Consumer sentiment drops in wake of SVB collapse

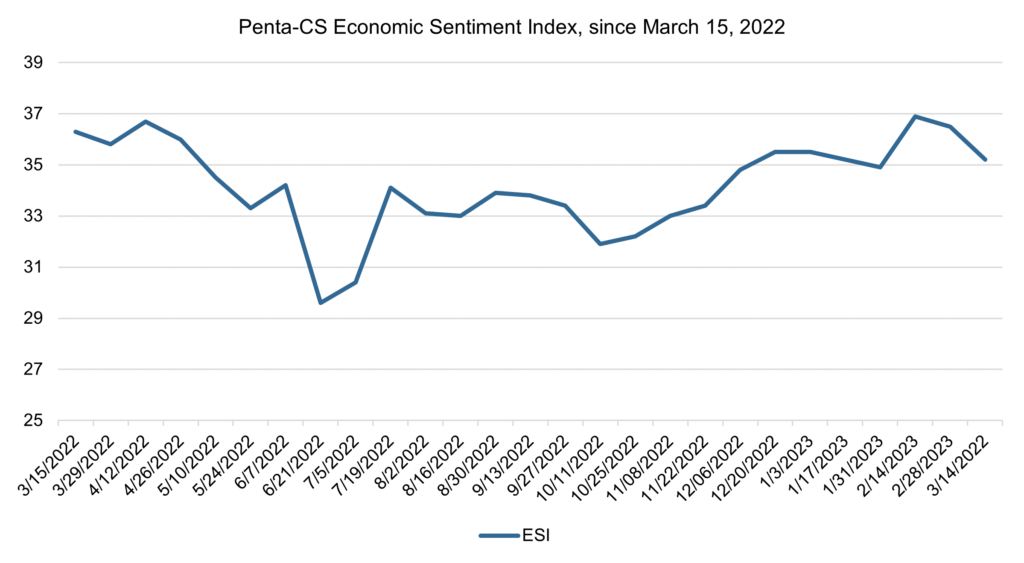

Economic sentiment dropped in a two-week span that saw the failures of three U.S. banks, driven by a significant fall in confidence in the overall U.S. economy. The Penta-CivicScience Economic Sentiment Index (ESI) fell 1.3 points to 35.2, its largest fall since mid-October.

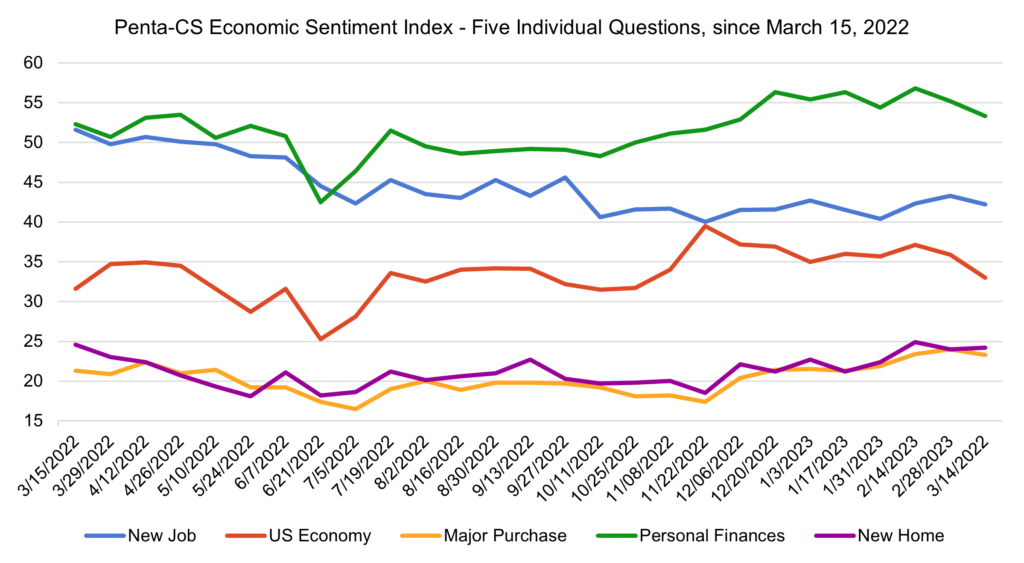

Four of the ESI’s five indicators decreased over the past two weeks. Confidence in the overall U.S. economy dropped 2.9 points to 33.0—its largest single-reading decrease since June 2022.

—Confidence in personal finances fell 1.9 points to 53.3.

