Economic sentiment suffers third-biggest decline of past twelve months

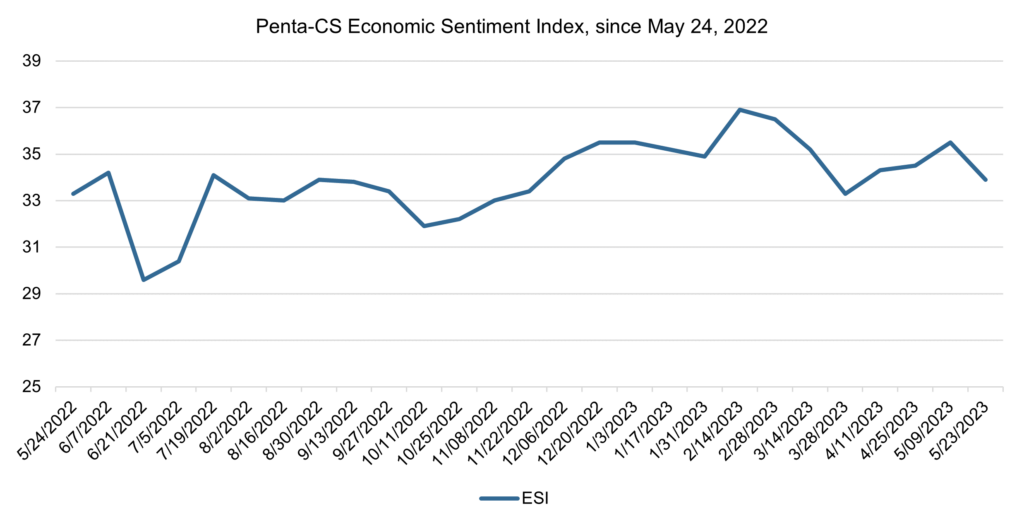

Economic sentiment decreased over the past two weeks following three consecutive reading increases. The Penta-CivicScience Economic Sentiment Index (ESI) fell 1.6 points to 33.9.

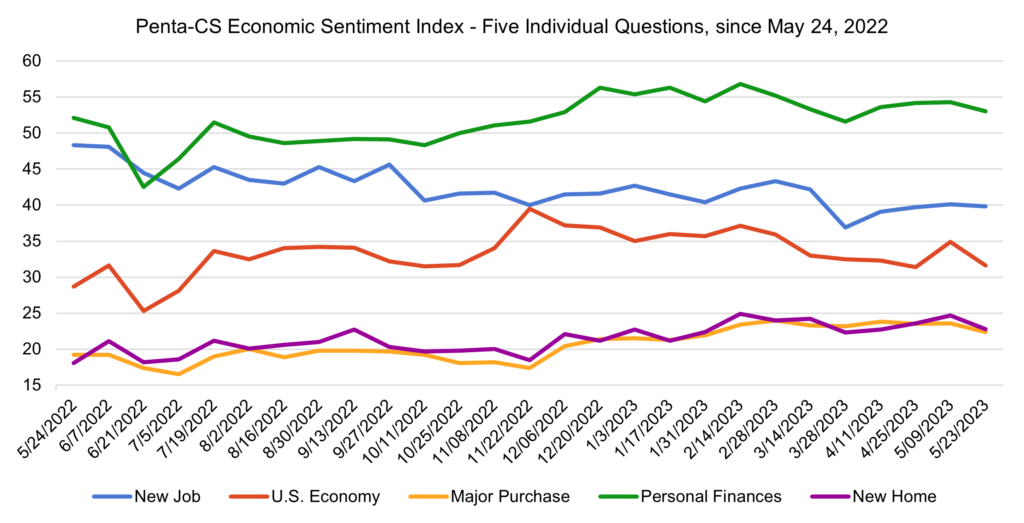

All of the ESI’s five indicators decreased over the past two weeks. Confidence in the overall U.S. economy decreased the most, falling 3.3 points to 31.6—its largest single-reading decrease since July 2022.

—Confidence in buying a new home fell 1.9 points to 22.8.

