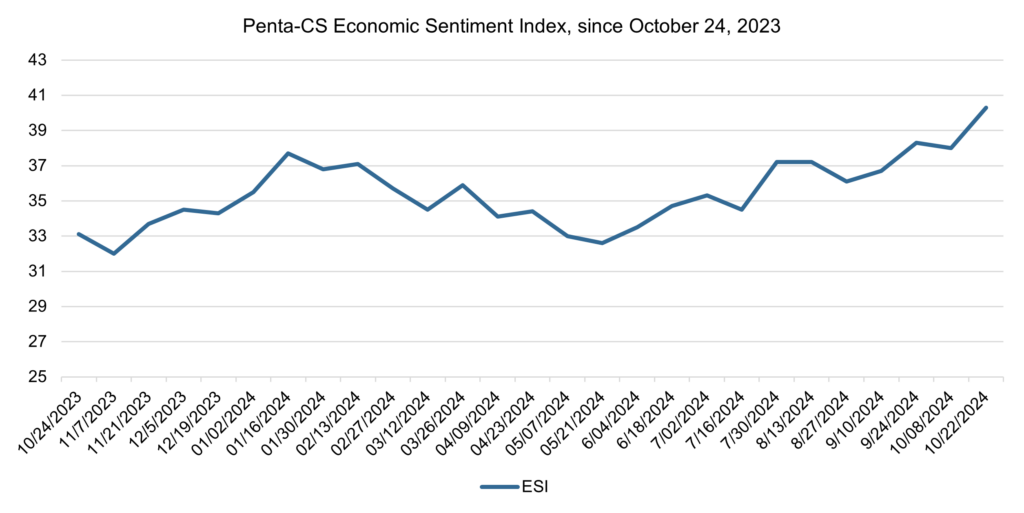

Economic sentiment rises to its highest level in over a year

Economic sentiment posted a huge increase this period, rising to its highest point in over a year. The latest biweekly reading of the Penta-CivicScience Economic Sentiment Index (ESI) increased by 2.3 points to 40.3, driven by a huge jump in confidence in finding a new job.

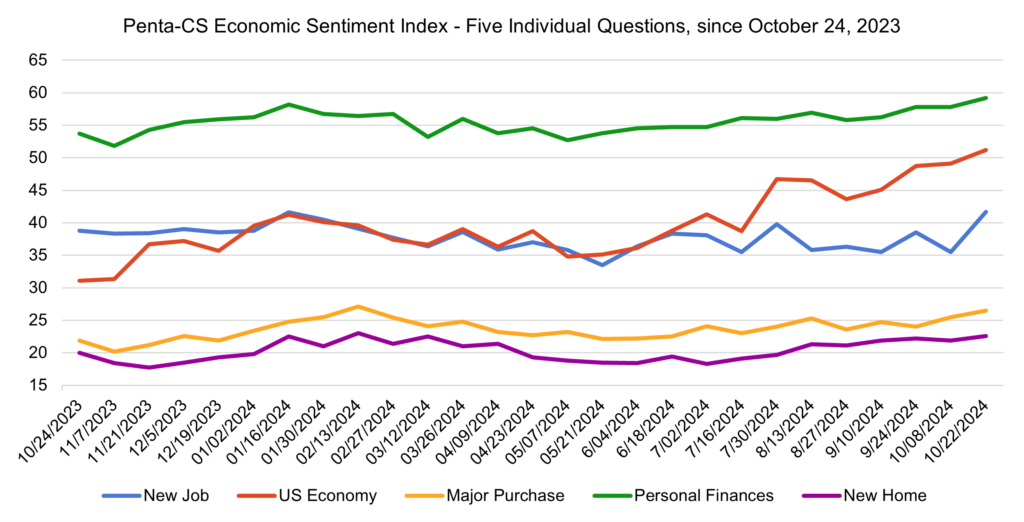

All five of the ESI’s indicators increased during this period. Confidence in finding a new job increased the most, rising 6.2 points to 41.7. This marks this indicator’s largest increase since June 2020.

