Confidence in the overall U.S. economy pushes consumer sentiment higher

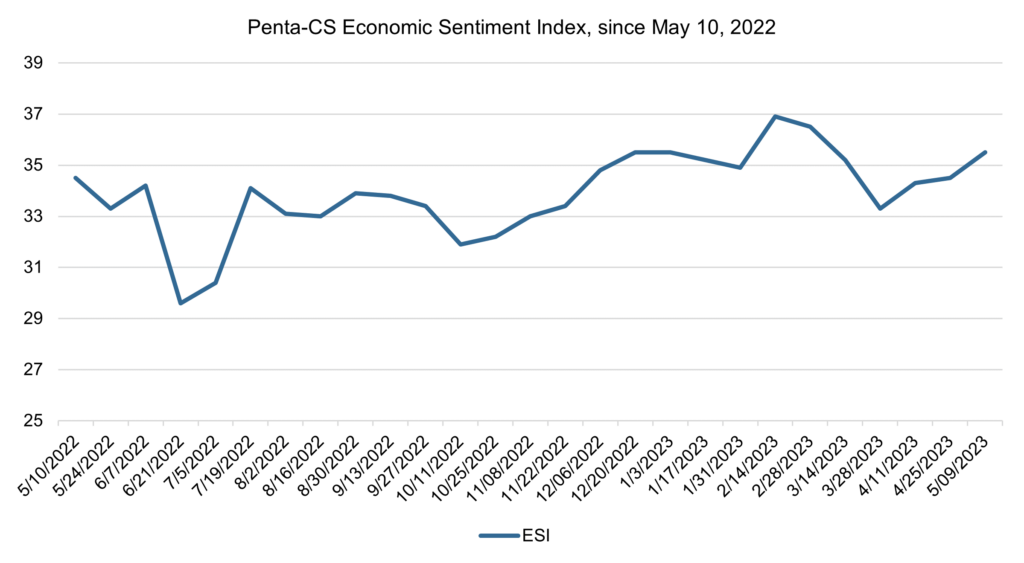

Economic sentiment increased again over the past two weeks—its third consecutive hike following multiple large drops in March and early April. The Penta-CivicScience Economic Sentiment Index (ESI) rose 1.0 point to 35.5.

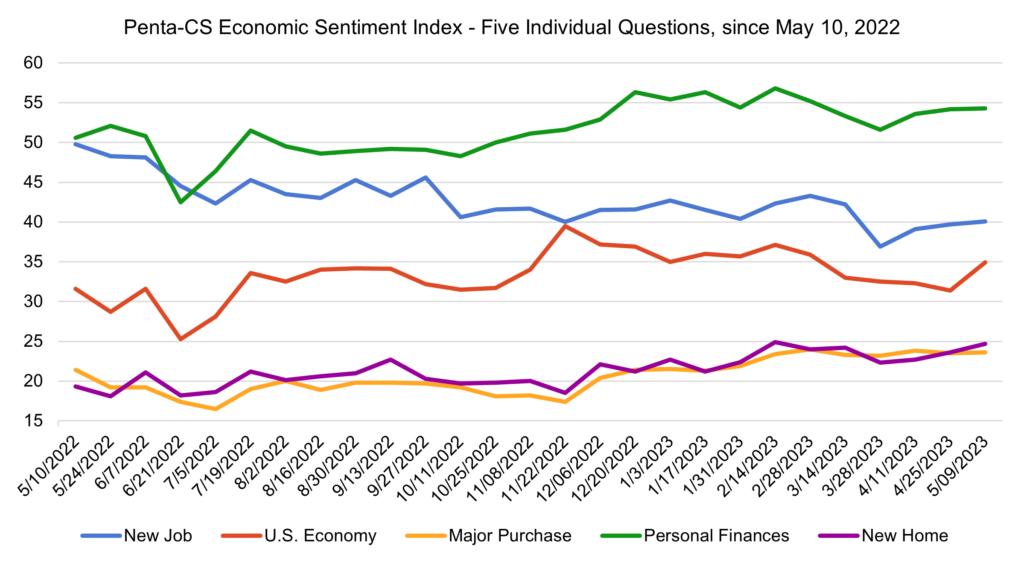

All of the ESI’s five indicators increased over the past two weeks. Confidence in the overall U.S. economy improved the most, rising 3.5 points to 34.9—its largest single-reading increase since November 2022.

