Economic sentiment increases slightly ahead of the September Fed meeting

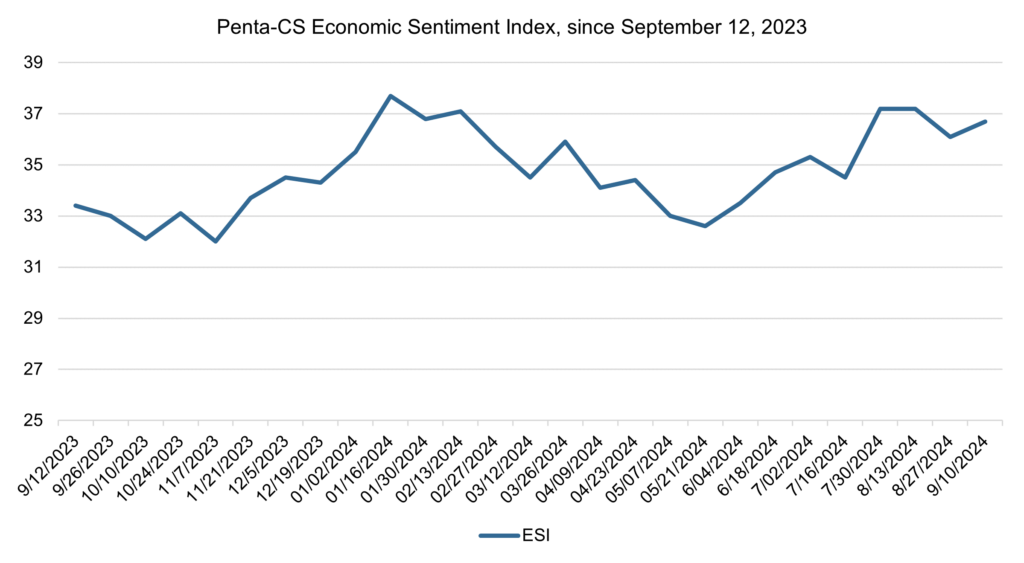

The latest biweekly reading of the Penta-CivicScience Economic Sentiment Index (ESI) increased by 0.6 points to 36.7, a slight improvement in confidence over the past two weeks.

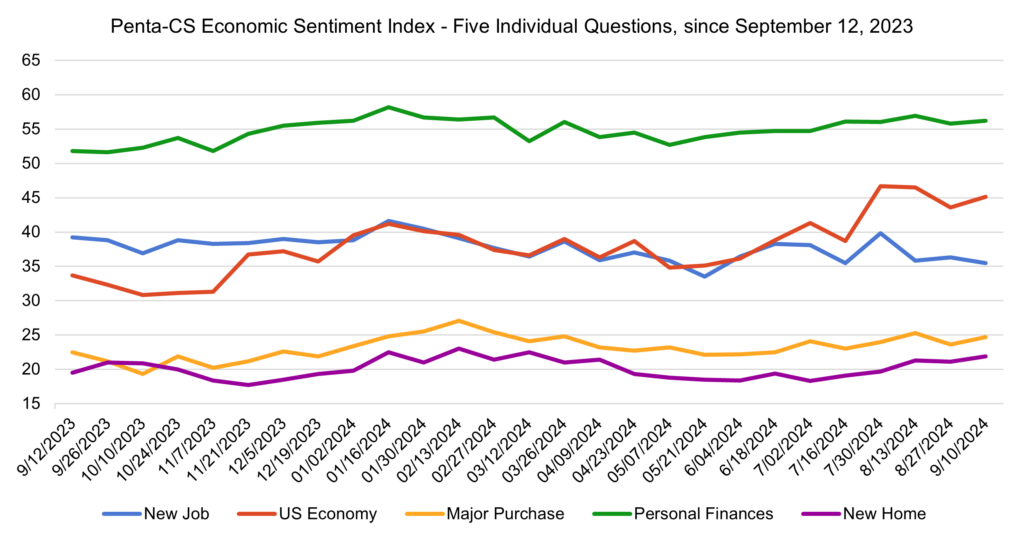

Four of the ESI’s five indicators increased during this period. Confidence in the overall U.S. economy saw the largest gain, rising 1.5 points to 45.1.

—Confidence in finding a new job decreased by 0.8 points to 35.5.

—Confidence in personal finances increased by 0.4 points to 56.2.

—Confidence in buying a new home increased by 0.8 points to 21.9.

—Confidence in making a major purchase increased by 1.1 points to 24.7.

The Federal Reserve’s preferred inflation metric held steady in July with personal consumption expenditures, excluding volatile food and energy prices, rising 2.6% year-over-year, in-line with the previous two months. The steadying rate of inflation combined with slowing job creation has bolstered expectations for the first interest rate cut in over a year next week at the Fed’s September meeting.

The Bureau of Economic Analysis reported that the U.S. economy grew faster than initially thought in the second quarter of 2024, at an annualized rate of 3.0%. This growth was primarily driven by an upturn in inventory investment and strong consumer spending, which remain crucial forces in sustaining the broader economy despite inflationary pressures.

The September Jobs Report from the Bureau of Labor Statistics revealed that nonfarm payroll employment increased by 142,000 in August, which was less than expected and below the average monthly gain seen over the previous year. Jobs gained in June and July were revised down, showing that job creation has slowed. However, the unemployment rate fell to 4.2% signaling the labor market may be remaining resilient.

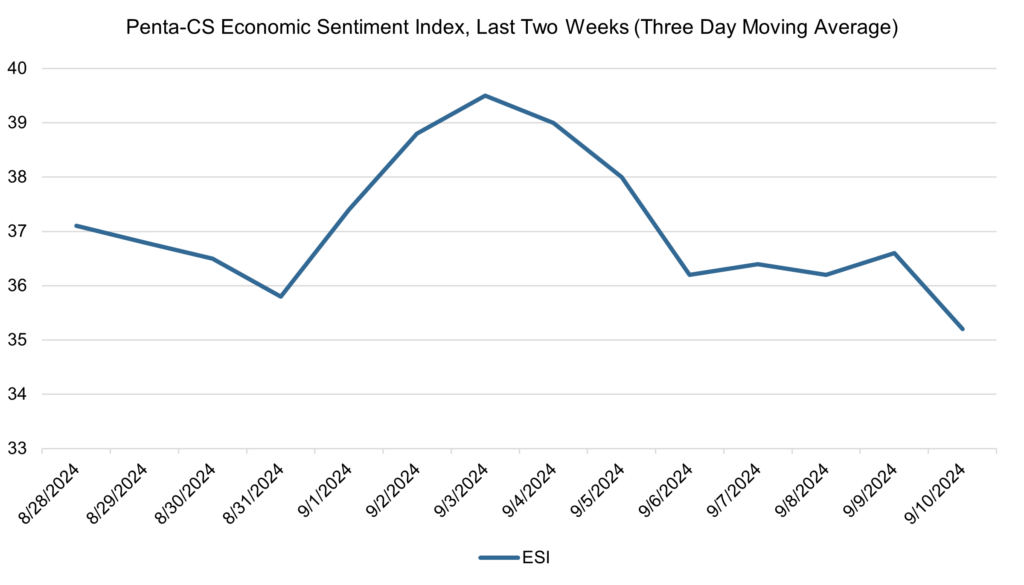

The ESI’s three-day moving average began this two-week stretch at 37.1 before slipping to 35.8 on August 31. It rebounded in early September, peaking at 39.5 on September 3. After that, it declined again, closing out the period at 35.2 on September 10.

The next release of the ESI will be on Wednesday, September 25, 2024.