Economic sentiment increases after a month of decline

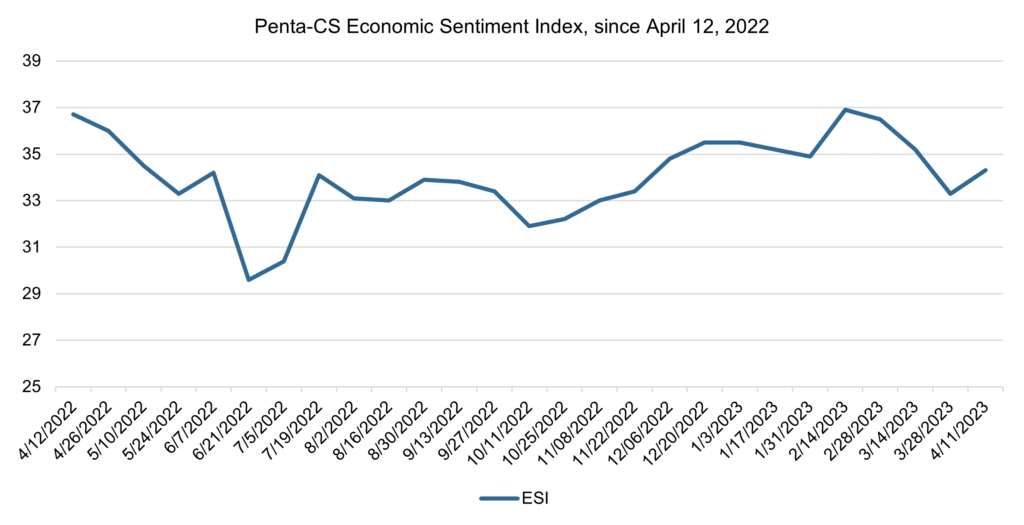

Economic sentiment increased over the past two weeks, for just the second time this year. The Penta-CivicScience Economic Sentiment Index (ESI) rose 1.0 points to 34.3, after a brutal drop in sentiment between mid-February and the end of March.

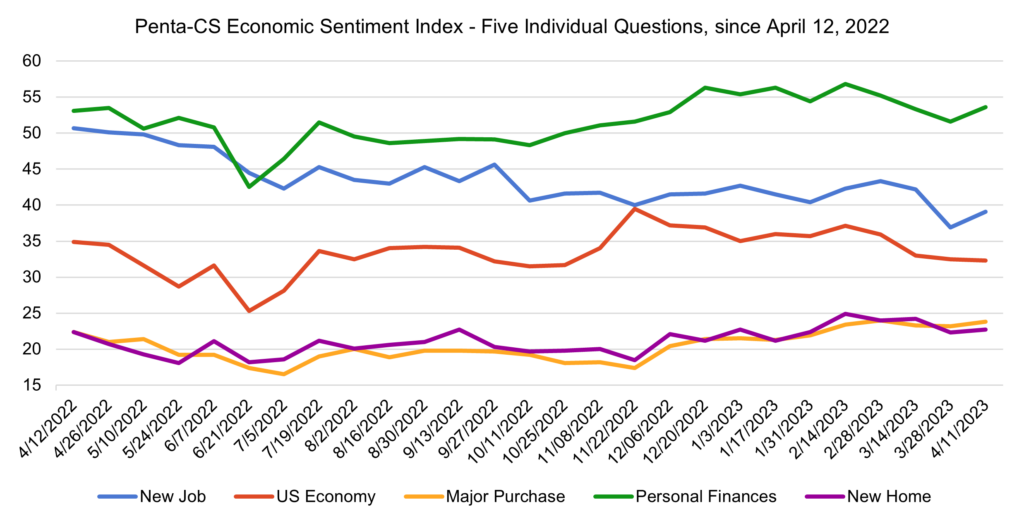

Four of the ESI’s five indicators increased over the past two weeks. Following its largest single-reading decrease ever in the last reading, confidence in finding a new job recovered slightly, rising 2.2 points to 39.1.

