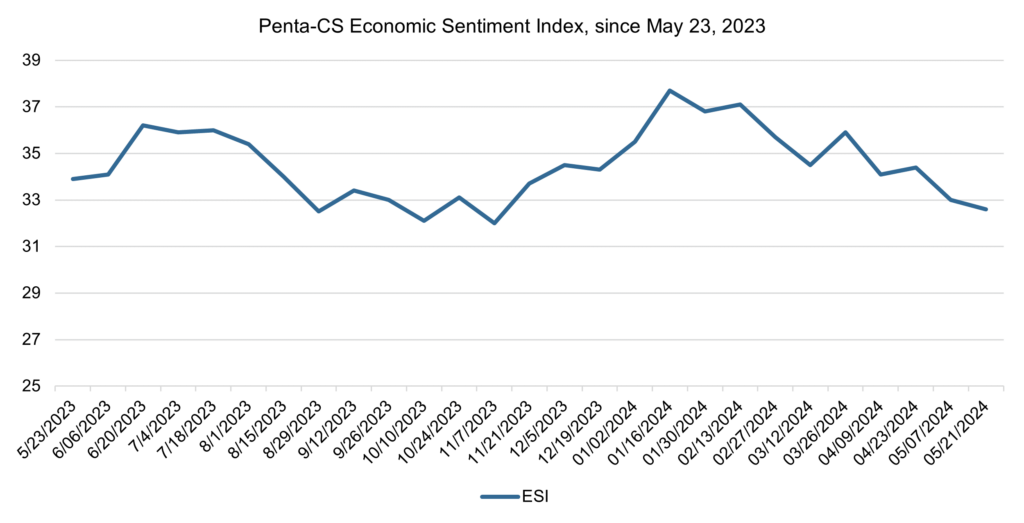

Economic sentiment falls for third consecutive reading

Economic sentiment decreased over the last two weeks, reaching its lowest point so far in 2024. The Penta-CivicScience Economic Sentiment Index (ESI) fell 0.4 points to 32.6.

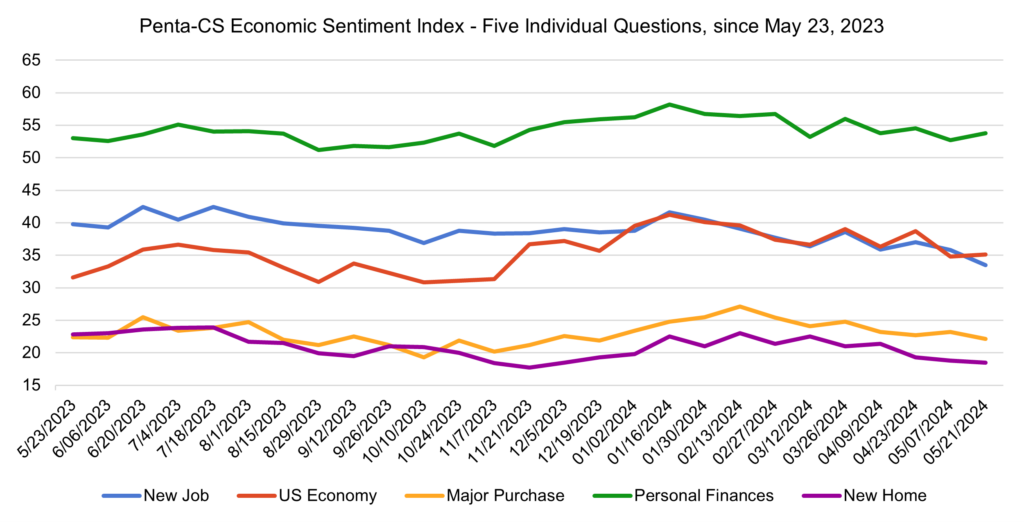

Three of the ESI’s five indicators decreased over the past two weeks. Confidence in finding a new job decreased the most, falling 2.3 points to 33.5—the indicator’s lowest point in over a year.

—Confidence in making a major purchase decreased 1.1 points to 22.1.

—Confidence in buying a new home decreased 0.3 points to 18.5.

—Confidence in the overall U.S. economy increased 0.3 points to 35.1.

—Confidence in personal finances increased 1.1 points to 53.8.

While the job market remains resilient, with generally strong job growth and a relatively steady unemployment rate of 3.9%, LinkedIn reported a 14% increase in the number of applications per open role on the platform between November 2023 and March 2024. Additionally, workers’ expectations of forthcoming job losses are elevated: 15.1% of respondents surveyed by the New York Fed in its April 2024 Survey of Consumer Expectations perceived a probability of losing their job in the next twelve months—a slight decline from March, but the second-highest probability since October 2020.

Research from the New York Fed also shows that, over the past year, delinquency rates on credit card balances have risen past pre-pandemic levels to 8.9% and household debt climbed to $17.69 trillion. Credit card delinquencies disproportionately come from borrowers who have maxed-out their balances, and the share of maxed-out borrowers has been increasing from pandemic lows—highlighting the potential for delinquencies to continue growing.

The median U.S. home prices hit an all-time high in April, rising 6.2% year-over-year to $433,558. Meanwhile, new listings remain roughly 20% below pre-pandemic levels, in large part because many homeowners continue to feel “locked in” by the low mortgage rates that occurred during the pandemic.

The U.S. Department of Labor Statistics reported that the Consumer Price Index (CPI) increased by 0.3 percent in April and rose 3.4 percent on an annual basis. Core CPI inflation increased as well, rising 0.3 percent in April. The release of this CPI data comes as Fed Chair Jerome Powell, speaking at the Foreign Bankers’ Association in Amsterdam on Tuesday, reiterated the need to hold interest rates high given persistent inflation. Powell stated, “these [inflation readings] were higher than I think anybody expected… What that has told us is that we’ll need to be patient and let restrictive policy do its work.”

The ESI’s three-day moving average began this two-week stretch at 32.4 on May 8. It rose to 32.8 on May 9, then fell to a low of 30.9 on May 13. The three-day moving average then trended upward to a high of 34.9 on May 20 before falling to 33.4 on May 21 to close out the session.

The next release of the ESI will be Wednesday, June 5, 2024.