Economic sentiment decreases slightly following Thanksgiving

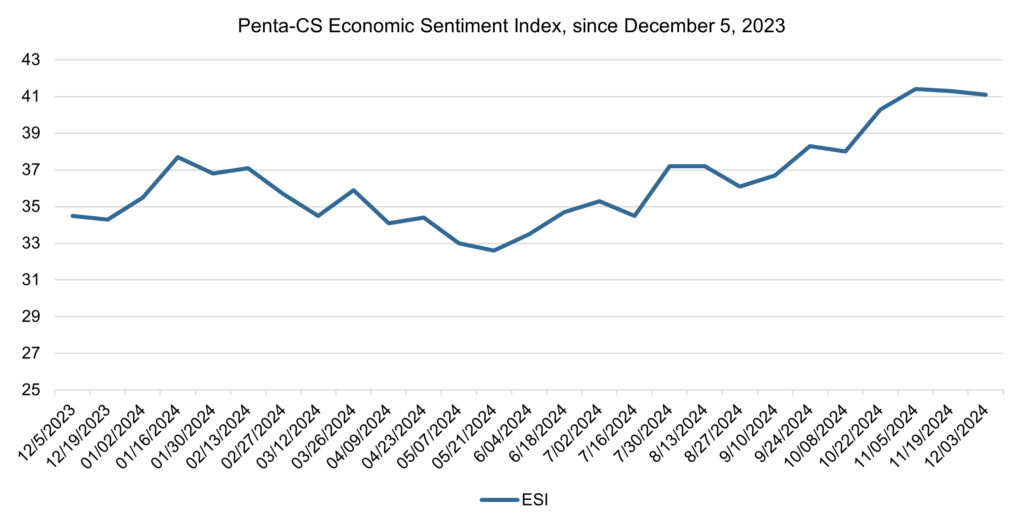

The latest biweekly reading of the Penta-CivicScience Economic Sentiment Index (ESI) decreased by 0.2 points to 41.1, marking a minor dip in overall economic confidence as the holiday shopping season begins.

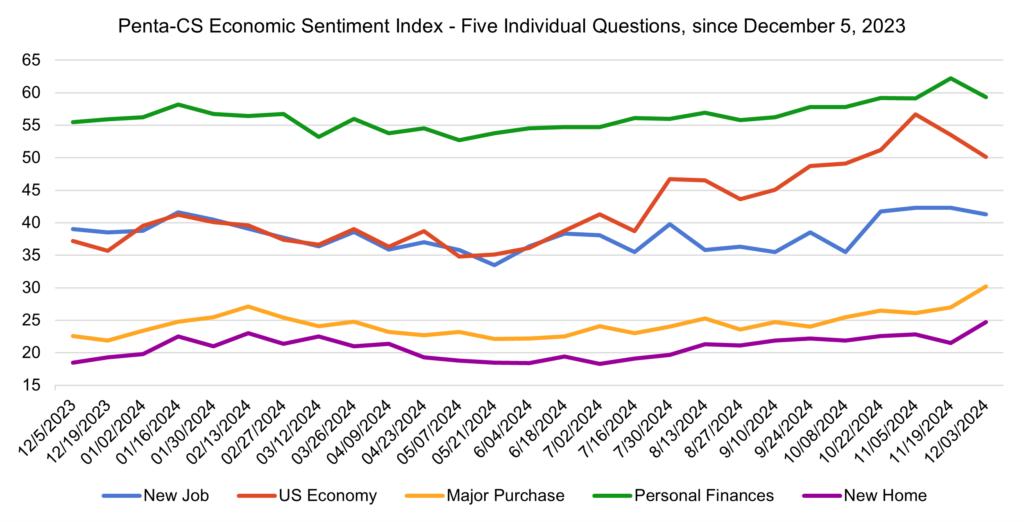

Three of the ESI’s five indicators decreased during this period. Confidence in the overall U.S. economy decreased the most, falling 3.4 points to 50.1. This marks the second period in a row this indicator has fallen by more than 3 points.