—Confidence in buying a new home rose 1.1 points to 24.7.

—Confidence in finding a new job rose 0.4 points to 40.1.

—Confidence in making a major purchase rose 0.1 points to 23.6.

—Confidence in personal finances rose 0.1 points to 54.3.

The U.S. economy remains resilient but shaky as markets see the effects of the Federal Reserve’s efforts to cool the economy—including causing the housing sector to shrink for the eighth consecutive quarter and business investment in equipment falling for the second straight quarter.

However, thus far these slowdowns have been counteracted by robust consumer spending and a strong labor market, which helped U.S. GDP increase 1.1% in the first quarter of 2023, according to the Bureau of Economic Analysis’ advance estimate. Despite persistent inflation and high prices, consumers continue to spend, even sticking to their typical shopping habits instead of transitioning to cheaper alternatives.

Americans’ confidence in their personal finances fell despite their wages increasing 4.4% year over year as of April. The U.S. personal savings rate remains below its historical average, sitting at 5.1% in March compared to the average annual rate of more than 8%, according to the U.S. Bureau of Economic Analysis, .

The labor market is showing continued strength: U.S. employers added the most jobs since January—253,000 in April—and the unemployment rate fell to 3.4% last month, matching the lowest reading since 1969. The job market’s continued strength helped quell some concern over the economy as U.S. stocks snapped a four-day skid and all three major benchmarks sharply rose on May 5 after the April jobs data was released.

Spring is frequently a hot time for the housing market, but this year the market appears to be stuck. In April, new home listings were down more than 20% from a year ago according to data from Realtor.com. The lack of housing units and high mortgage rates, as well as relatively elevated home prices, have kept the affordability of houses low, evidenced by the Mortgage Bankers Association’s Purchase Applications Payment Index increasing in March.

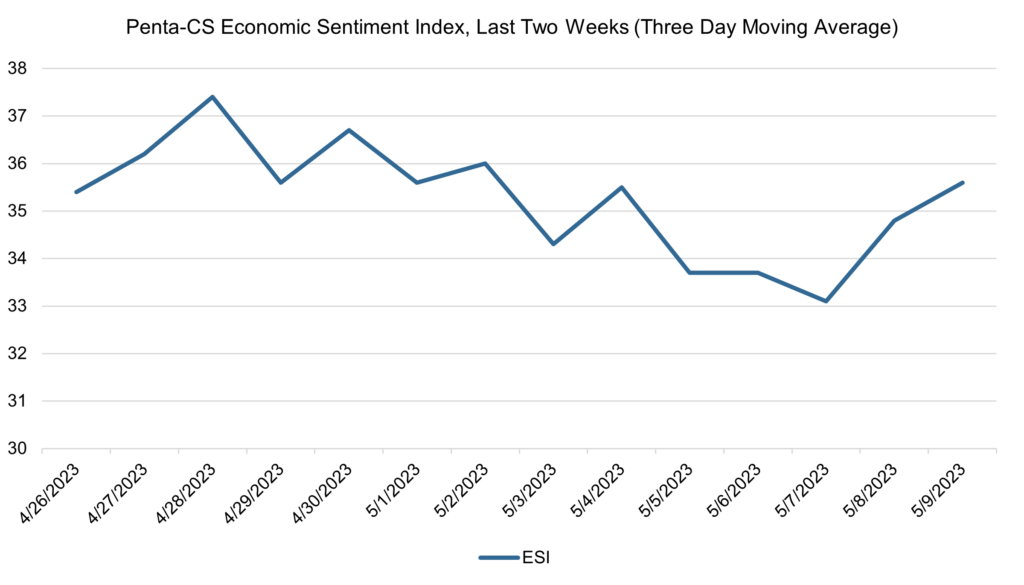

The ESI’s three-day moving average began this two-week stretch at 35.4 on April 26. It then trended upward to a peak of 37.4 on April 28, before falling to 35.6 on April 29. The three-day average then oscillated between rising and falling before falling to a low of 33.1 on May 7. It then rose to 35.6 on May 9 to close out the session.

The next release of the ESI will be Wednesday, May 24, 2023.