Economic sentiment increases for the first time in 2025

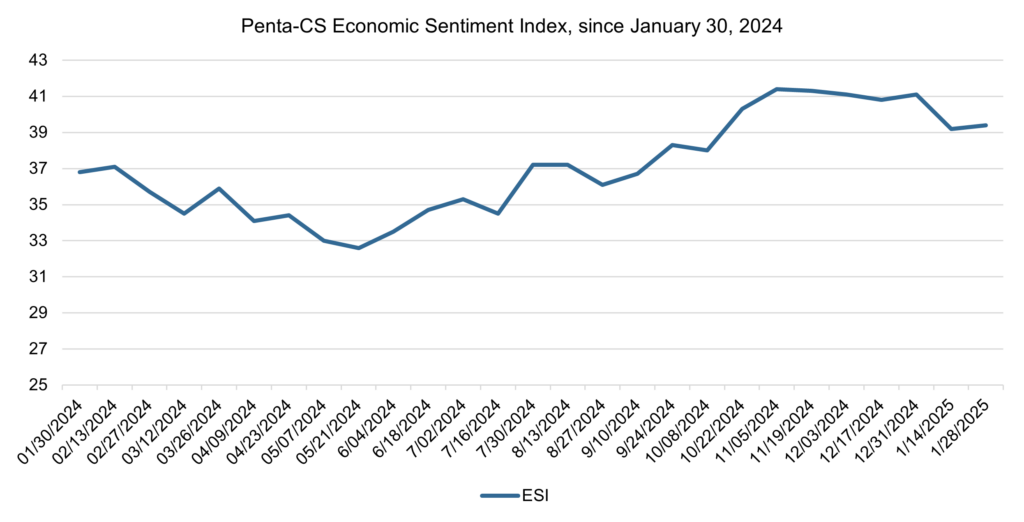

The latest biweekly reading of the Penta-CivicScience Economic Sentiment Index (ESI) increased by 0.2 points to 39.4, marking a minor increase in overall economic confidence.

Four of the ESI’s five indicators increased during this two-week period. Confidence in the overall U.S. economy increased the most, rising 1.8 points to 48.2.

—Confidence in making a major purchase increased 0.6 points to 27.4.

—Confidence in finding a new job increased 0.4 points to 40.7.

—Confidence in personal finances increased 0.2 points to 59.2.

—Confidence in buying a new home decreased 2.4 points to 21.3.

The Federal Reserve left interest rates unchanged at between 4.25 and 4.5 percent, marking a pause after three consecutive rate cuts last year. In its statement, the Federal Open Markets Committee said, “The unemployment rate has stabilized at a low level in recent months, and labor market conditions remain solid.” However, the statement also noted that, “Inflation remains somewhat elevated” above the Fed’s 2 percent target.

Artificial intelligence (AI) stocks plummeted following the release of a new AI chatbot by Chinese startup, DeepSeek, which is said to use less data than current models and cost a fraction to design. Notably, Nvidia’s stock price dropped almost 17 percent, and major U.S. indices also faced losses. The Nasdaq Composite declined by 3.07 percent while the S&P 500 fell by 1.46 percent.

Data from the U.S. Bureau of Labor Statistics showed that grocery prices rose 1.8 percent in the one year period between December 2023 and December 2024. Notably, egg prices during this same period surged 36.8 percent, driven in part by the ongoing bird flu outbreak. These rising prices are putting an increased burden on Americans in the midst of decades-high mortgage rates and high credit card balances.

Despite these financial pressures, consumer spending has shown surprising resilience. The U.S. Census Bureau reported that retail sales rose modestly in December, increasing by 0.4 percent compared with November, signaling strong consumer spending through the holiday shopping season. This represented a 3.9 percent increase over the previous year and marked the fourth consecutive monthly increase in retail sales.

The International Monetary Fund (IMF) upgraded its projection of U.S. economic growth for 2025 by 0.5 percentage points, raising its estimate of real GDP growth from 2.2 percent to 2.7 percent. IMF chief economist Pierre-Olivier Gourinchas stated, “we have stronger potential output growth in the U.S. compared to prepandemic” but noted that this anticipated growth represents a “divergence” from the rest of the world. Gourinchas stated that the IMF is predicting “weaker potential growth in other areas, like the euro area or China.”

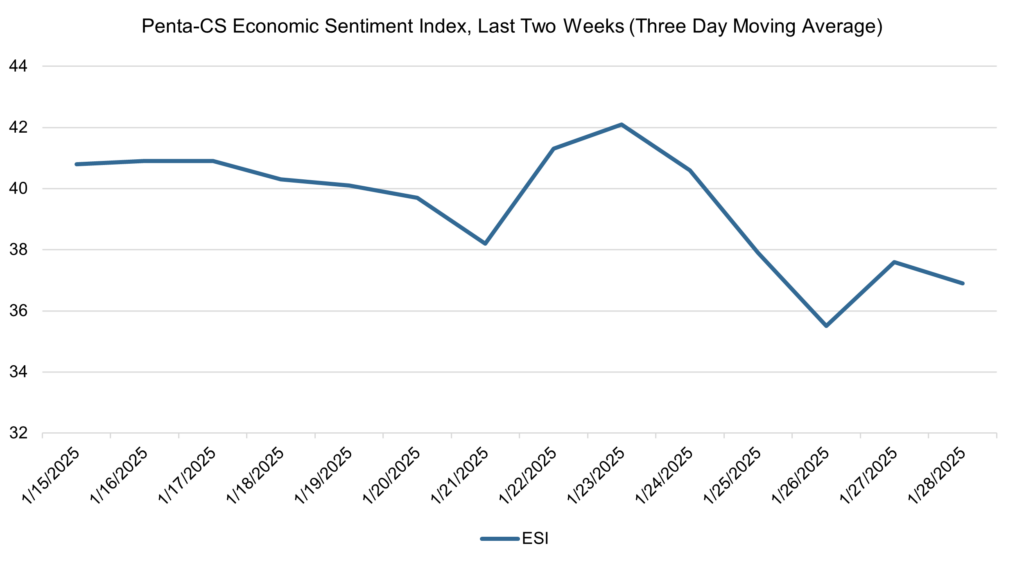

The ESI’s three-day moving average began this two-week stretch at 40.8 on January 15. The next day, it increased slightly to 40.9, then trended downward to 38.2 on January 21. The three-day moving average then rose up to a high of 42.1 on January 23 before falling to a low of 35.5 on January 26. It then ticked up to 37.6 on January 27 before falling to 36.9 on January 28 to close out the session.

The next release of the ESI will be on Wednesday, February 12, 2025.