Economic sentiment rises as inflation continues to cool

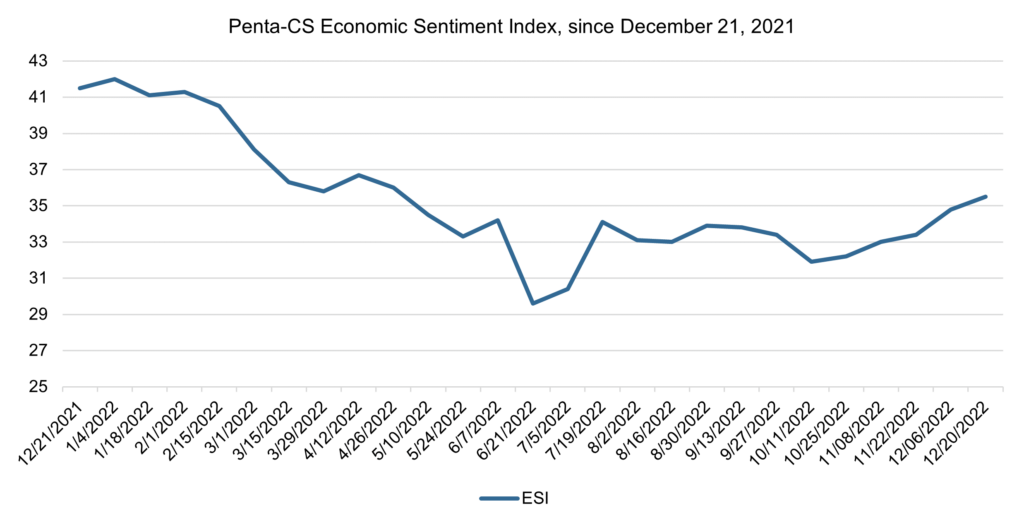

Economic sentiment increased over the past two weeks. The Penta-CivicScience Economic Sentiment Index (ESI) rose 0.7 points to 35.5, the fifth consecutive rise since October 2022.

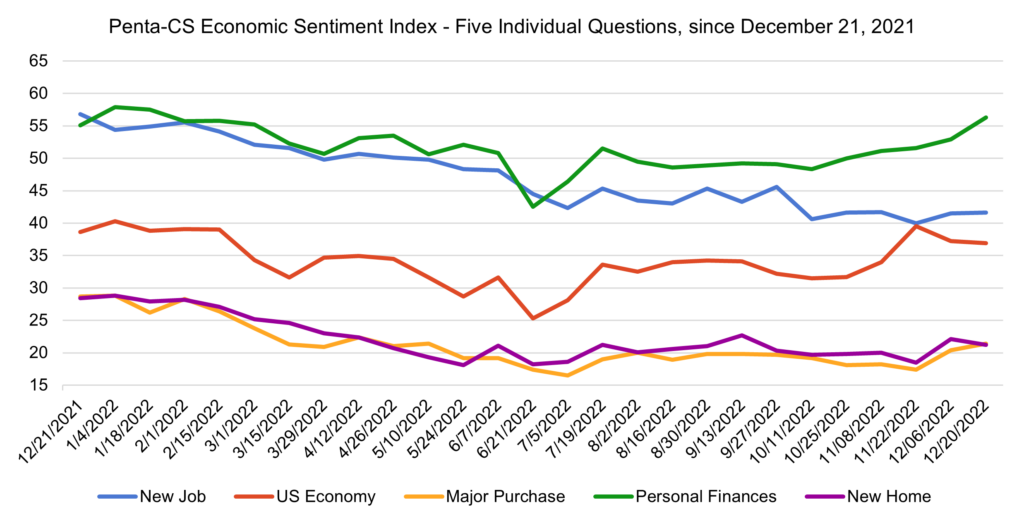

Three of the ESI’s five indicators increased over the past two weeks. Confidence in personal finances improved the most, increasing 3.4 points to 56.3, its largest increase since July.

—Confidence in making a major purchase rose 1.0 points to 21.4.

—Confidence in finding a new job rose 0.1 points to 41.6.

—Confidence in buying a new home fell 0.9 points to 21.2.

—Confidence in the overall U.S. economy fell 0.3 points to 36.9.

Confidence in the overall U.S. economy fell as interest rates reached a fifteen-year high following the Fed’s decision to raise rates by another half a percentage point. This increase created market turmoil, with the Dow falling more than 700 points, and marked a shift from the previous consecutive rate hikes of .75%, largely due to cooling inflation.

November’s Consumer Price Index (CPI) data left consumers feeling positive ahead of the holiday season, as prices saw their lowest increase since December 2021. While inflation remained high with a 7.1% CPI increase in November from a year ago, it was only a 0.1% increase from October, beating some economists’ estimate of 0.3% and continuing a trend of falling prices that began after June’s peak of 9.1%.

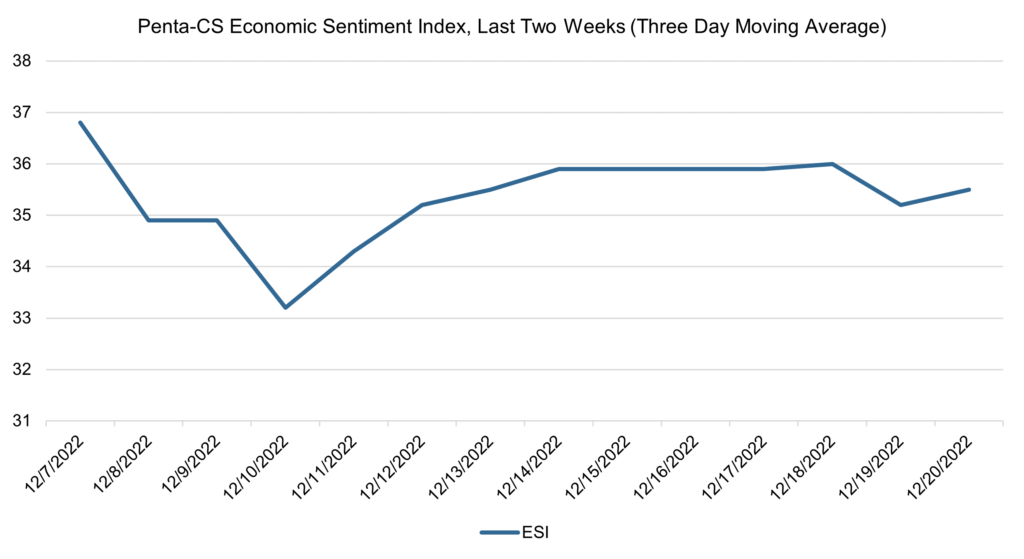

The ESI’s three-day moving average began this two-week stretch at a peak of 36.8 on December 7. It fell to a low of 33.2 on December 10 before rising to 36.0 on December 18. The three-day average then trended downward to 35.2 on December 19, before rising to 35.5 on December 20 to close out the session.

The next release of the ESI will be Wednesday, January 4, 2023.