—Confidence in finding a new job fell 1.1 points to 42.2.

—Confidence in making a major purchase fell 0.7 points to 23.3.

—Confidence in buying a new home rose 0.2 points to 24.2.

Confidence in the overall U.S. economy fell as the U.S. was rocked by three bank closures. Silvergate Capital, a central lender to the crypto industry, announced on March 8 that it would be winding down operations and liquidating its bank. That news was followed by the collapse of Silicon Valley Bank (SVB)—a critical player for tech startups and a top-20 U.S. bank by assets—which became the biggest American bank to fail since the collapse of Washington Mutual in 2008. On Sunday, March 12, another major bank was shuttered when regulators closed Signature Bank, which was facing a crisis of confidence after SVB collapsed.

The unemployment rate increased but remained low—rising to 3.6% in February from 3.4% in January. Despite this, Chair Jerome Powell’s comments that the Federal Reserve could increase the size of its interest rate hikes and raise borrowing costs to higher levels than previously projected, along with the slowing wage growth, are likely driving concern with the job market.

The extent to which Powell’s statements come to fruition will largely be determined by the fallout of SVB’s collapse and the resultant risks influencing the U.S. banking system. Goldman Sachs and Barclays, among others, now expect the Fed to hold rates steady following its meeting on March 22 as a result of the recent volatility.

Others predict the Fed will raise interest rates by a quarter point, which would still represent a lower increase than originally anticipated. This outcome may be more likely given the latest release of the Consumer Price Index (CPI), which increased by 0.4% in February and 6.0% annually—indicating the slowest annual increase in inflation since September 2021.

The rapid bank failures also caused stocks to tumble over concerns about what might collapse next. As of Friday, March 10, the S&P 500 dropped 1.4% to cap its worst week since September, the Dow Jones Industrial Average fell 1.1%, and the Nasdaq composite sank 1.8%.

The labor market continued to grow in February, with employers adding 311,000 jobs, down slightly from the average of 344,000 over the previous three months. While job growth remained strong, wage growth only increased 0.2% from January.

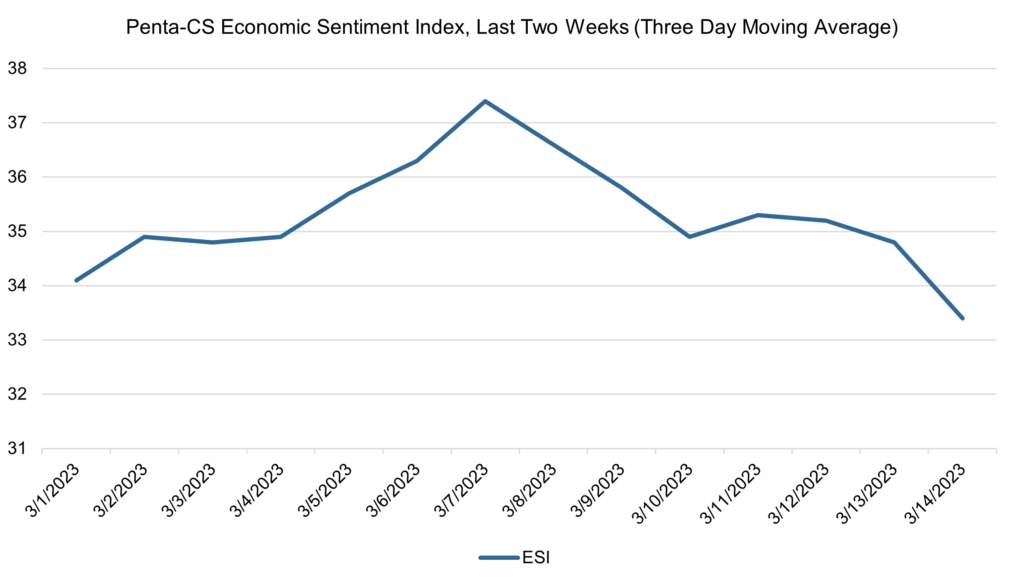

The ESI’s three-day moving average began this two-week stretch at 34.1 on March 1. It then rose to a peak of 37.4 on March 7 before falling to 34.9 on March 10, the day SVB failed. The three-day average then trended upward to 35.3 on March 11 before it to a low of 33.4 on March 14 to close out the session—coinciding with Silvergate’s March 12 announcement that it would be liquidating the bank helped drive.

The next release of the ESI will be Wednesday, March 29, 2023.