Economic sentiment holds steady

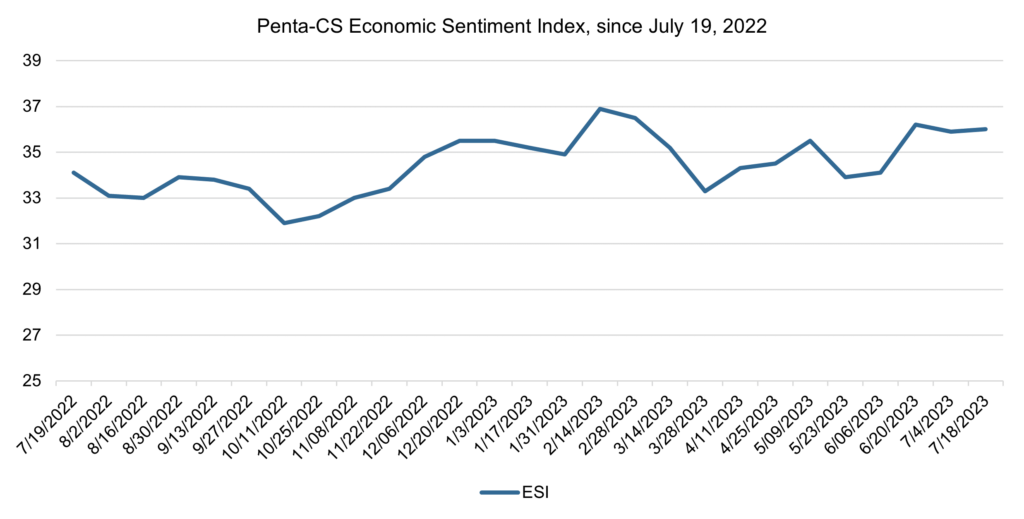

Economic sentiment increased slightly over the past two weeks, hanging on to a period of relative elevation that began in mid-June. The Penta-CivicScience Economic Sentiment Index (ESI) rose 0.1 points to 36.0.

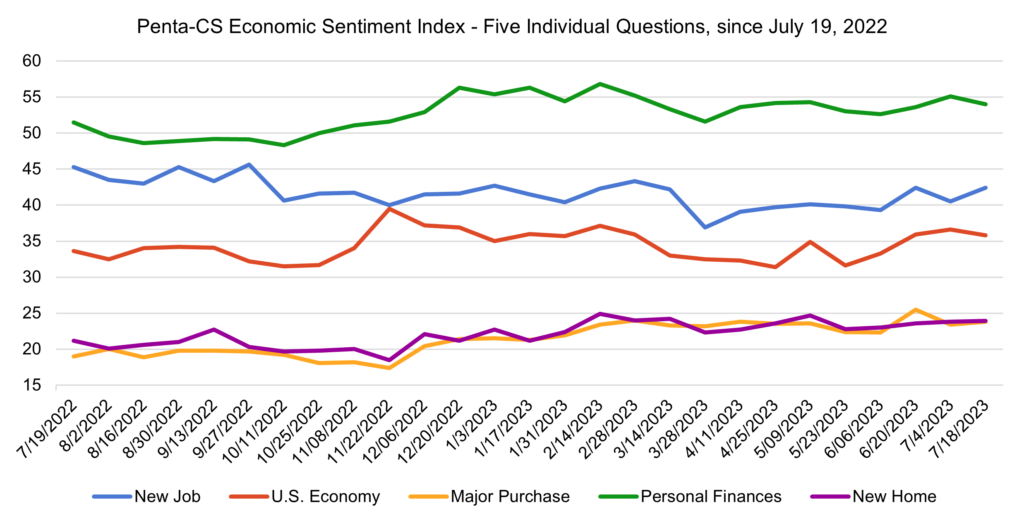

Three of the ESI’s five indicators increased over the past two weeks. After experiencing its second-biggest drop of 2023 last reading, confidence in finding a new job improved the most this reading, rising 1.9 points to 42.4.

—Confidence in making a major purchase rose 0.4 points to 23.8.

—Confidence in buying a new home rose 0.1 points to 23.9.

—Confidence in the overall U.S. economy fell 0.8 points to 35.8.

—Confidence in personal finances fell 1.1 points to 54.0.

