Economic sentiment slightly recovers after large drop

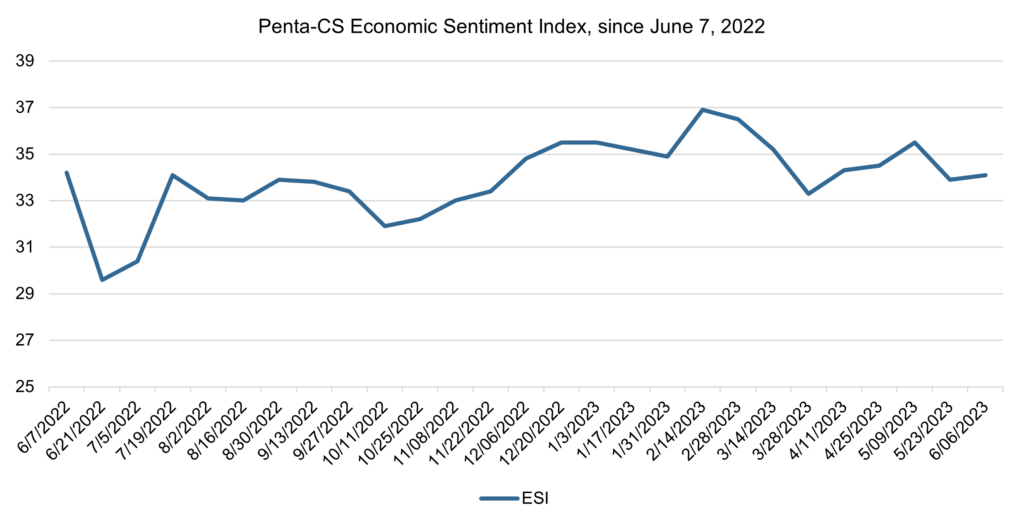

Economic sentiment recovered slightly over the past two weeks, in the wake of the debt ceiling deal. The Penta-CivicScience Economic Sentiment Index (ESI) rose 0.2 points to 34.1.

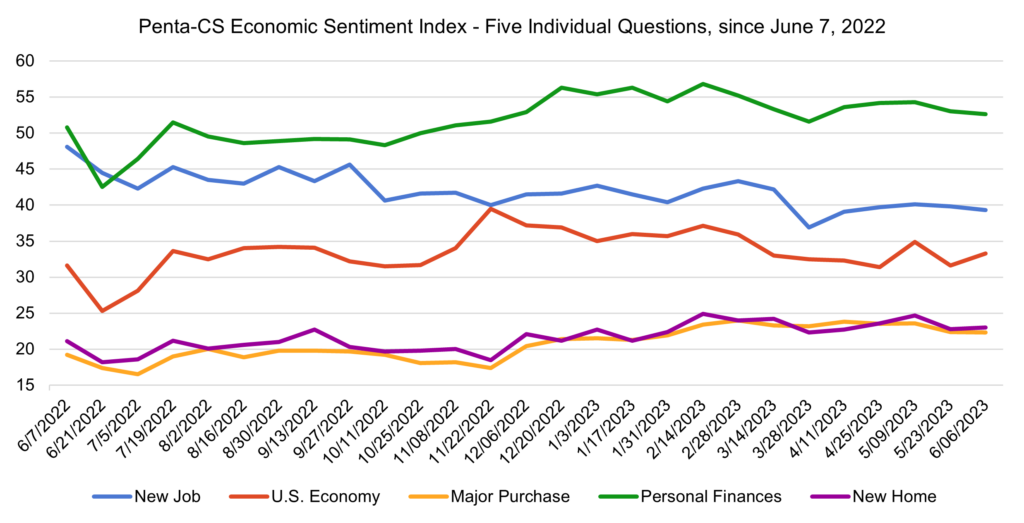

The overall increase in confidence was driven by jumps in just two of the ESI’s five indicators. Confidence in the overall U.S. economy increased the most, rising 1.7 points to 33.3—its second largest single-reading increase of the year.

—Confidence in buying a new home rose 0.2 points to 23.0.

—Confidence in making a major purchase fell 0.1 points to 22.3.