—Confidence in personal finances rose 2.0 points to 53.6.

—Confidence in making a major purchase rose 0.6 points to 23.8.

—Confidence in buying a new home rose 0.4 points to 22.7.

—Confidence in the overall U.S. economy fell 0.2 points to 32.3.

The job market continued to show signs of resiliency—adding 236,000 jobs in March and keeping the unemployment rate near constant at 3.5 percent, according to the U.S. Bureau of Labor Statistics.

Following its release on April 7, the jobs report also caused technology stocks to fall on April 10 over concerns that the Federal Reserve will continue to hike interest rates due to a resilient labor market.

While the jobs added and unemployment rate were evidence of labor market resiliency, there were signs that parts of the economy may face trouble, as the retail sector shed 14,600 jobs in March, after adding 41,300 the prior month, and nearly 9,000 jobs were lost in construction, a sector that gained 12,000 jobs in February.

Mortgage rates continued to fall, with the average 30-year fixed mortgage dipping to 6.28% as of April 6, down from 6.32% the week prior. Despite the lower rates, the volume of mortgage applications for a home purchase decreased by 4% on a seasonally adjusted basis from one week earlier, according to data for the week ending March 31 from the Mortgage Bankers Association (MBA).

The IMF and World Bank spring meetings are underway, and on April 11, Treasury Secretary Janet Yellen announced her top priorities for the meetings, highlighting the global economy and Russia’s war in Ukraine as key areas for discussion. Secretary Yellen also displayed “cautious optimism” on the future of the world economy, while many others continue to worry about the impacts of persistent high inflation and inhibited growth.

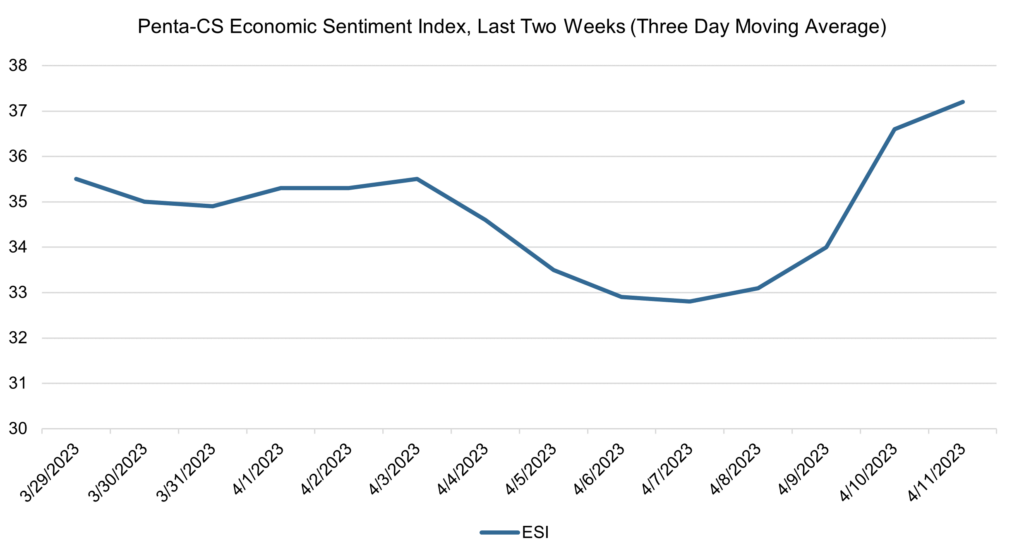

The ESI’s three-day moving average began this two-week stretch at 35.5 on March 29. It then fell to 34.9 on March 31, before rising to 35.5 on April 3. The three-day average then trended down to a low of 32.8 on April 7, and then rose to a peak of 37 on April 11 to close out the session.

The next release of the ESI will be Wednesday, April 26, 2023.