The labor market continues to show strength, although it displays some signs of cooling. In June, U.S. employers added 209,000 jobs, down from 306,000 in May, and the unemployment rate fell to 3.6% from 3.7% in May. June marked the 30th consecutive month of job gains, but it was also the lowest total since the streak began. Wage growth also continued to be strong—average hourly earnings rose 0.4% from the previous month and 4.4% from June 2022.

The strong jobs report—highlighted by continued job gains, wage growth, and low unemployment rate—have led many to believe it is likely the Federal Reserve will raise its benchmark federal funds rate to a 22-year high in the 5.25%-5.50% range later this month. On July 7, Federal Reserve Bank of Chicago President Austan Goolsbee, a voting member that decides interest rates, said he sees “a decent chance of further tightening down the pipeline” as the Federal Reserve seeks to further rein in inflation.

On July 14, three of the U.S.’s largest banks—JPMorgan Chase, Citi, and Wells Fargo—reported higher-than-expected quarterly earnings. In response to the new data, JPMorgan CEO Jamie Dimon noted the U.S. economy “continues to be resilient” despite the fact that the likelihood of a ‘soft landing’ remains uncertain.

The weekly average 30-year fixed mortgage rate is currently at 6.96% as of July 13, according to Freddie Mac, but only 9% of all existing mortgages in the U.S. were taken out with a rate above 6%. The difference between the rates most homeowners are paying and the rates they would need to pay if they were to buy a new home is a major contributing factor to the housing supply shortage—new listings were down 27% in July from a year ago according to Realtor.com.

A housing market recession continues to be avoided, as home builders, economists, and many in the real estate industry express optimism about the current demand for homes and stabilizing prices. July data from the National Association of Home Builders/Wells Fargo Housing Market index revealed U.S. home builder confidence is higher than it has been for over a year, marking the seventh-consecutive monthly increase in builder sentiment.

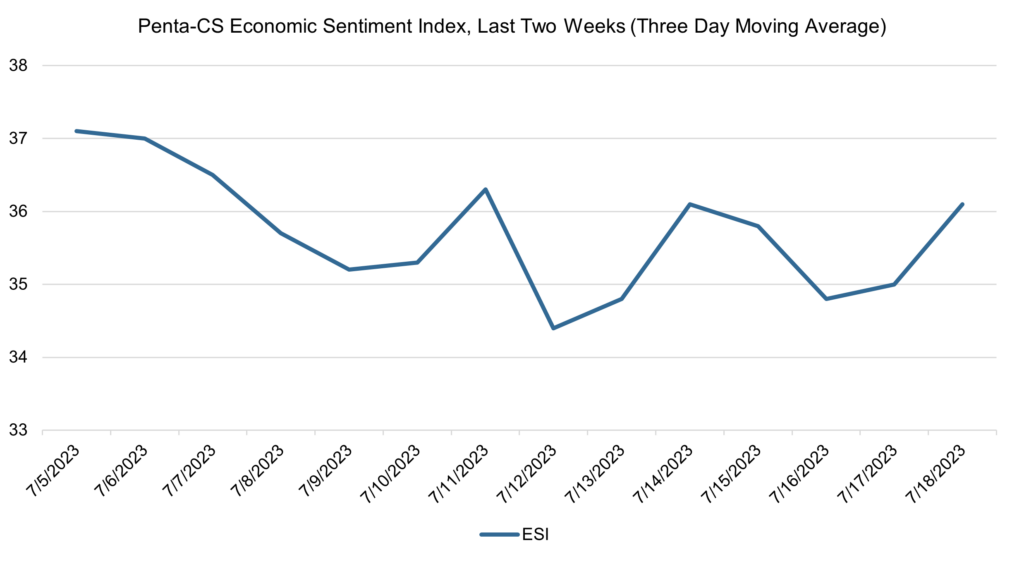

The ESI’s three-day moving average began this two-week stretch at a peak of 37.1 on July 5. It then trended downward to 35.2 on July 9 before rising to 36.3 on July 11. The three-day average then fell to a low of 34.4 on July 12, rose to 36.1 on July 14, and trended downward again to 34.8 on July 16. To close out the session the three-day moving average rose to 36.4 on July 18.

The next release of the ESI will be Wednesday, August 2, 2023.