Confidence in job market sees biggest drop since March 2020

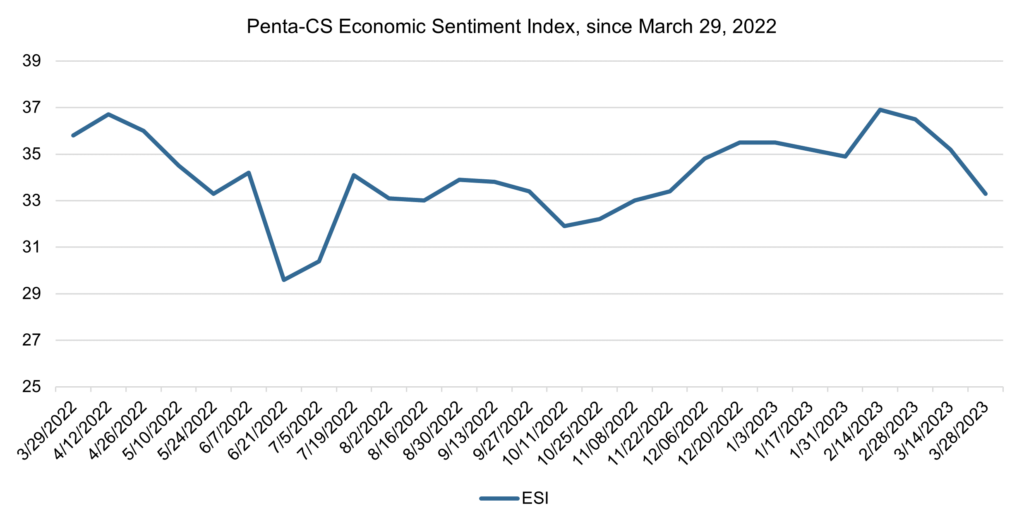

Economic sentiment dropped again over the past two weeks as unease about the banking system persisted. The Penta-CivicScience Economic Sentiment Index (ESI) fell 1.9 points to 33.3, the largest drop in the overall index since July 2022. Leading the decline was a collapse in confidence in find a new job—an especially notable development since confidence in the labor market had remained largely resilient over the past six months, even as some other indicators lagged.

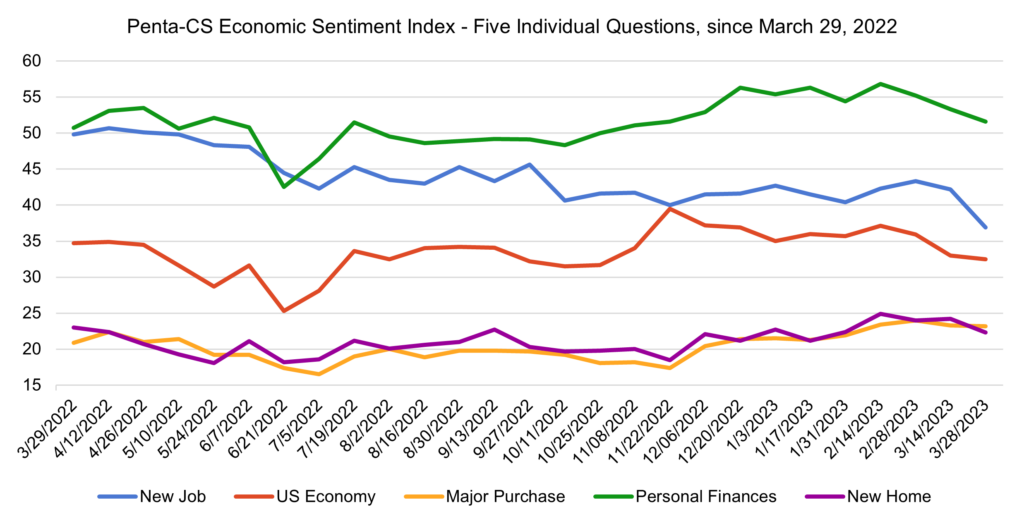

All five of the ESI’s indicators decreased over the past two weeks. Confidence in finding a new job dropped a drastic 5.3 points to 36.9—tied with March 2020 (the onset of COVID lockdowns in the U.S.) for its largest single-reading decrease ever.