—Confidence in personal finances fell 0.4 points to 52.6.

—Confidence in finding a new job fell 0.5 points to 39.3.

On Saturday, June 3, President Biden signed a bill to lift the debt ceiling while capping federal spending, preventing the U.S. from defaulting on its debt. The bill passed with little time to spare as the Treasury Department had estimated the federal government would run out of money on June 5 had the debt ceiling not been lifted. Despite the deal being reached, Fitch Ratings said the U.S.’ “AAA” credit rating will remain on negative watch, highlighting the risk many still see in the U.S.

As the question of recession continues to dominate headlines, there is a lack of consensus on the current state of the U.S. economy. This could be attributed to discrepancies in how higher versus lower earners are experiencing different aspects of the economy, with people earning over $125k or more having year over year declines in household income while people in lower income brackets are still seeing improvements. Thus, much of the discussion of recession may be because “people who are overrepresented in online discussions of the economy feel like it’s a recession, while people who are overrepresented in the economy itself feel just fine.”

Meanwhile, the U.S. job market continues to be robust. In May, employers added 339,000 jobs, which beat forecasters’ expectations, and the unemployment rate rose to 3.7% from April’s unusually low 3.4%. The average U.S. employee makes $33.4 an hour—more than a 17.5% increase since pre-pandemic levels.

The increase in unemployment, combined with slowing hourly wage growth and a decline in hours worked, has led some to predict that the Federal Reserve will skip raising interest rates in June. Some officials have signaled they would like to pause rate hikes to help evaluate how previous moves are impacting the economy, while others argue that incoming data shows action is needed.

In May, home inventory fell in 21 out of 50 of the largest metropolitan cities, according to Realtor.com. While home inventories have fallen in certain areas, they are surging in others. High mortgage rates have likely contributed to this trend by helping subdue activity in expensive areas and stimulate it in more affordable ones. Active listings in the South, for instance, rose 54% in May compared to last year, though overall housing supply is still 41% lower than it was before the pandemic.

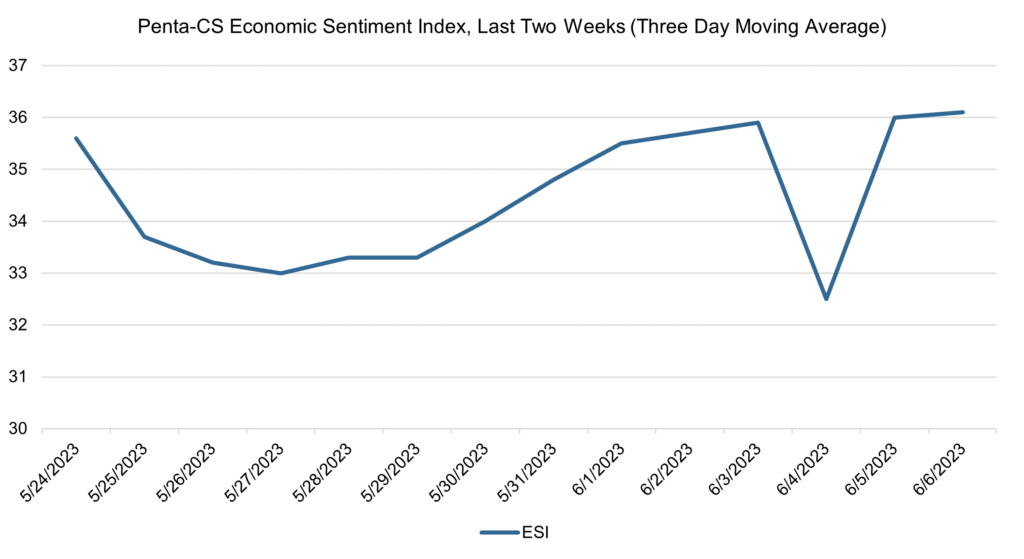

The ESI’s three-day moving average began this two-week stretch at 35.6 on May 24. It trended downward to 33.0 on May 27 and then rose to 35.9 on June 3. The three-day average then fell to a low of 32.5 on June 4 and rose to a peak of 36.2 on June 6 to close out the session.

The next release of the ESI will be Wednesday, June 21, 2023.