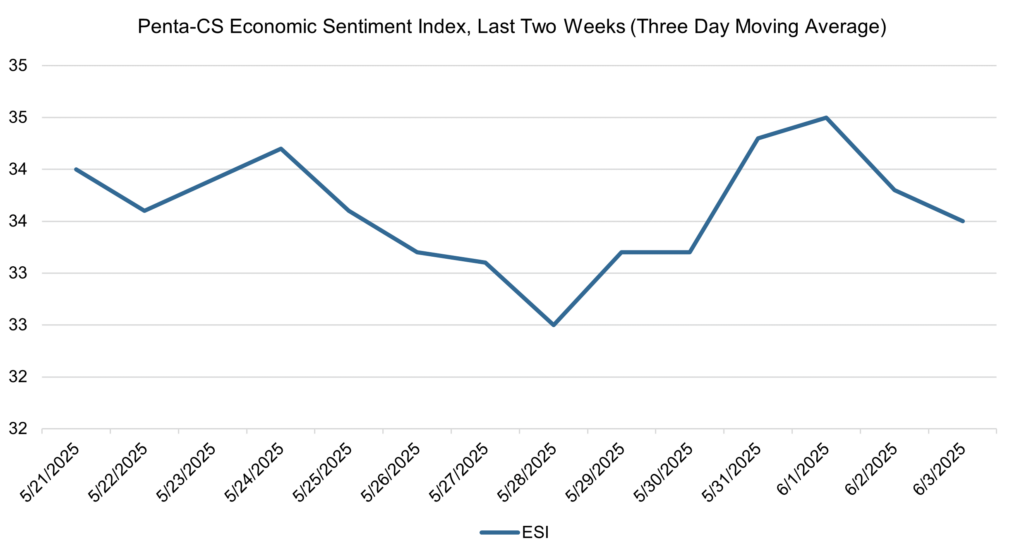

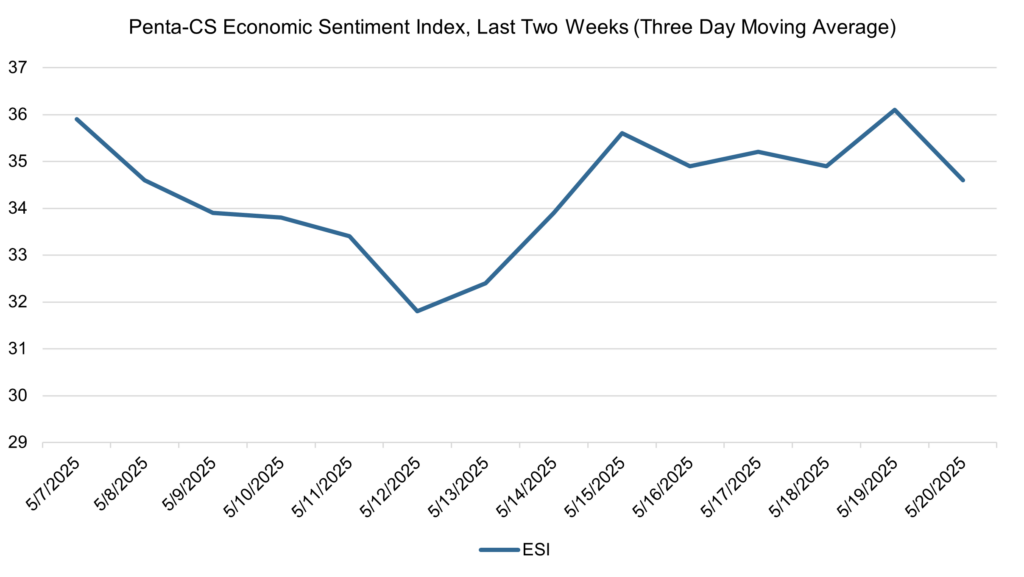

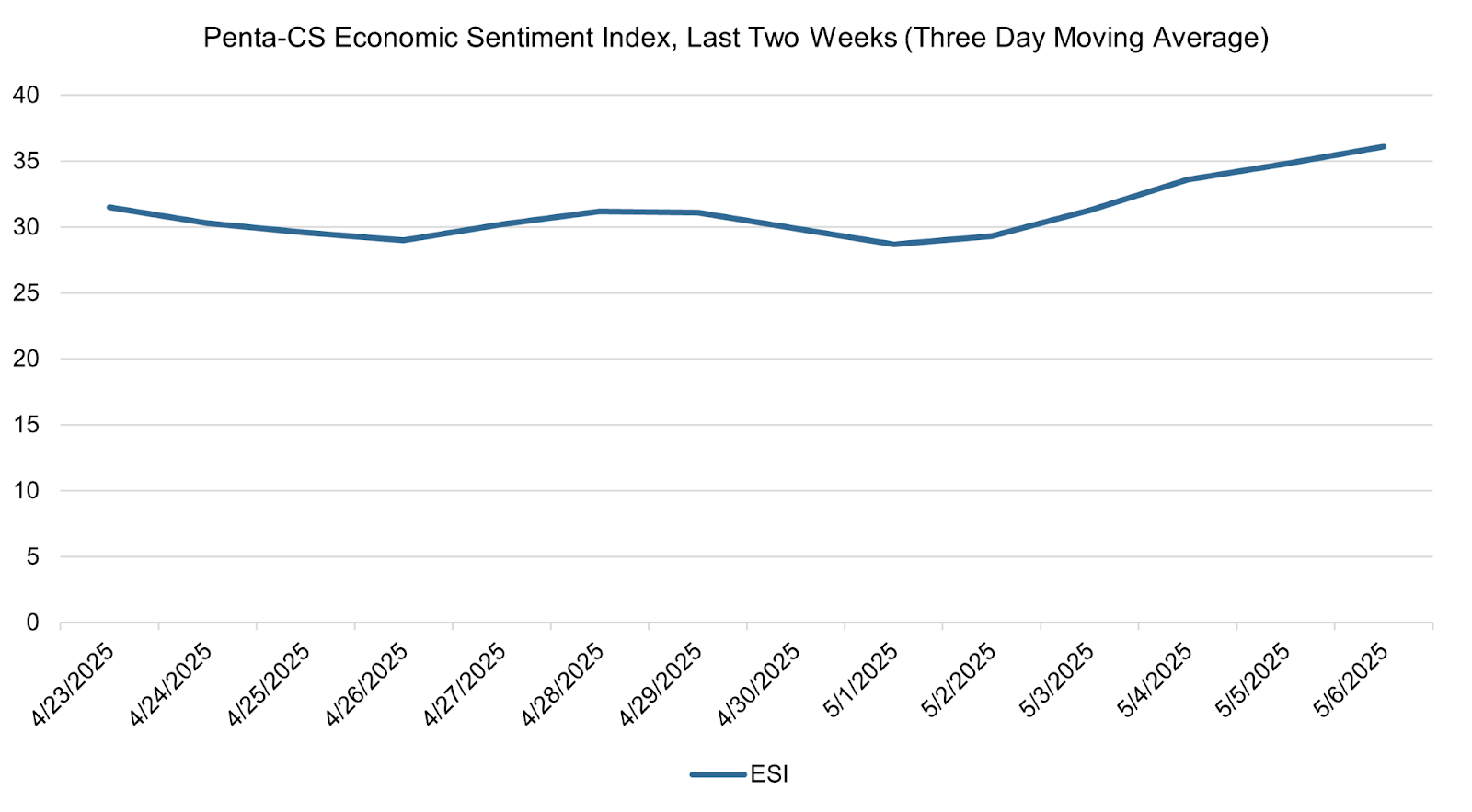

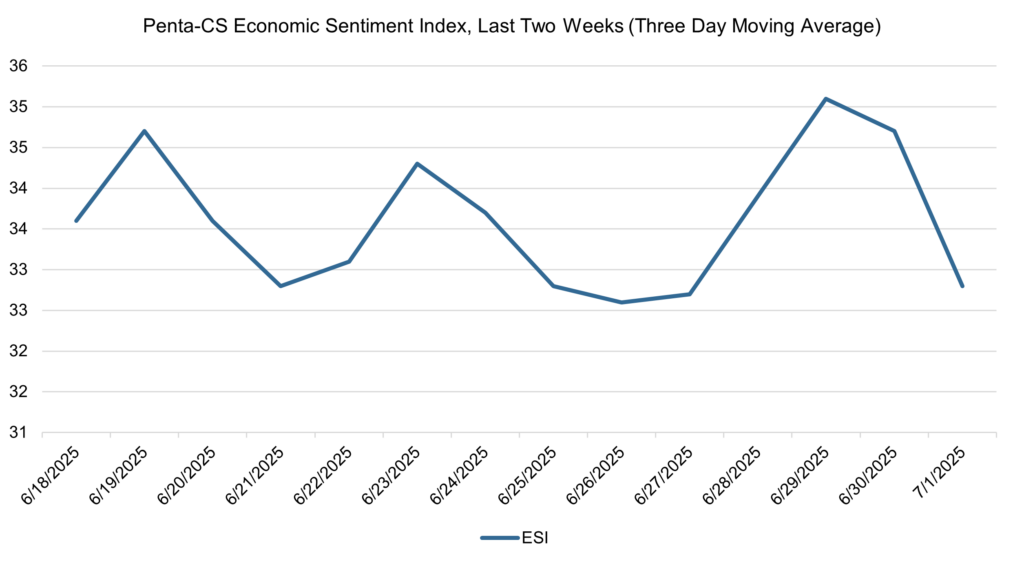

The ESI’s three-day moving average began the two-week stretch at 33.6 on June 18. It then climbed to 34.7 on June 19, then oscillated between rising and falling before decreasing to its lowest point of 32.6 on June 26. The three-day moving average then climbed to a high of 35.1 on June 29 before falling to 32.8 on July 1 to close out the session.

The next release of the ESI will be on Wednesday, July 16, 2025.