—Confidence in personal finances fell 1.3 points to 53.0.

—Confidence in making a major purchase fell 1.2 points to 22.4.

—Confidence in finding a new job fell 0.3 points to 39.8.

The possibility of the U.S. defaulting on its debt looms large despite optimism that a deal will be made. Analysis from Moody’s predicts that even if the debt limit were breached for no more than a week, roughly 1.5 million jobs would be lost. If the default lasts into the summer then that figure would rise to 7.8 million American jobs lost and would be accompanied by a stock-market plunge that would erase $10 trillion in household wealth.

Ahead of the Federal Reserve’s June policy meeting, officials lack consensus on whether or not the Fed should pursue further interest rate hikes. Some, like Atlanta Fed president Raphael Bostic, support keeping rates the same, while others think the Fed should skip its June meeting altogether, waiting until July to implement another increase. St. Louis Fed president James Bullard took a harder stance, announcing that he hopes to see two more quarter-percentage-point interest rate hikes in 2023.

In light of raised interest rates, U.S. economic activity hit its 13-month peak in May. This growth was led by service-providing businesses, such as travel companies and restaurants, highlighting Americans’ post-pandemic spending habits.

The housing market remained tight over the last two weeks. In April sales of previously owned U.S. homes fell 23.2% from a year earlier. At the same time, the average 30-year fixed-rate mortgage remains high—sitting at 6.39% the week of May 18—despite being down from a peak of 7.08% in November, which was the highest since 2002. However, the housing market also got a boost after permits for future U.S. single-family homebuilding increased to a seven-month high in April.

The labor market remained strong over the past two weeks. The Labor Department reported that initial claims for state unemployment benefits had the largest drop since November 20, 2021—declining 22,000 to a seasonally adjusted 242,000 for the week ended May 13.

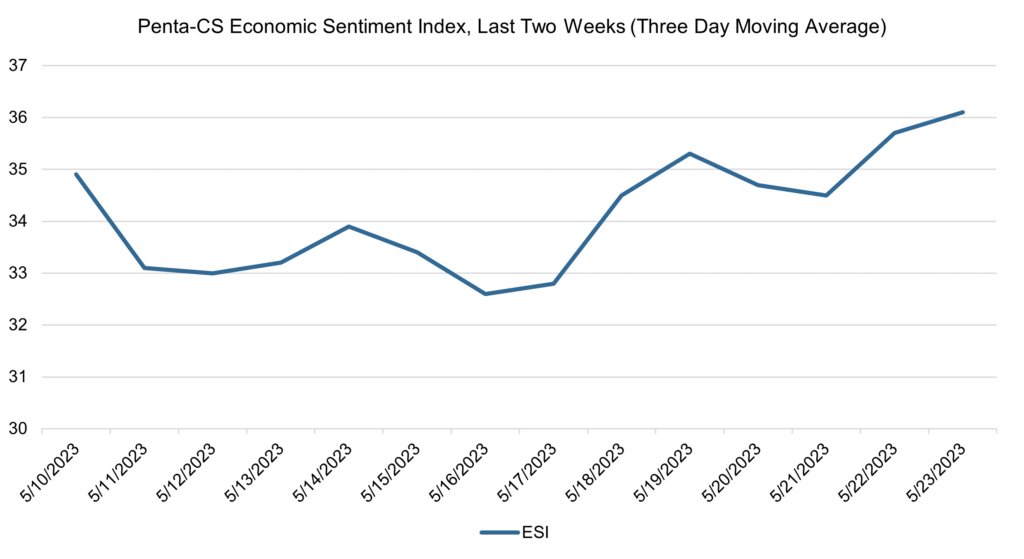

The ESI’s three-day moving average began this two-week stretch at 34.9 on May 10. It trended downward to 33.0 on May 12, rose to 33.9 on May 14, and then fell to a low of 32.6 on May 16. The three-day average then rose to 35.3 on May 9, fell to 34.5 on May 21, and rose to a peak of 36.1 on May 23 to close out the session.

The next release of the ESI will be Wednesday, June 7, 2023.