—Confidence in the overall U.S. economy increased 2.1 points to 51.2.

—Confidence in personal finances increased 1.4 points to 59.2.

—Confidence in making a major purchase increased 1.0 points to 26.5.

—Confidence in buying a new home increased 0.7 points to 22.6.

The International Monetary Fund released its World Economic Outlook on October 22, which predicted that the U.S. economy will grow by 2.8% in 2024 and 2.2% in 2025. These predictions are 0.2 and 0.3 percentage points higher than the IMF previously projected in July 2024, respectively.

Neel Kashkari, President of the Minneapolis Fed, stated in a speech to the Central Bank of the Argentine Republic that further rate cuts are likely to occur in the U.S. Kashkari said, “As of right now, it appears likely that further modest reductions in our policy rate will be appropriate in the coming quarters to achieve both sides of our mandate.” Kashkari also pointed to other positive economic metrics, affirming that the U.S. is still on target to its goal of reducing inflation to 2% and that job growth remains strong.

The U.S. Commerce Department reported that retail sales rose 0.4% from August to September and 1.7% from September 2023. This represents this indicator’s third straight increase and points to continued, robust consumer spending in the U.S.

Meanwhile, the U.S. Bureau of Labor Statistics released the September Consumer Price Index (CPI), showing that core inflation—the index excluding volatile food and energy costs—rose 0.3% in September and 3.3% over the last year. Both readings were 0.1 percentage points higher than economists’ forecasts. Despite this reading, Chicago Fed President Austan Goolsbee stated, “The overall trend is what’s important, not the day to day fluctuations…The overall trend over 12, 18 months is clearly that inflation has come down a lot, and the job market has cooled to a level which is around where we think full employment is.”

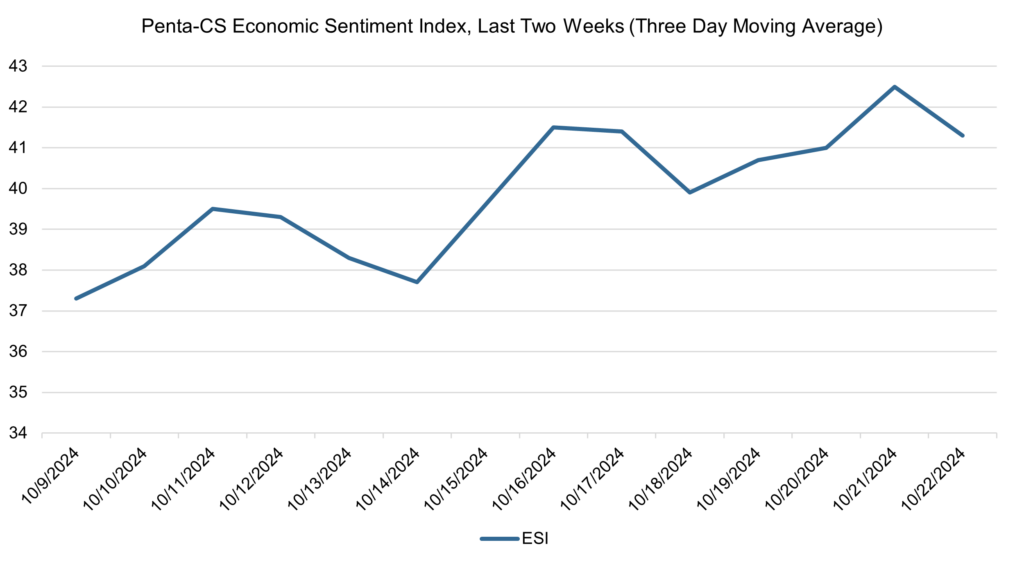

The ESI’s three-day moving average began this two-week stretch at a low of 37.3 on October 9. It then rose up to 39.5 on October 11 before falling to 37.7 on October 14. The three-day moving average then rose up to 41.5 on October 16 and decreased back down to 39.9 on October 18 before rising to a high of 42.5 on October 21. It then fell back down to 41.3 on October 22 to close out the session.

The next release of the ESI will be on Wednesday, November 6, 2024.