Bad week to be a bird, good week for economic sentiment

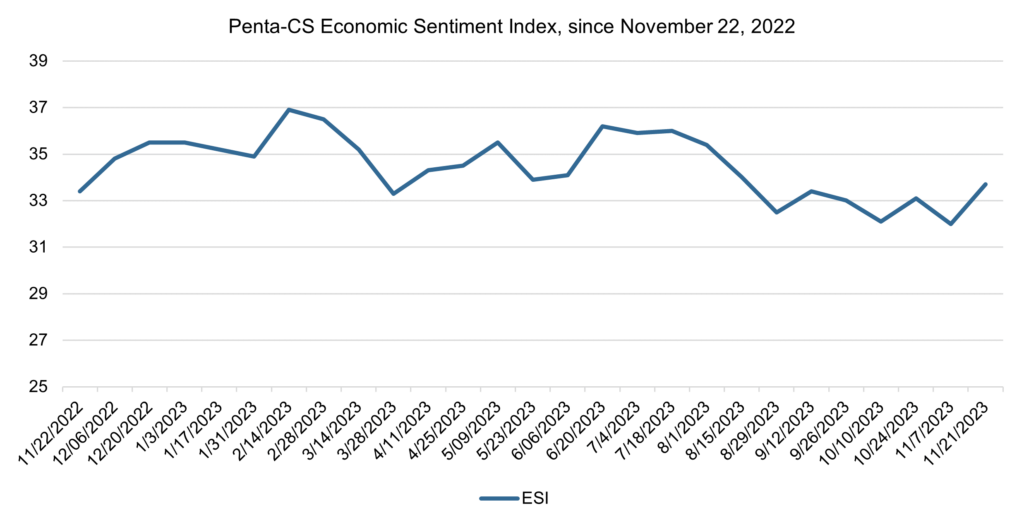

Economic sentiment rallied heading into Thanksgiving and Black Friday weekend, on the back of a blockbuster jump in confidence in the overall US economy. The Penta-CivicScience Economic Sentiment Index (ESI) increased 1.7 points to 33.7 after having fallen to its lowest point in over a year last reading.

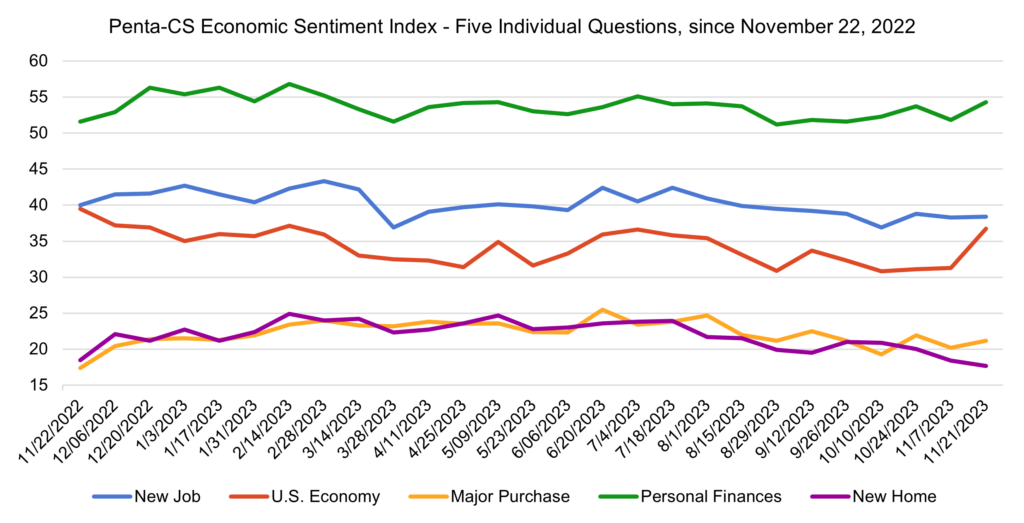

Four of the five ESI indicators increased over the past two weeks. Confidence in the overall U.S. economy increased the most, rising 5.4 points to 36.5—its largest increase in more than a year.

—Confidence in personal finances rose 2.5 points to 54.3.

—Confidence in making a major purchase rose 1.0 points to 21.2.

—Confidence in finding a new job rose 0.1 points to 38.4.

—Confidence in buying a new home fell 0.7 points to 17.7—its lowest point in over a year.

The Commerce Department reported that retail sales fell 0.1% in October from the prior month, the first monthly decline since March. Despite declining, the figure was less than economists’ forecasts of a 0.3% drop.

Data released by the Department of Labor showed the overall Consumer Price Index decreased to 3.2% in October, lower than the 3.7% in September and the lowest figure since July. Following the release of the inflation data, the stock market saw a significant jump as hopes that the Federal Reserve’s campaign to slow inflation may be near its end.

The strong data lends credence to the growing belief that the U.S. economy is heading towards a soft landing. Goldman Sachs reaffirmed its view that the probability of a recession presently sits at just 15% over the next 12 months.

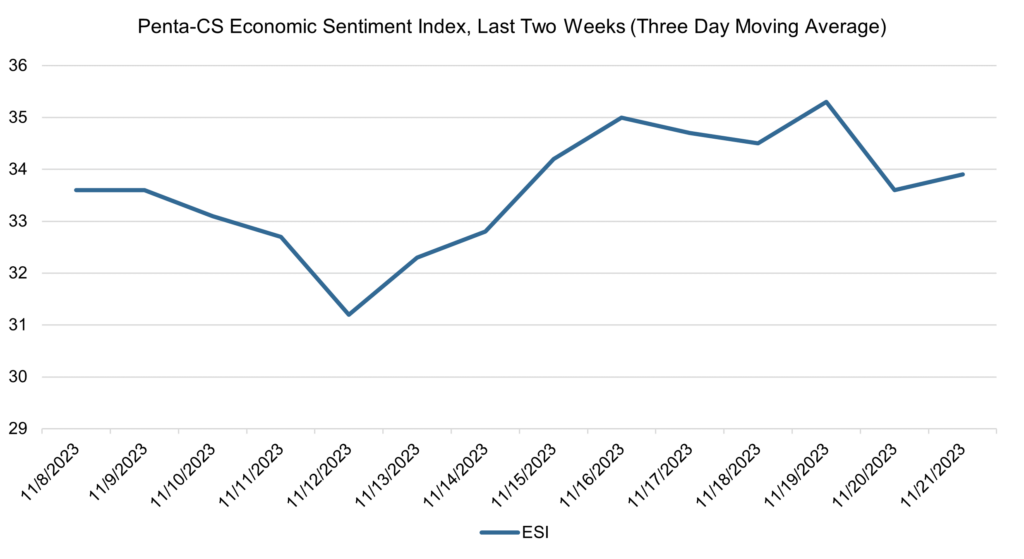

The ESI’s three-day moving average began this two-week stretch at 33.6 on November 8. It trended downward to a low of 31.2 on November 12 before rising to 35.0 on November 16. The three-day average then fell to 34.5, rose to a peak of 35.3, and fell to 33.9 to close out the session.

The next release of the ESI will be Wednesday, December 6, 2023.