—Confidence in personal finances decreased 2.9 points to 59.3.

—Confidence in finding a new job decreased 1.0 points to 41.3.

—Confidence in making a major purchase increased 3.2 points to 30.2.

—Confidence in buying a new home increased 3.2 points to 24.7.

The Commerce Department’s second estimate of U.S. third quarter GDP remained unrevised from the advance estimate released in early November, showing that the U.S. economy expanded at an annual pace of 2.8 percent. This marks the ninth consecutive quarter that GDP growth exceeded 2 percent.

Meanwhile, the Commerce Department released the October personal consumption expenditures (PCE) price index which showed that inflation excluding volatile food and energy prices increased by 0.3 percent from September to October and 2.8 percent year-over-year. This represents a minor acceleration from September, where core PCE increased 2.7 percent year-over-year. This data points to the stickiness of inflation and raises questions about whether the Federal Reserve will continue to cut rates in December as its preferred inflation metric remains stubbornly above their 2 percent target.

The National Association of Realtors (NAR) reported that home sales in October increased 3.4 percent from September, reflecting a short-term drop in mortgage rates. While NAR Chief Economist Lawrence Yun stated that, “the worst of the downturn in home sales could be over, with increasing inventory leading to more transactions,” he also affirmed that “we are not going to return to 3 percent, 4 percent, or 5 percent mortgage-rate conditions” and that “the new normal will be around 6 percent.” Economists at Wells Fargo are projecting that rates will average around 6.3 percent by the end of next year, and Fannie Mae is estimating an average of 6.4 percent in 2025.

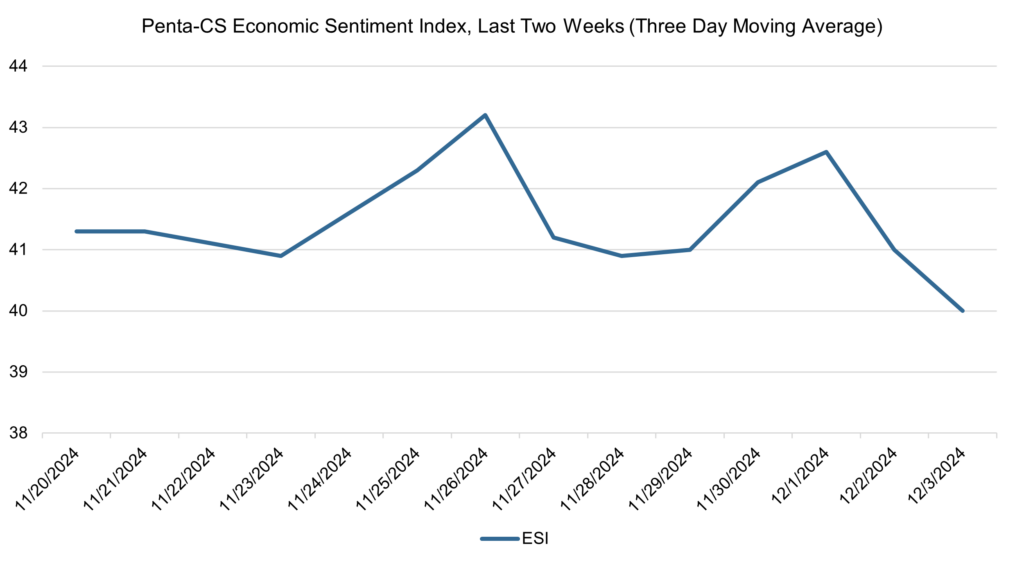

The ESI’s three-day moving average began this two-week stretch at 41.3 on November 20. It then fell slightly to 40.9 on November 23 before increasing back up to a high of 43.2 on November 26. The three-day moving average then fell back down to 40.9 on November 28, then rose to 42.6 on December 1 before decreasing to a low of 40.0 on December 3 to close out the session.

The next release of the ESI will be on Wednesday, December 18, 2024.