—Confidence in buying a new home fell 1.9 points to 22.3.

—Confidence in personal finances fell 1.7 points to 51.6.

—Confidence in the overall U.S. economy fell 0.5 points to 32.5.

—Confidence in making a major purchase fell 0.1 points to 23.2.

A wave of layoffs over the past two weeks has expanded beyond the tech industry. Amazon, Accenture, LinkedIn, Walmart, and others all announced they would be cutting jobs—with Accenture cutting 2.5% of its total workforce and LinkedIn about 15% of its staff. Recent issues in the banking sector could cause further loosening in the job market, with Fed Chair Jerome Powell telling reporters that “the events of the last two weeks are likely to result in some tightening of credit conditions for households and businesses, and thereby weigh on demand on the labor market and inflation.”

The substantial drop in confidence in finding a new job has coincided with the collapse of multiple banks and the resulting fallout over the past two weeks. The KBW bank index, which tracks the performance of 24 U.S. banks, fell more than 5% and has lost over 20% of its value this year compared to the small increase in the broader market over the same period. This crisis has renewed concerns of a recession for some experts, including Jay Bryson, chief economist at Wells Fargo, who noted that he “would raise the probability of a recession given what’s happened in the last week.”

Mortgage rates continued to fall as the Fed announced another quarter-point rate hike on March 22. However, there was also improved purchase demand and stabilizing home prices. A geographic divide has emerged in the housing market, with home prices falling in the western United States and rising in the eastern U.S. This trend reflects the impact of COVID-19, as people are increasingly deciding to leave “Zoom towns”—areas that saw population growth during the pandemic.

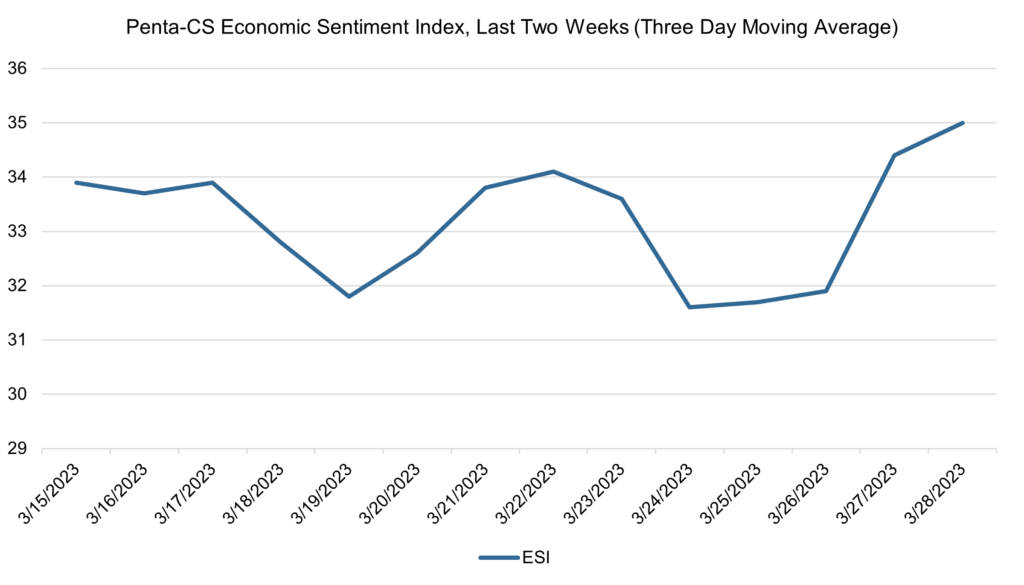

The ESI’s three-day moving average began this two-week stretch at 33.9 on March 15. It then fell to 33.7 on March 16 before rising to 33.9 on March 17. After another dip on March 18 and 19, the three-day average trended upward to 34.1 on March 22. The three-day average then fell to a low of 31.6 on March 24 before rising to a peak of 35.0 on March 28 to close out the session.

The next release of the ESI will be Wednesday, April 12, 2023.